|

Getting your Trinity Audio player ready...

|

High Yield | ACUITE BBB/Stable Rated | Minimum Investment: 5k Only

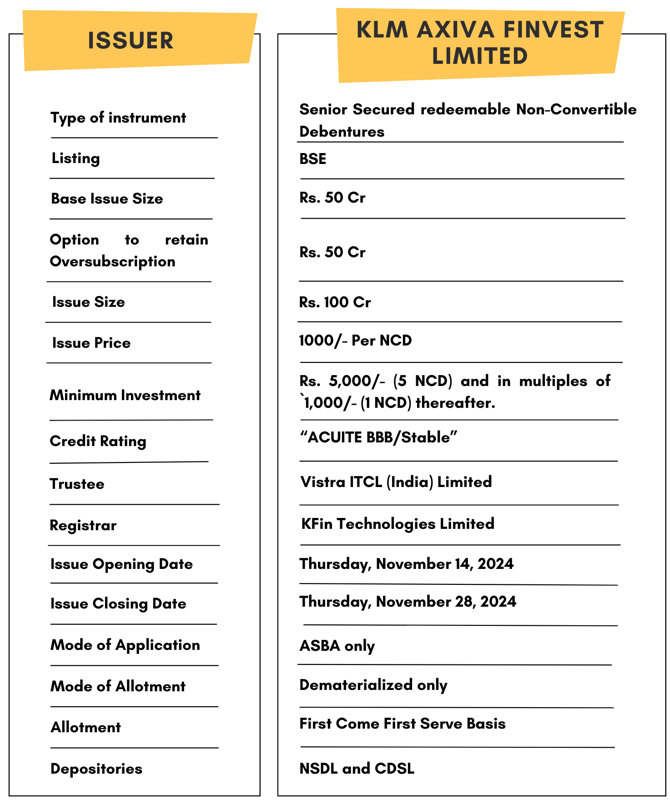

Bond overview

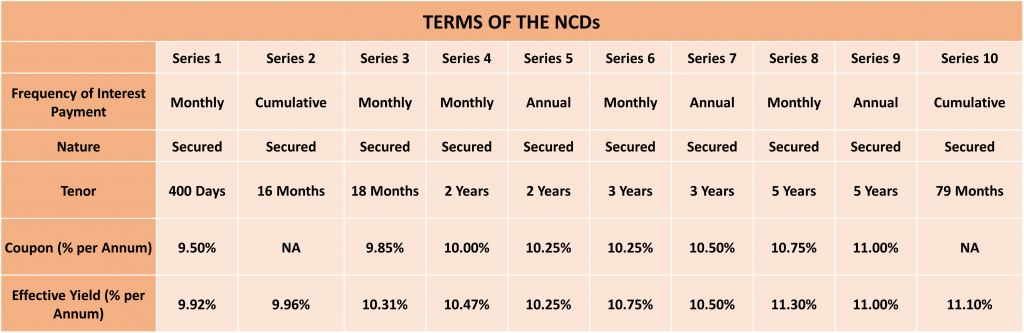

KLM Axiva Finvest Limited is issuing the Non-Convertible Debentures. These NCDs are BBB rated with stable outlook by Acuite Ratings. The NCDs are being issued in ten series: coupon ranges from 9.5% to 11% p.a. and different tenures of 400 days, 16 months, 18 months, 2 years, 3 years, 5 years, and 79 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

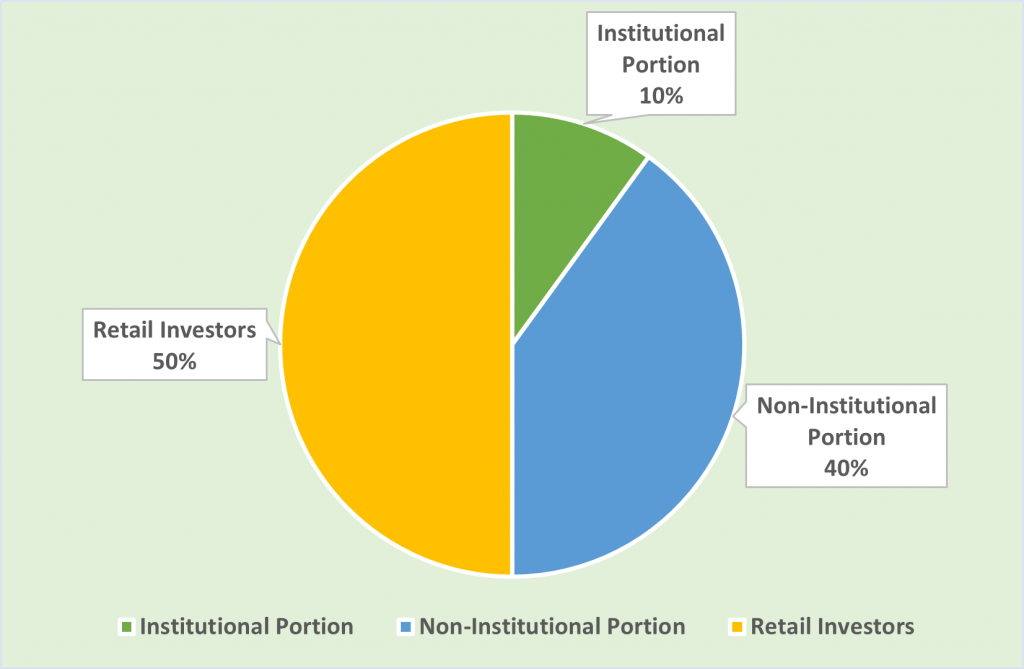

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for KLM Axiva Finvest NCD-IPO.

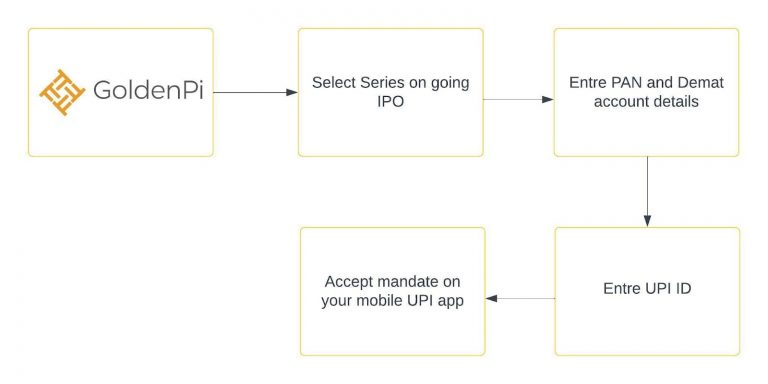

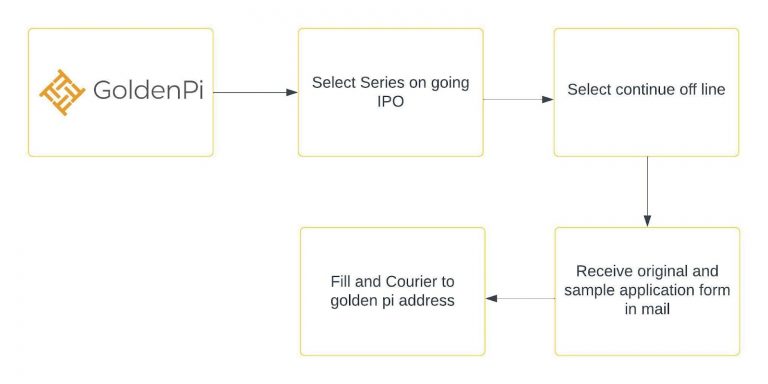

Investment Process for KLM Axiva Finvest NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Issue analysis

Pros

- The yield offered is up to 11.3% which is much higher than many traditional fixed-income investments like FDs.

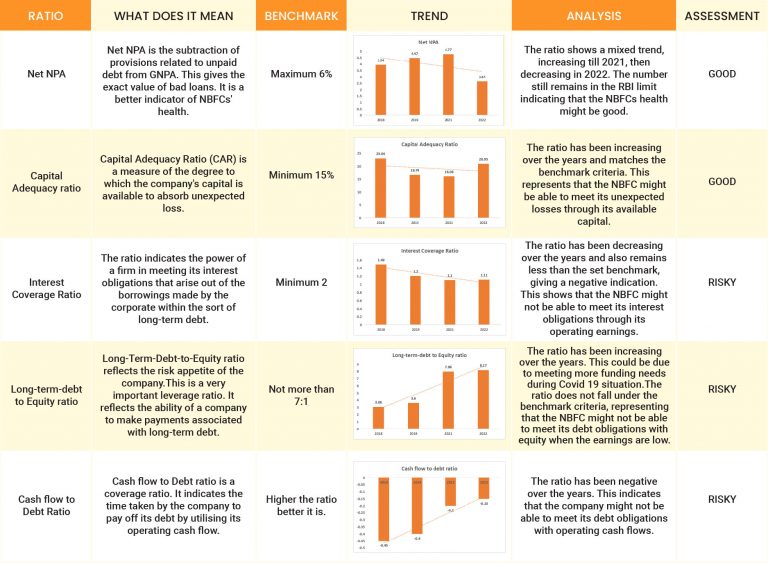

- The company has adequate Capital Adequacy Ratio in order to overcome unexpected losses during the year.

- The minimum investment amount for these NCDs is ₹5,000, with additional investments in increments of ₹1,000. This flexibility allows you to diversify your investment portfolio effectively.

- In one of the series provided by the company, there is an option for investors to redeem their investment at double the Face Value on maturity.

- The company has been actively raising money through NCDs and sub debt from local high-networth individuals and retail investors in Kerala.

Cons

- The ratings of the company is BBB/Stable by ACUITE which is a slightly lower grade rating.

- The company is prone to regulatory risk associated with RBI and other regulators as well.

Liquidity

Adequate Liquidity Position:

KLM has no negative cumulative mismatches in the near to medium term, supported by the shorter tenor of its loans and longer-tenor borrowings.

- As of March 31, 2024, the company held a cash and bank balance of ₹68.08 Cr.

- ALM as of December 2023 shows comfortable liquidity due to well-matched asset-liability profiles.

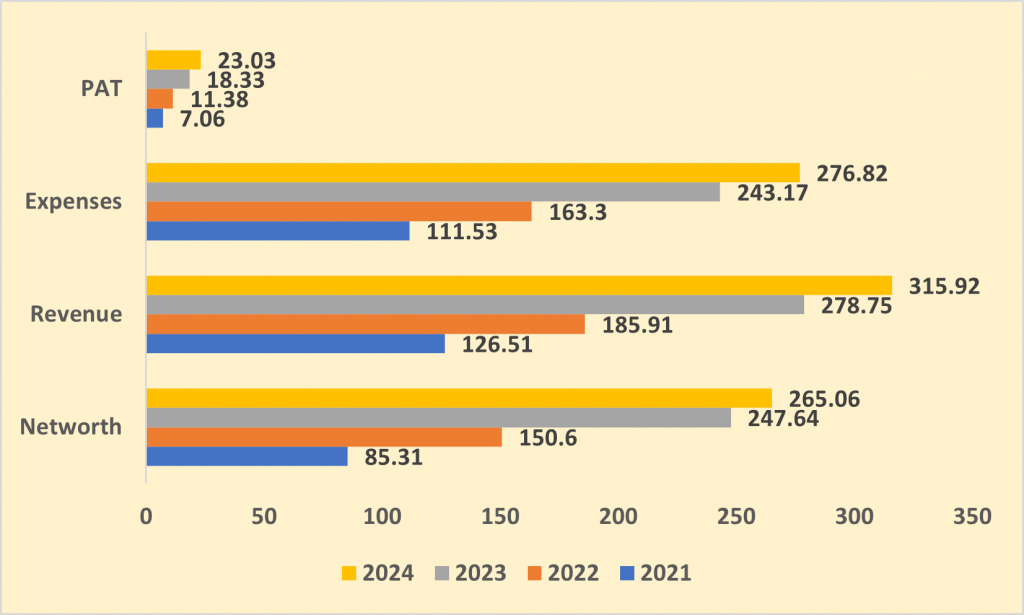

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

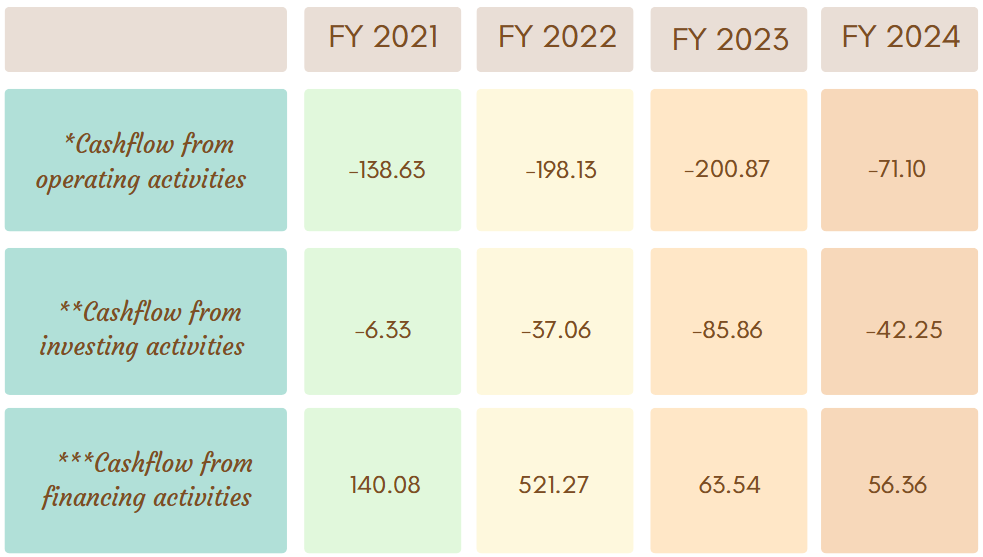

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

Ratio Analysis

To get better returns than Bank FDs, invest in NCD-IPOs online.

About KLM Axiva Finvest Limited

KLM Axiva Finvest is a Kerala based non-deposit taking systemically important NBFC ( Middle Layer ) registered with RBI. Since Incorporation in 1997, the company has been serving Low and middle income individuals and businesses that have limited or no access to formal credit facilities and finance channels. KLM operates in four business verticals mainly- Gold loan and household jewelry loans, MSME Loans, Personal Loans and Microfinance Loans. Apart from that the company also provides Money transfer facility, Insurance and Forex related services to their customers. Mr Manoj Ravi is serving the position of Chief Executive Officer in the company.

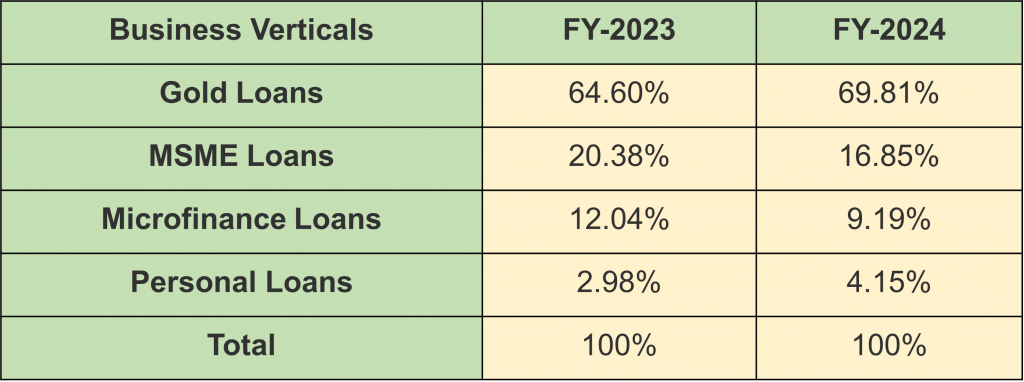

Here is a table below illustrating the % of interest income generated by the company across its business segments.

Approximately 70% of the business of the company is generated through Gold loans and household jewelry Loans.

Key Highlights

Strengths

- Experienced Management and Promoter Support:

Led by Mr. Shibu Varghese, with over 30 years of financial services experience, supported by a seasoned management team with over a decade of expertise. The promoters’ deep industry knowledge has strengthened the company’s capital-raising capability and operational strategy. - Growth in AUM:

AUM grew by ~18% to ₹1,720.96 Cr. as of March 31, 2024, compared to ₹1,460 Cr. in FY23 and ₹1,073 Cr. in FY22, driven by increased disbursements and business expansion efforts. - Improved Asset Quality:

GNPA improved from 1.84% in FY23 to 1.6% in FY24, while NNPA reduced from 0.82% to 0.67%. The on-time portfolio rose to 94.45% as of December 2023 from 92.82% in March 2023, reflecting effective underwriting policies and enhanced collection efficiency. - Profitability Growth:

PAT increased to ₹23.03 Cr. in FY24 from ₹18.33 Cr. in FY23, with ROAA improving to 1.25% from 1.15%. Interest income grew to ₹305.62 Cr. in FY24 from ₹275.40 Cr. in FY23. - Capital Adequacy:

Maintains a healthy capital adequacy ratio of 23.66% as of FY24, with Tier-1 capital at 15.61%, well above regulatory requirements.

Weakness

- Leveraged Capital Structure:

Total debt stood at ₹1,606 Cr. as of March 2024, resulting in a gearing ratio of 5.91x, up from 5.43x in FY23. Subordinated liabilities accounted for ₹771.60 Cr. of total debt, indicating a need for additional equity infusion to support future growth. - Geographical Concentration:

Operations remain concentrated in Kerala (~50% of the portfolio) and Karnataka (~22%), despite recent expansion into Andhra Pradesh, Tamil Nadu, and Maharashtra. - Funding Concentration:

Borrowings are heavily reliant on NCDs and subordinated debt, forming ~90% of total borrowings as of March 2024. Although bank loans are increasing, their share remains modest.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus November 13, 2024

Disclaimer- The information is published as on date 04/03/2024 based on information available on Prospectus November 13, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors