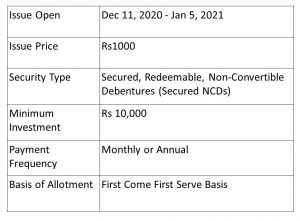

Details: Muthoot is issuing secured and redeemable non-convertible–debentures with a coupon of 6.75 to 7.75%pa.

Ratings: Muthoot Finance NCD is rated AA by CRISIL.

Usage of funds raised: The net proceeds will be utilized for lending (minimum of 75% of the amount raised) and general corporate purposes (not more than 25% of the amount raised).

Issue Size: The base size of the issue is 100 crores, but it has a greenshoe option of 900 crores.

Issue Closure Date: 5th January 2020. Can close before this date itself in case the issue receives oversubscription before 5th January 2020.

To know the Perks of Investing in Bonds and Debentures, click here.

About the issuer – Muthoot Finance

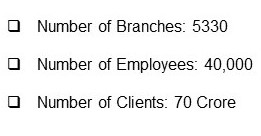

Muthoot Finance was established in the year 1939 by M.George Muthoot. . It is registered as “Systemically Important Non-Deposit -Taking Non-Banking Financial Company” with RBI.

Muthoot Finance is the largest gold financing company in the world. It has a diversified product portfolio with Foreign exchange, Money transfers, Wealth management, and a few others.

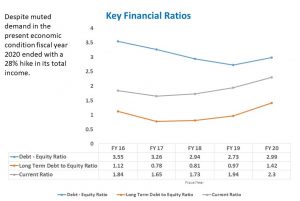

Financial Performance of the Company

Muthoot Finance has witnessed revenue growth every year: in 2016, the revenue was Rs. 4936.04 crores, and in 2020, it is 9683.98 crores.

Want to strategize your investment? To know about “Bond Investment Strategies,” click here.

Investment Process

IPOs are facilitated by entities called Lead Managers. Generally, these lead managers are brokerage firms. Investors need to apply for IPO through lead managers, and once the allotment is made, investors will receive the bond units in their Demat account.

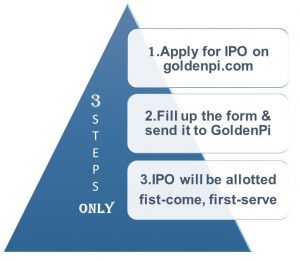

You can invest in IPOs via GoldenPi in three steps.

Step 1: Apply for IPO on Goldenpi.com

Click ‘Apply’ on Bond IPO. You will receive the application via email from your Relationship Manager at GoldenPi.

Step 2: Fill up the form and send it to GoldenPi.

Fill up the form with the required information. Take a photo of your form and share it with your Relationship Manager for bidding on exchange.

Courier the filled up IPO form to our office address as early as possible. The issue closes by 5th January 2021.

Our Address: IndiQube Orion, Ground Floor,

24th Main Road, Garden Layout, Sector 2,

HSR Layout, Bangalore, Pincode: 560102

To know how to invest in Muthoot Finance NCD-IPO online, read this blog.

Step 3. IPO allotment

IPO will be allotted to you on a first-come, first-serve basis and credited to your Demat account.

Please note that in case of oversubscription, the IPO can close well before 5th January 2021.

To participate in Muthoot Finance NCD – IPO, click here.

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Muthoot Finance NCD IPO April 2023 | 8.60%% | 75 cr | ICRA AA+ (Stable) | April 12, 2023 | April 26, 2023 | More Details |

| Muthoot Finance NCD IPO February 2023 | 8.60%% | 500 cr | ICRA AA+ (Stable) | February 8, 2023 | March 3, 2023 | More Details |

| Muthoot Finance NCD IPO September 2023 | 8.60% | 700 cr | ICRA AA+ (Stable) | September 21, 2023 | October 6, 2023 | More Details |

| Muthoot Finance NCD IPO November 2022 | 8.25% | 300 cr | ICRA AA+ (Stable) | November 28, 2022 | Dece,ber 19, 2022 | More Details |

| Muthoot Finance NCD IPO October 2022 | 8% | 500 cr | ICRA AA+ (Stable) | October 6, 2022 | October 26, 2022 | More Details |

| Muthoot Finance NCD IPO May 2022 | 8% | 300 cr | ICRA AA+ Stable | May 25, 2022 | June 17, 2022 | More Details |

| Muthoot Finance NCD IPO April 2022 | 8% | 500 cr | ICRA AA+ Stable | April 7, 2022 | April 29, 2022 | More Details |

| Muthoot Finance NCD IPO December 2020 | 7.75% | 100 cr | CRISIL AA | December 11, 2020 | January 5, 2021 | More Details |