|

Getting your Trinity Audio player ready...

|

High Yield | A+ /Stable Rated | Minimum Investment: 1 Lakh

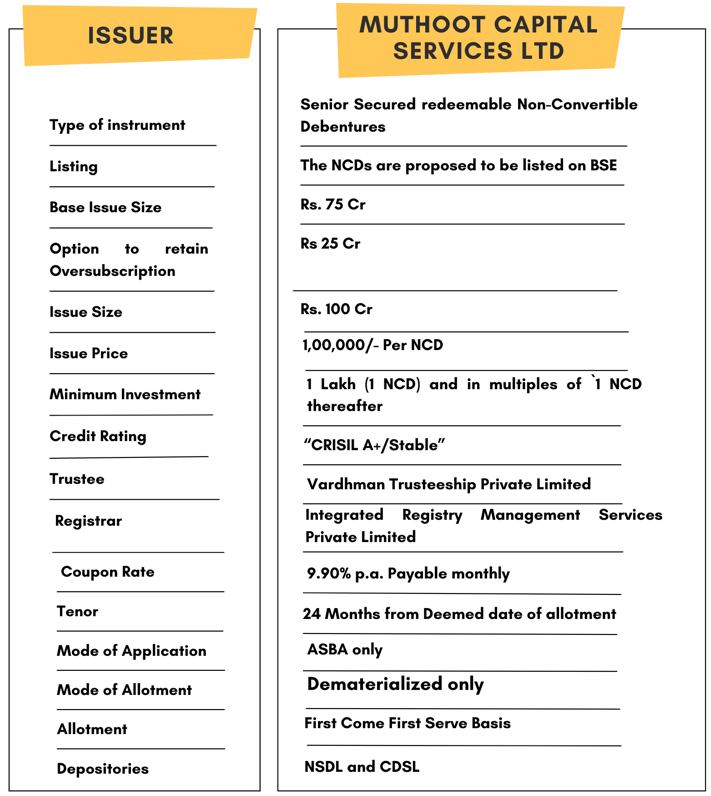

Bond overview

Muthoot Capital Services Ltd is issuing Non-Convertible Debentures (NCDs) rated A+/Stable by CRISIL. These debentures are available in multiples of ₹1 Lakh, offering a coupon rate of 9.90% per annum with monthly interest payment. The tenure for these NCDs is 24 months. The NCDs are secured and redeemable in nature.

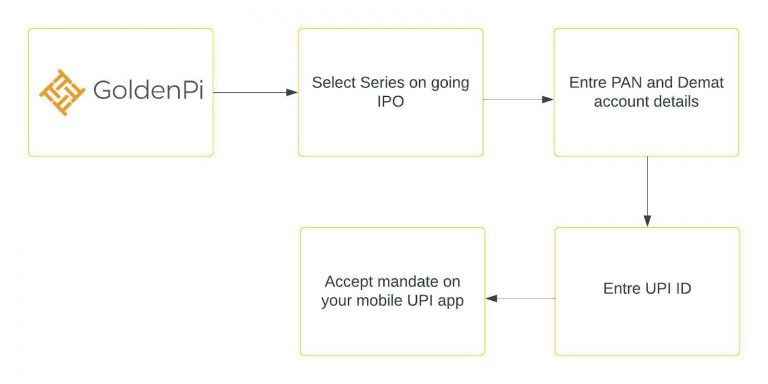

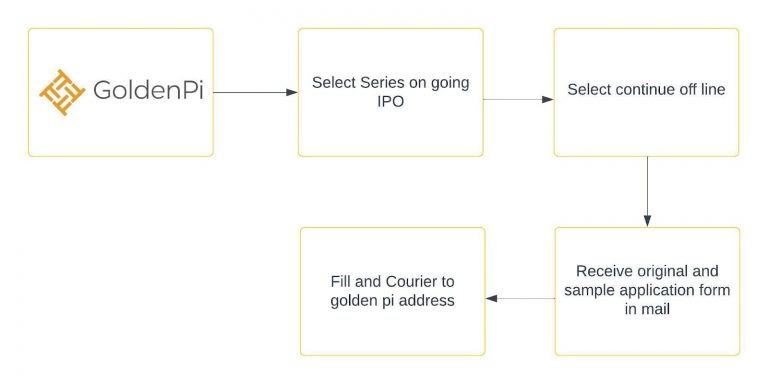

Investment Process for Muthoot Capital Services Ltd. NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

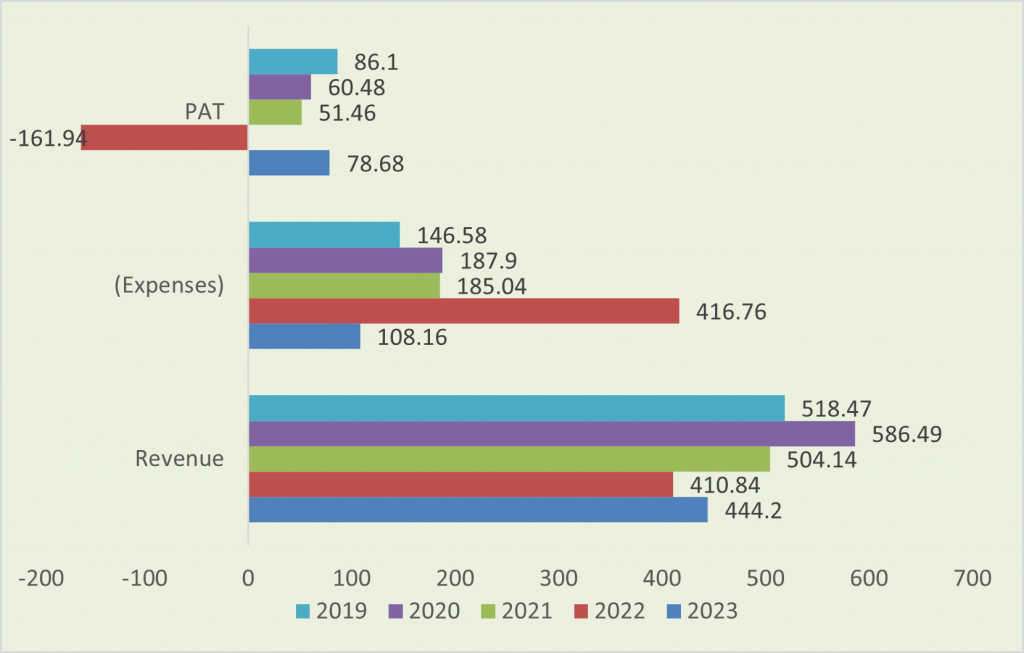

Financial Overview

Snapshot stating the Revenue, Expenses, PAT (In crores)

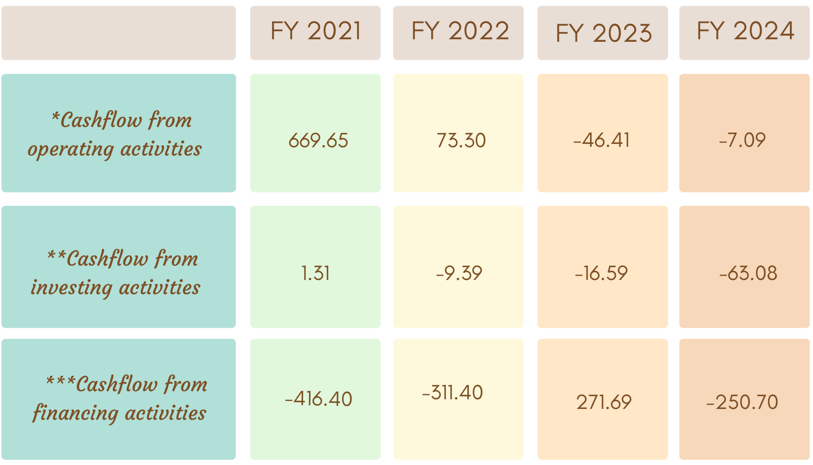

Cash flow for last 5 years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

Ratio Analysis

| RATIO | WHAT DOES IT MEAN | Benchmark | TREND | ANALYSIS | ASSESSMENT |

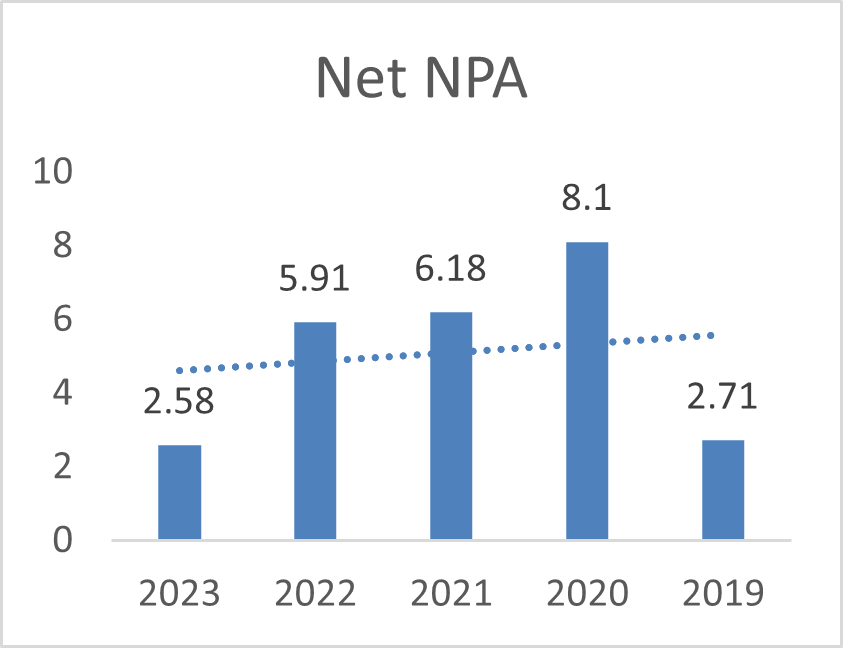

| Net NPA | Net NPA is the subtraction of provisions related to unpaid debt from GNPA. This gives the exact value of bad loans. It is a better indicator of NBFCs’ health. | Maximum 6% |  |

The Net Non-Performing Assets (NPAs) have exhibited a consistent decline over time, remaining comfortably below the 6% threshold, indicative of a strengthening asset quality within the company. | GOOD |

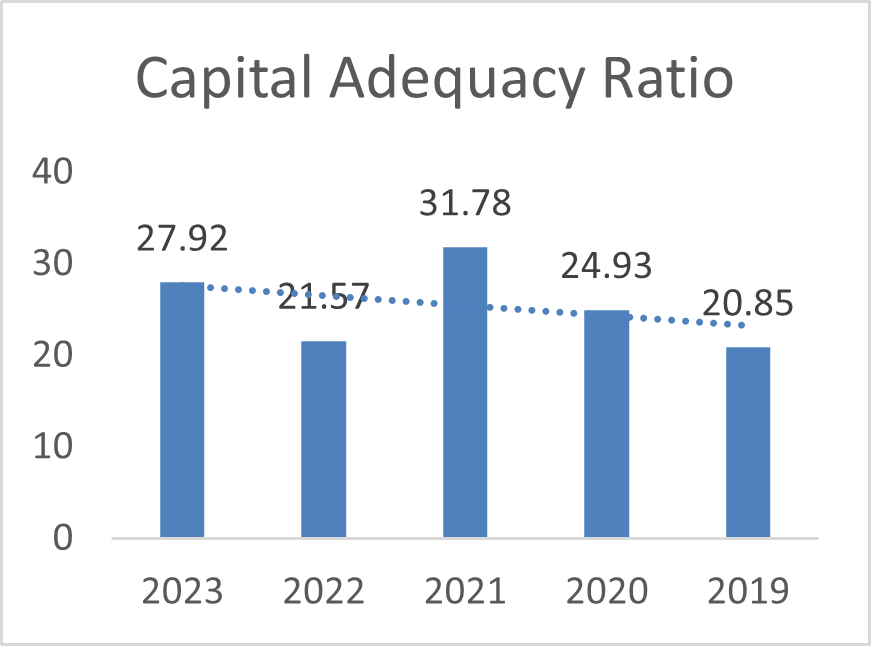

| Capital Adequacy ratio | Capital Adequacy Ratio (CAR) is a measure of the degree to which the company’s capital is available to absorb unexpected loss. | Minimum 15% |  |

Trend shows the CRAR of the company is very high, almost double the standards. A higher CRAR signifies greater stability and investor confidence. | GOOD |

| Interest Coverage Ratio | The ratio indicates the power of a firm in meeting its interest obligations that arise out of the borrowings made by the corporate within the sort of long-term debt. | Minimum 2 | Ratio is increasing and is less than the Benchmark. Company might not be able to meet its interest obligation easily. | SLIGHTLY RISKY | |

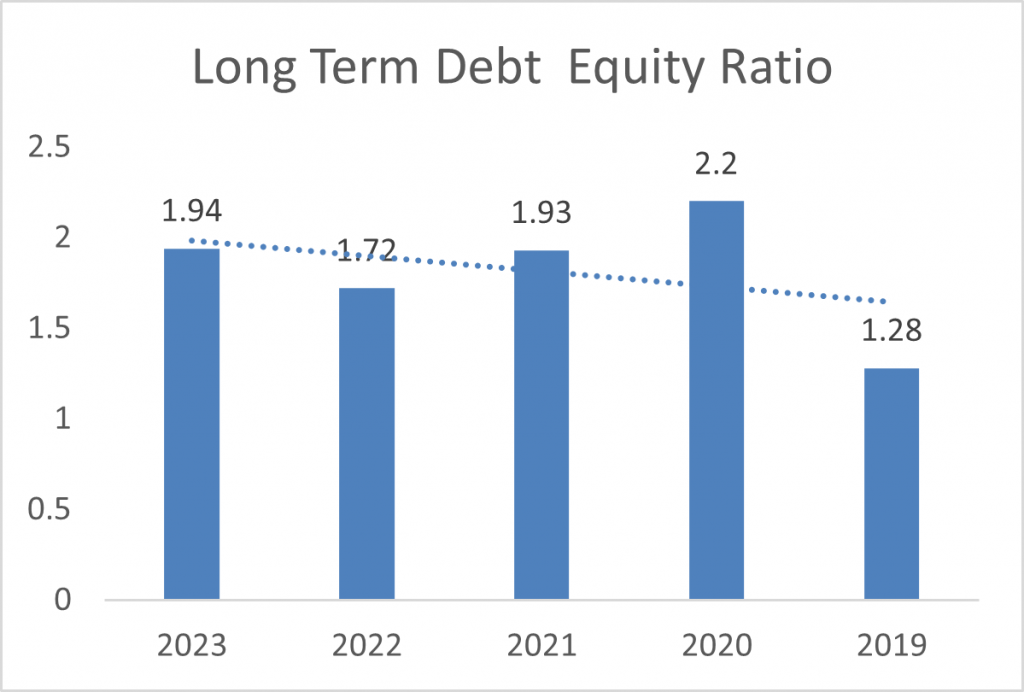

| Long-term-debt to Equity ratio | Long-Term-Debt-to-Equity ratio reflects the risk appetite of the company.This is a very important leverage ratio. It reflects the ability of a company to make payments associated with long-term debt. | Not more than 7:1 |  |

Over the years the long term debt to equity ratio had decreased but again it started rising in the year 2023 and is within the set criteria. A Higher ratio is indicating large amounts of long term debt as compared to its equity. | GOOD |

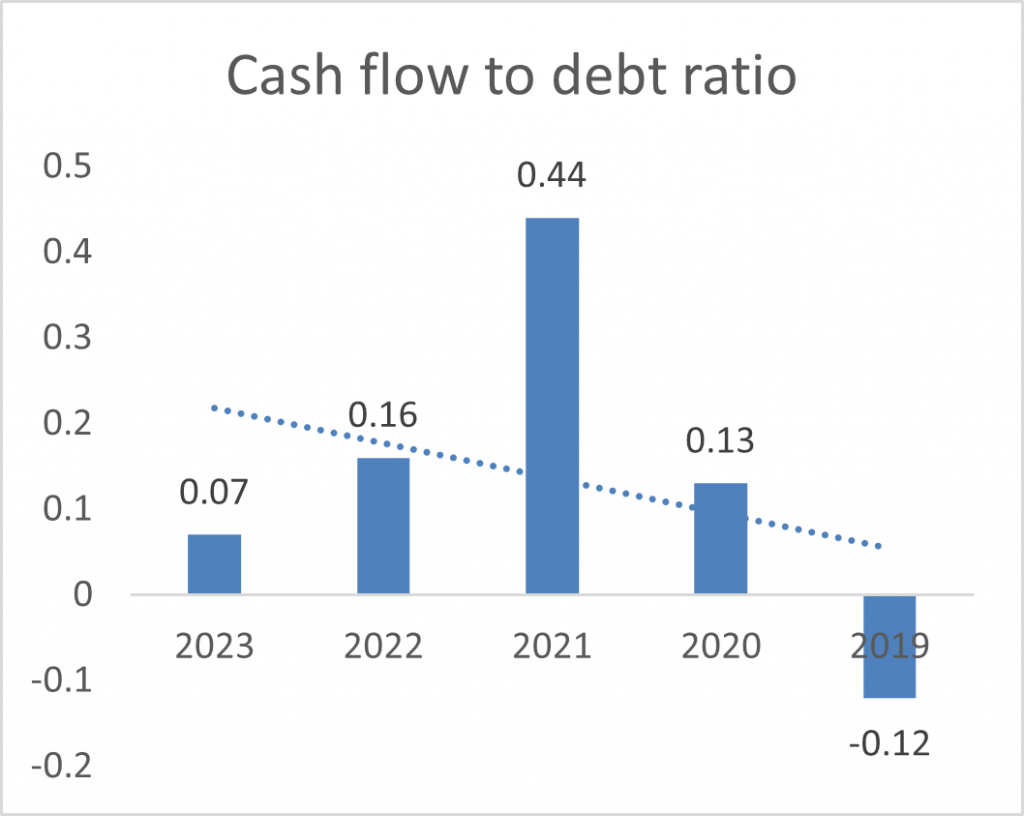

| Cash flow to debt ratio | Cash flow to Debt ratio is a coverage ratio. It indicates the time taken by the company to pay off its debt by utilising its operating cash flow. | Higher the ratio better it is. |  |

The trend shows that the company is not able to cover its debt from its operating cash flows for many years, which is concerning from a long-term perspective. This sustained inability to generate sufficient cash flow to meet debt obligations indicates potential financial instability and raises questions about the company’s future solvency. | RISKY |

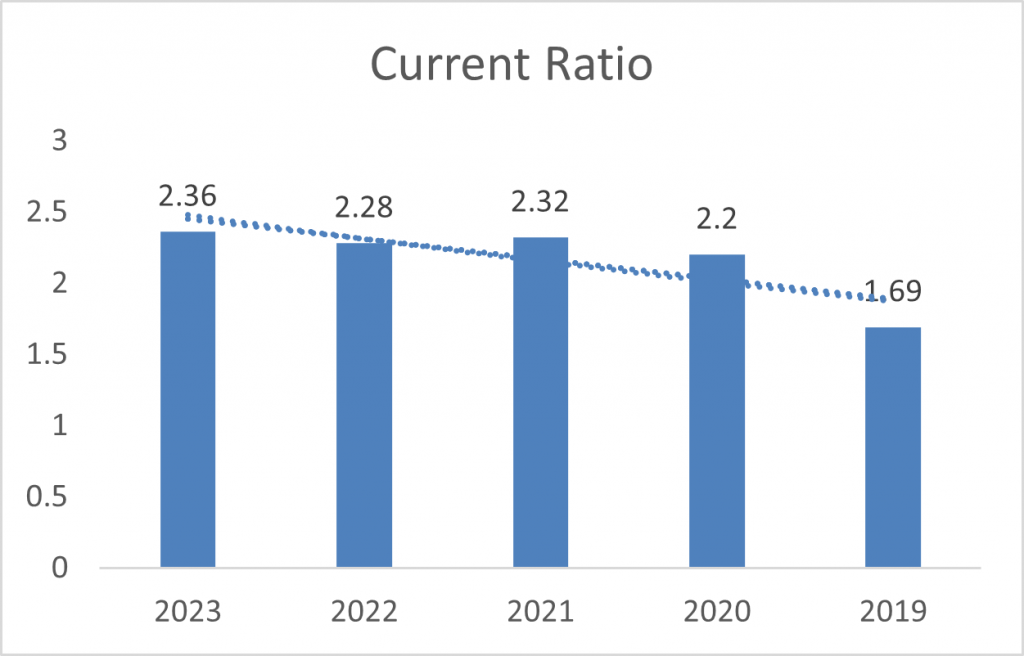

| Current Ratio | Assesses a company’s ability to meet short-term liabilities with short-term assets. A ratio above 1 indicates good short-term financial health. | A ratio of 1:1 is better |  |

Current ratio of the company is within permissible limits, and this says that the company can liquidate its short term liability very easily. | GOOD |

Issue analysis

Pros

- The NCD is A+ rated security with a stable outlook.

- The yield offered is 9.90% which is much higher than FDs.

- Adding NCDs to a portfolio can enhance diversification, reducing overall portfolio risk by including fixed-income securities.

- It is a better opportunity to invest in fixed income securities for the short term, earning monthly interest.

- The company is actively borrowing money with over 1600 crore Rupees raised in FY 2024.

Cons

- The operations of the NBFC is geographically constrained. It is majorly operated in South India.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Muthoot Capital Services Ltd.

Muthoot Capital Services Ltd, backed by the Muthoot Pappachan Group, is a publicly listed Non-Banking Finance Company (NBFC) registered with the Reserve Bank of India. Founded in 1994, it stands out as one of India’s most progressive automobile finance companies. The company provides both fund-based and non-fund-based financial services to retail, corporate, and institutional clients. Their product portfolio includes two-wheeler loans, used car loans, and fixed deposit investment products. Mr. Ramandeep Singh Gill serves as the Chief Financial Officer for the company.

Here is a table showing their products and interest rates.

| Products | Interest Rates |

| Two-Wheeler Loan | Starting @ 6.99% per annum. |

| Used Car Loan | Starting @ 0.70% P.M. (8.50%* P.A.) |

| Fixed-Deposits | Upto 9.91% p.a |

In addition, Muthoot offers secured business loans and loyalty loans to its existing customers at attractive rates.

Liquidity

The company has 180.99 crores as of 31st march, 2024 in liquid assets. Also the current ratio of the company is 7.2:1 which is very good.

Strengths

- Wider Reach– The company boasts an extensive reach, with over 3500 branches and a robust network spanning across 20 states nationwide.

- Diversified-One of the strengths of the NBFC lies in its proactive approach to raising funds from the public, evident in its successful combination of diverse financial instruments, including NCDs, Commercial Papers, amounting to 754.49 CR in the last financial year.

- Synergy -Muthoot has cultivated key partnerships with players like WheelsEMI, Manba Finance, Up Money, EV.fin, and Credit Wise Capital within the co-lending sector, enhancing its customer outreach. These firms specialize in two-wheeler financing, aligning well with Muthoot’s expansion strategy in the Indian market.

- Lower GNPA Levels– Over the past year, the company has successfully slashed its Gross Non-Performing Assets (GNPA) by an impressive 54%, with the current GNPA standing at 431 Crores.

- Customer Highlight-The company has welcomed 45,667 new customers during the last quarter of FY 2024.

- Exemplary Record -Within the co-lending arena, the company boasts a commendable track record with zero Non-Performing Assets (NPA).

- Increasing PAT-The company witnessed a remarkable growth in its Profit After Tax (PAT), rising from 79 crores to 123 crores, reflecting a substantial 56% increase.

Weakness

- The company previously operated in the gold loan sector, but one of its group entities expanded in that field, leading to the company’s exit from it.

- The retail loan portfolio of the company is heavily concentrated in the two-wheeler segment, accounting for over 99% of its composition, thus indicating a significant imbalance in its business focus.

- Borrowing cost of the company is 9.8% .

- The company’s geographical presence is predominantly focused in South India, indicating a high level of concentration in this region.

Invest in Bond IPO online in just 5 minutes

Source- Key Information Document- 11/06/2024

Disclaimer- The information is published as on date 06/21/2024 based on information available on Key Information Document- 11/06/2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors