|

Getting your Trinity Audio player ready...

|

High Yield | CARE AA- /Stable Rated | Minimum Investment: 10k Only

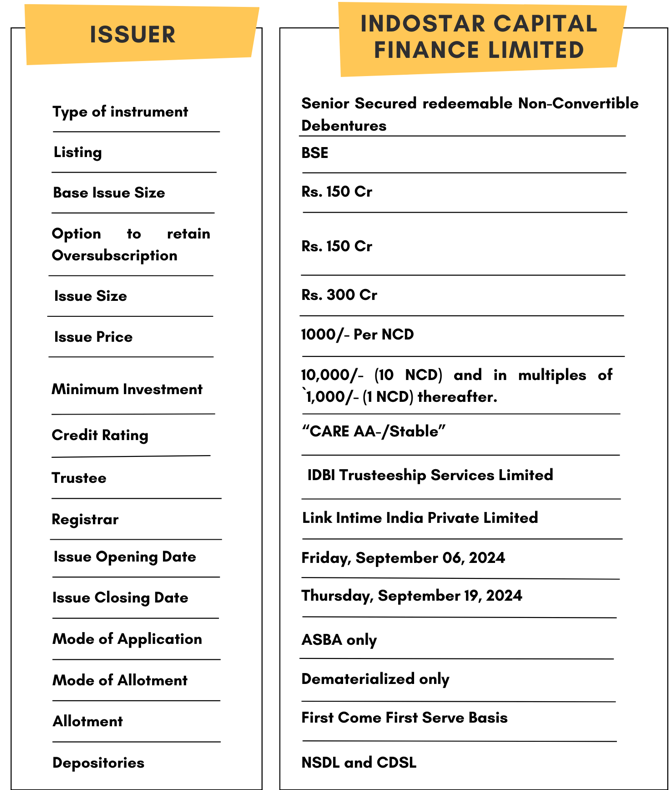

Bond overview

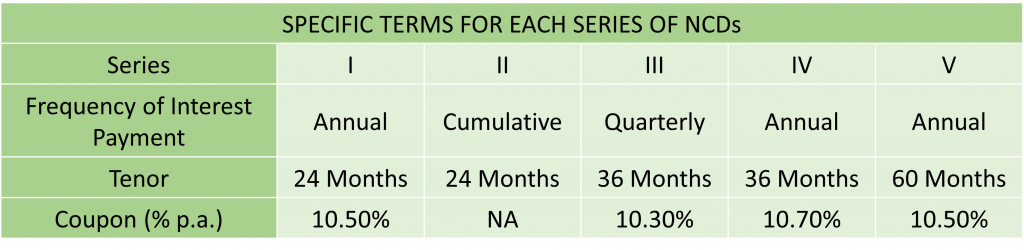

Indostar Capital Finance Limited is issuing the Non-Convertible Debentures. These NCDs are AA- rated with stable outlook by CARE Ratings. The NCDs are being issued in five series: coupon ranges from 10.3% to 10.7% p.a. and different tenures of 24 months, 36 months, and 60 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

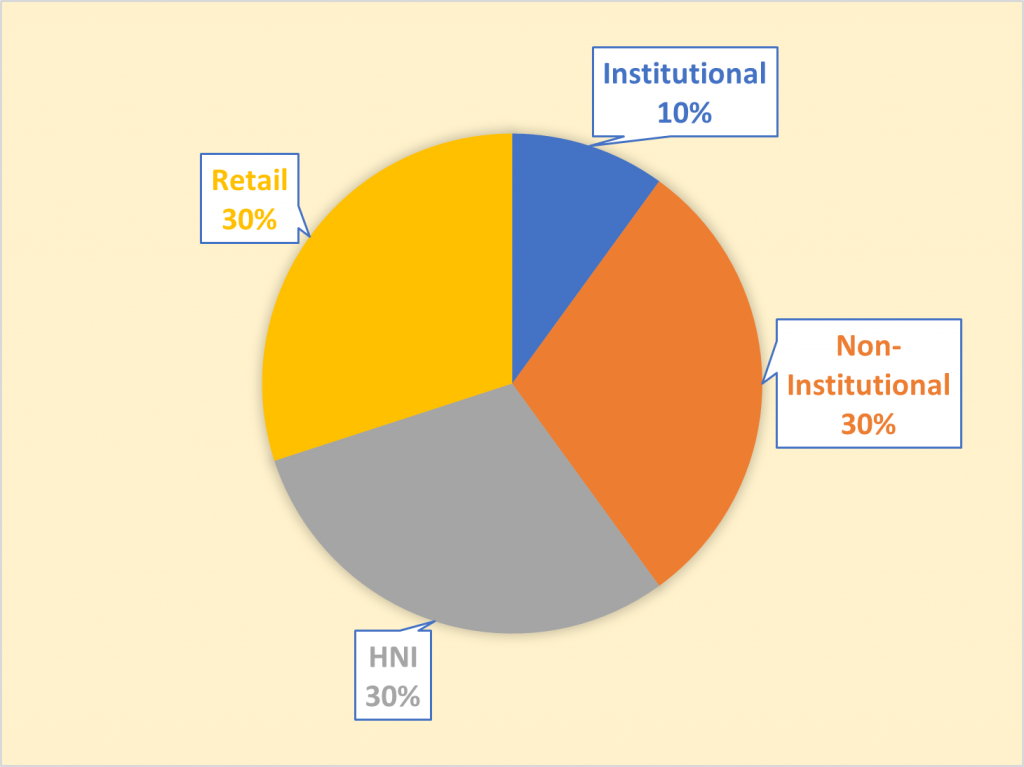

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Indostar Capital Finance Limited NCD-IPO.

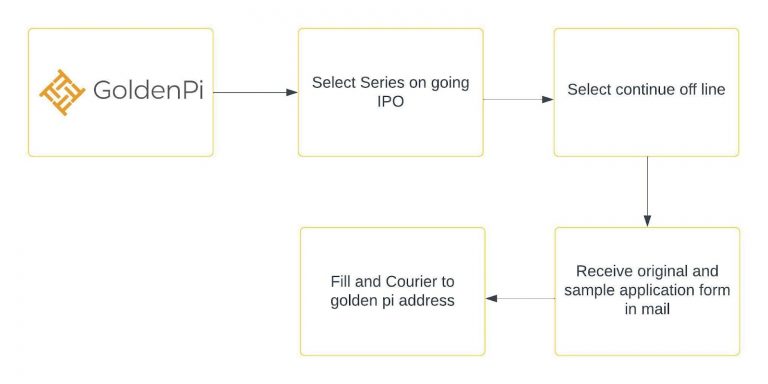

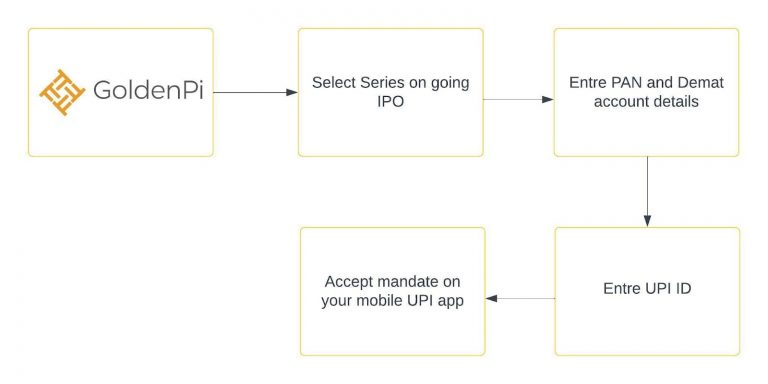

Investment Process for Indostar Capital Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Issue analysis

Pros

- The coupon offered is up to 10.7% which is much higher than many traditional fixed-income investments like FDs.

- The company has adequate Capital Adequacy Ratio in order to overcome unexpected losses during the year.

Cons

- The ratings of the company is AA-/Stable by CARE which is a slightly lower grade rating.

- The company is prone to regulatory risk associated with RBI and other regulators as well.

Liquidity

Indostar Capital Finance Limited has a strong liquidity profile with unencumbered cash and liquid investments of 68.08 Crores as of 31st March,2024. The upcoming public issuance of NCDs in July 2024 is expected to further enhance its liquidity profile.

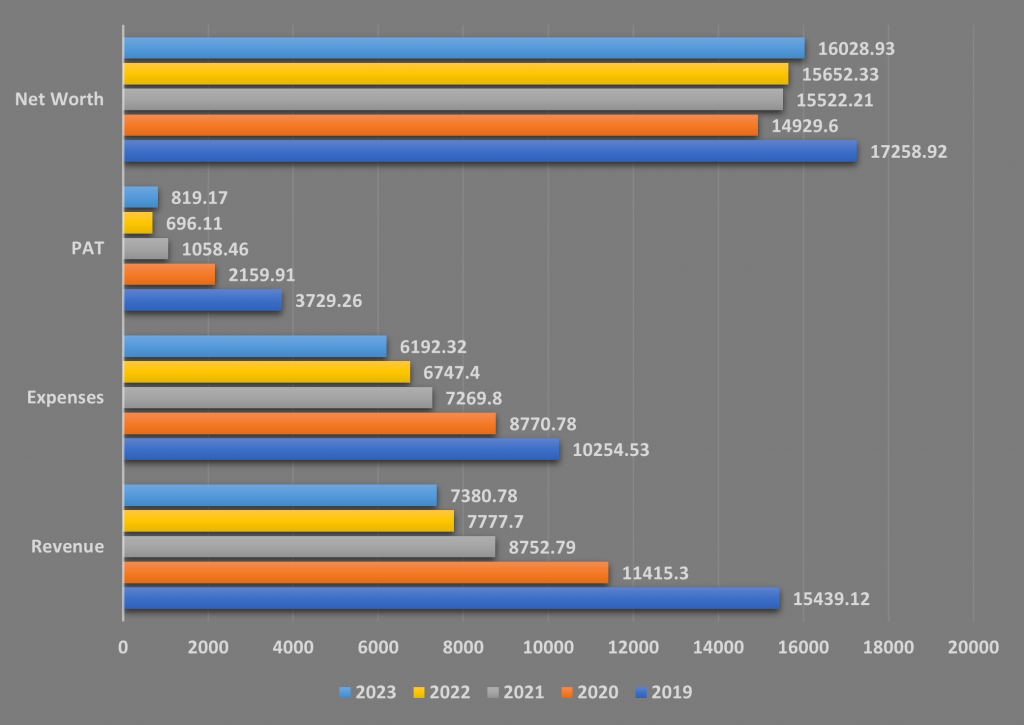

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

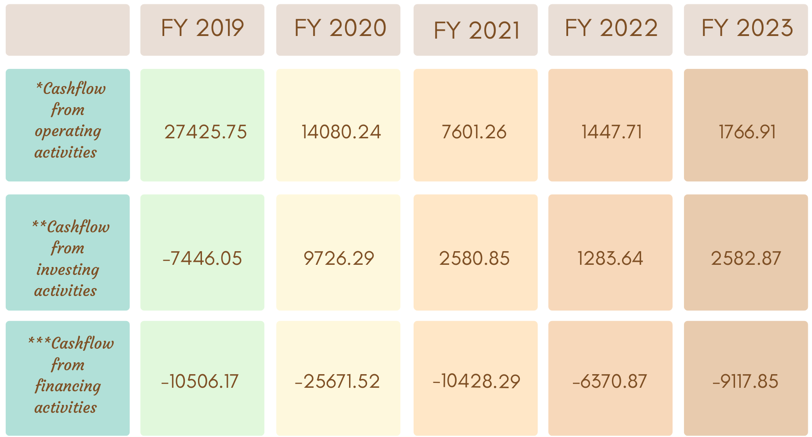

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

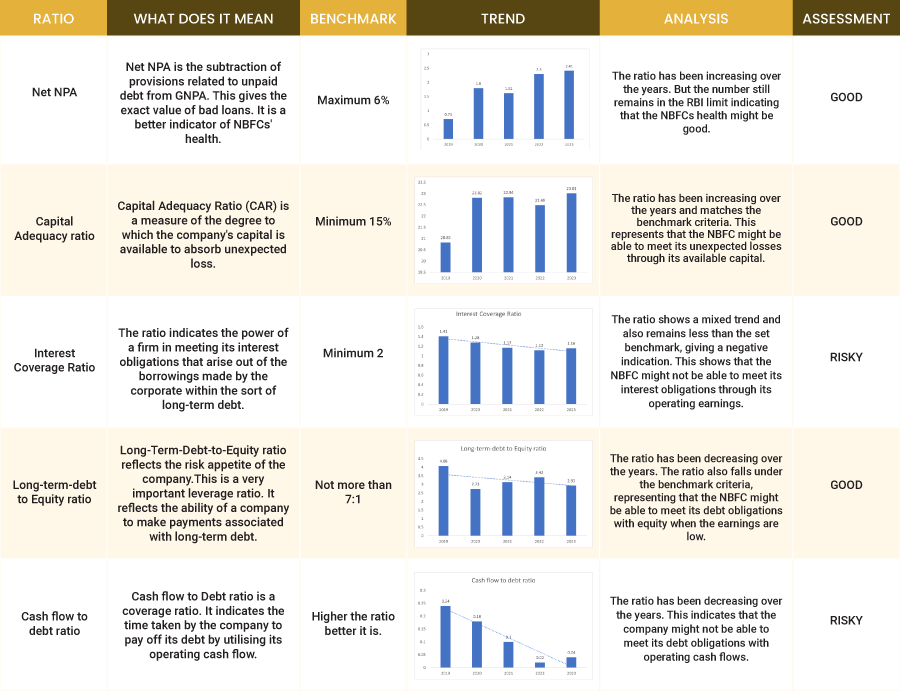

Ratio Analysis

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Indostar Capital Finance Limited

Established in 2011, Indostar Capital Limited is a dynamic non-banking finance company (NBFC) focused on retail financing solutions across multiple segments. The company offers comprehensive services, including commercial vehicle financing, housing finance, SME lending, and corporate lending. With 95.28% of its assets under management (AUM) dedicated to retail finance, Indostar Capital emphasizes accessible financial solutions.

The company operates through 515 branches across 23 states, ensuring widespread reach and service to diverse customer segments in urban, semi-urban, and rural areas. Indostar Capital’s subsidiaries include Indostar Home Finance Private Limited, which provides affordable housing loans, and Indostar Asset Advisory Private Limited, a SEBI-registered investment manager.

Strengths

- Strong Capital Foundation

The company maintains a robust capital base, with a Tier I Capital Adequacy Ratio (CRAR) of 28.87% as of March 31, 2024, significantly exceeding the RBI’s minimum requirement. This solid capitalization supports sustainable growth and operational stability. - Diverse Funding Sources

With a well-diversified funding profile, the company benefits from equity investments by notable investors and a wide range of lenders, including public and private sector banks. This diversity ensures a reliable capital source for ongoing operations. - Institutional Backing and Governance

Supported by institutional investors like BCP V Multiple Holdings Pte Ltd, the company enjoys strong capital and expertise. The board, comprising both independent and non-independent directors, oversees operations through specialized committees, ensuring effective management and governance.

Weakness

- Limited Diversification in Revenue Streams-The company’s focus on specific financial services may limit its ability to manage risks associated with economic downturns or sector-specific challenges.

- Market Competition-Intense competition in the financial services sector challenges the company’s ability to maintain market share and achieve growth targets, with competitors potentially offering superior products and services.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus August 29, 2024

Disclaimer – The information is published as on date 09/04/2024 based on information available on Prospectus August 29, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors