|

Getting your Trinity Audio player ready...

|

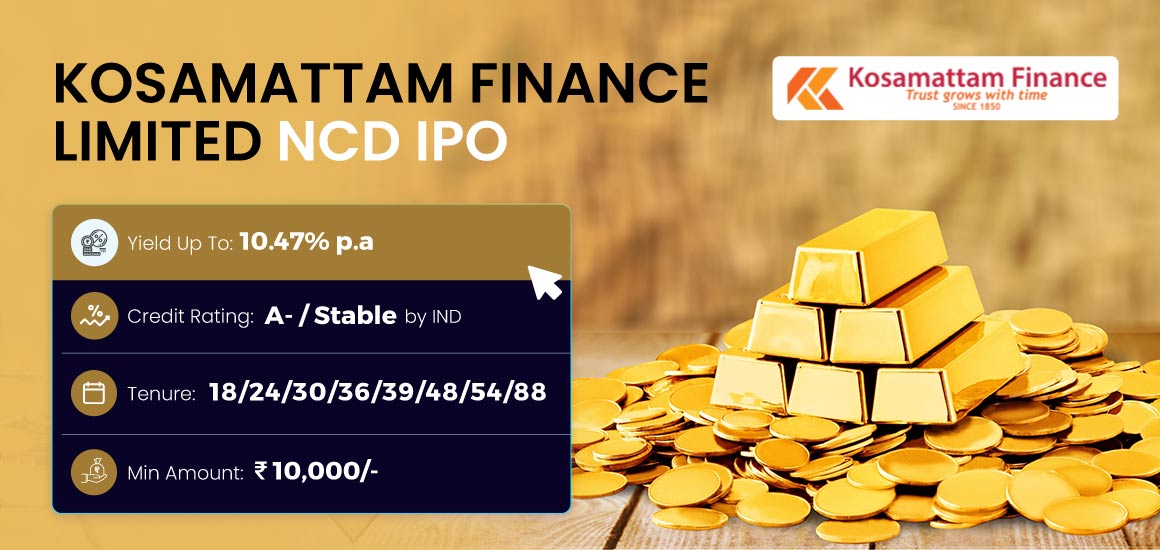

High Yield | A-/Stable Rated | Minimum Investment: 10k Only

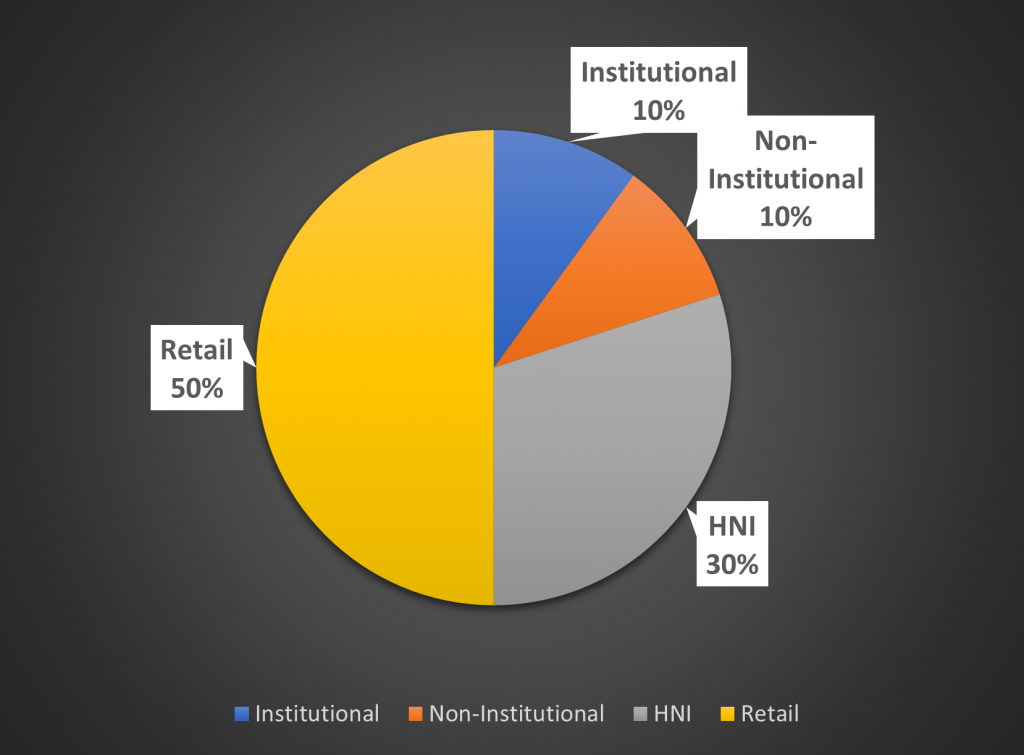

Kosamattam Finance Ltd is issuing NCDs

Is it a good decision to invest in kosamattam ncd

Investing in Kosamattam NCDs offers competitive returns of up to 10.47% annually with an A-/Stable grade, which makes it appropriate for higher returns, but make sure to be aware of risks such as declining debt coverage.

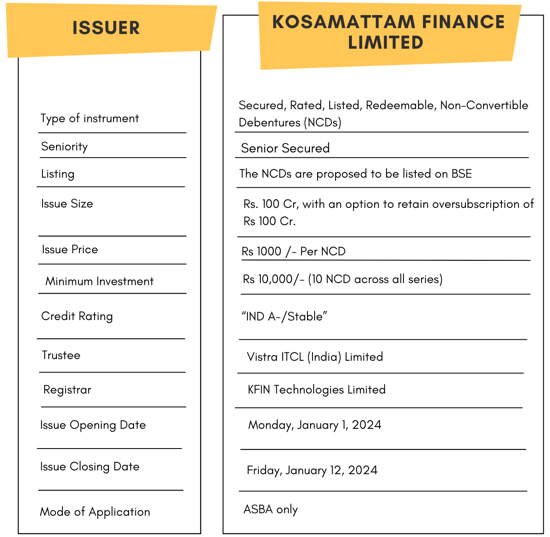

Kosamattam Finance Ltd is issuing the 3rd tranche of Non-Convertible Debentures. These NCDs are A-/Stable by India Ratings & Research. The NCDs are being issued in eight series: yield ranges from 8.52% to 10.47% p.a. and different tenures of 18 months, 24 months, 30 months, 36 months, 39 months, 48 months, 54 months and 88 months. The NCDs are secured and redeemable in nature.

Kosamattam Finance Ltd NCD IPO: Coupon rates and effective yield for each of the series

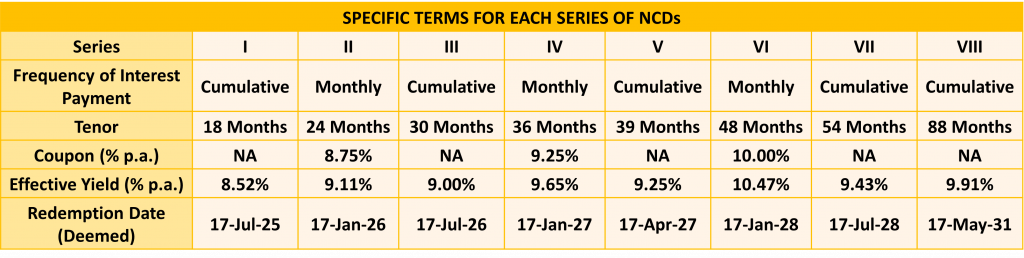

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Kosamattam Finance Ltd NCD-IPO.

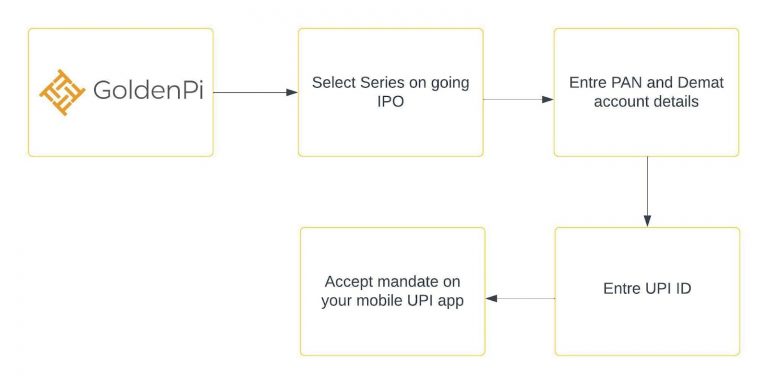

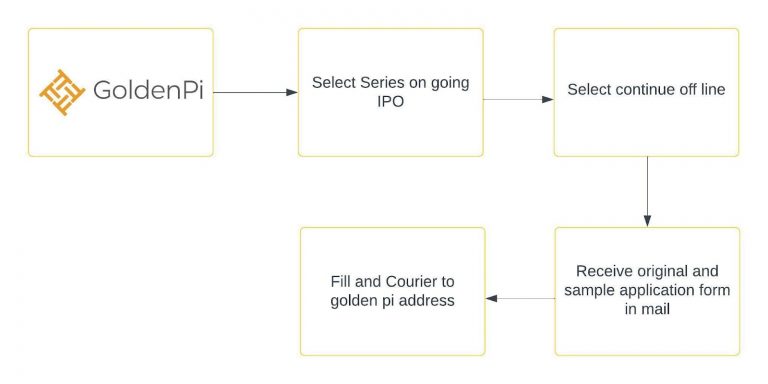

Investment Process for Kosamattam Finance Ltd NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Financial Overview

Snapshot stating the Revenue, Expenses, EBIT, Net Worth and PAT

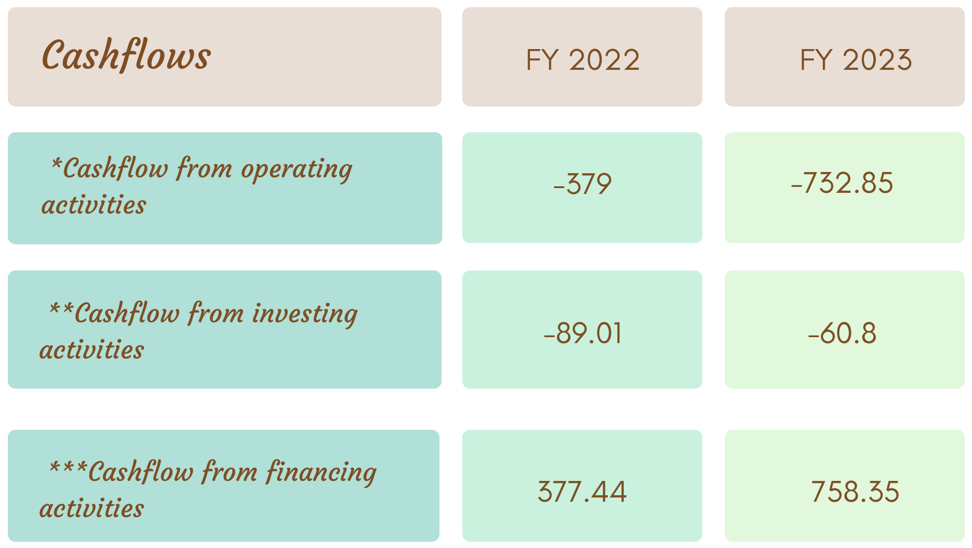

Cash flow for last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

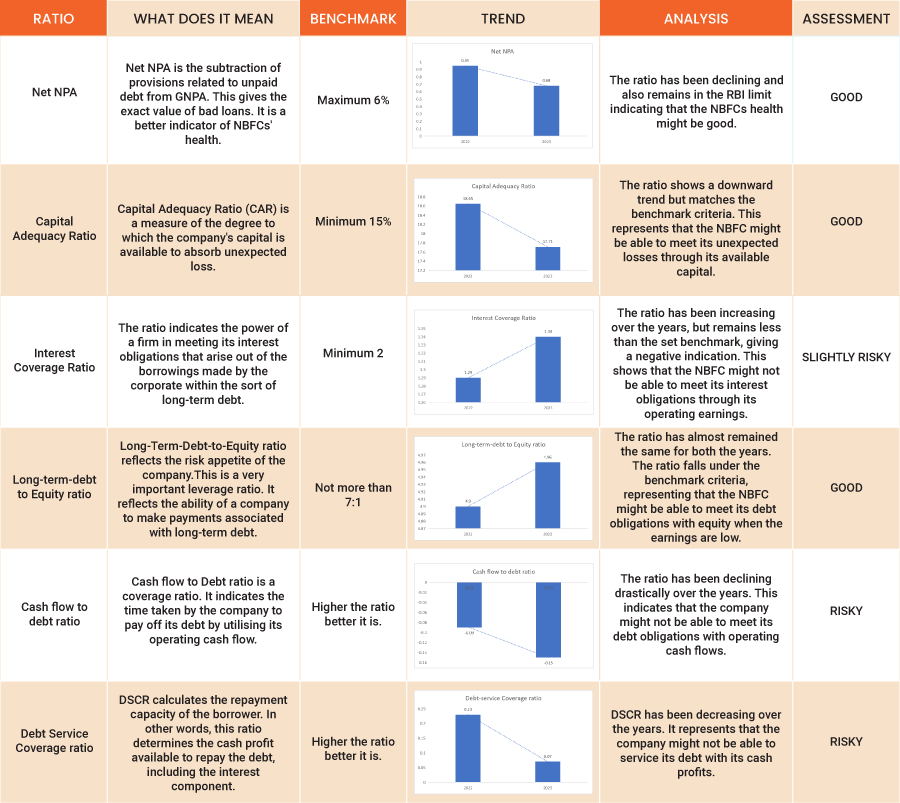

Ratio Analysis

Issue analysis

Pros

- The NCD is A- rated security with a stable outlook.

- The yield ranges upto 10.47% which is much higher than FDs.

Cons

- Debt Service Coverage ratio has been decreasing indicating that the company might not be able to service its debt through available profits.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Kosamattam Finance Ltd.

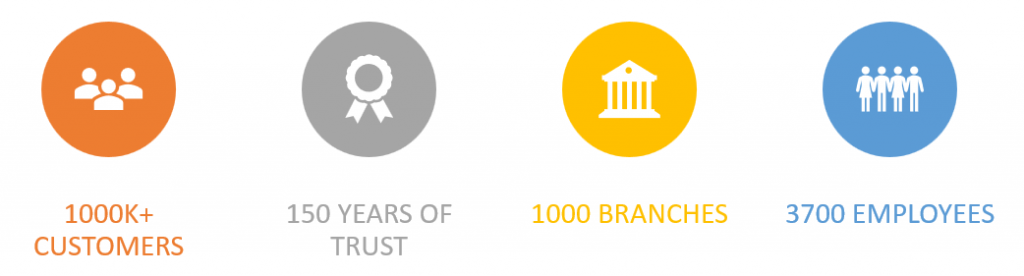

Kosamattam Finance is a leading non-banking financial company (NBFC) in India, renowned for its robust financial services and a legacy spanning over seven decades. Established in 1957, Kosamattam Finance has been a trusted name in providing a wide spectrum of financial solutions, including gold loans, microfinance, and other retail lending products. With a commitment to reliability, customer-centricity, and ethical practices, Kosamattam Finance continues to empower individuals and businesses across the country, catering to diverse financial needs while upholding a strong sense of community and service excellence.

Highlights

Strengths

- Boosted Footprint: KFL expands core gold loan franchise while conquering southern markets and venturing north.

- Rock-Solid Loans: Gross gold loan NPAs stay resilient at 0.45% in 1HFY2, showcasing KFL’s credit quality.

- Diversified Backing: Securely raising funds from diverse public & private sector banks, KFL builds a robust financial infrastructure.

- Balanced Portfolio: KFL boasts a perfectly matched asset-liability profile with steady surpluses across all timeframes up to one year,

Invest in Bond IPO online in just 5 minutes

Key Takeaways

- It provides a fair annual rate ranging from 8.52% to 10.47% for various tenures, making it an appealing option to standard bank FDs.

- India Ratings & Research rated secured NCDs based on a steady situation, indicating minimal risk but a largely stable investment.

- GoldenPi offers an easy online kosamattam ncd application process for independent investors with deposits of up to ₹10 lakh.

- Keep an eye out for a falling debt service coverage ratio as a risk factor and the probability of difficulties in repaying financial debt from operational earnings.

FAQs About Kosamattam Finance

Q. How is the allocation ratio determined for the Kosamattam Finance IPO?

The allotment ratio is determined by SEBI regulations and changed after close consideration to categorize kosamattam NCD applications for fair distribution.

Q. How does the cash flow analysis over the last 5 years provide insights into the financial stability of Kosamattam Finance Ltd for potential investors?

A cash flow study clears patterns in operational efficiency, liquidity, and financial situation, which are crucial for assessing Kosamattam Finance Ltd’s stability and fiscal situation to build investor trust.

Q. What are the risks associated with investing in Kosamattam NCDs despite the attractive returns?

Investing in Kosamattam NCDs involves risks such as credit risk related to the chance of default, liquidity risk due to market factors affecting selling, and interest rate uncertainty, which affects returns.

Q. Can investors apply for the NCD IPO online if they wish to invest more than ₹10 lakhs?

Investors can apply online for the kosamattam ncd application IPO, even if their investment exceeds ₹10 lakhs, making participation more simpler process.

Q. What are the credit ratings of the Kosamattam NCDs being offered?

India Ratings has graded Kosamattam Finance’s NCDs as IND A-/Stable, which shows moderate credit risk and financial stability.

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.