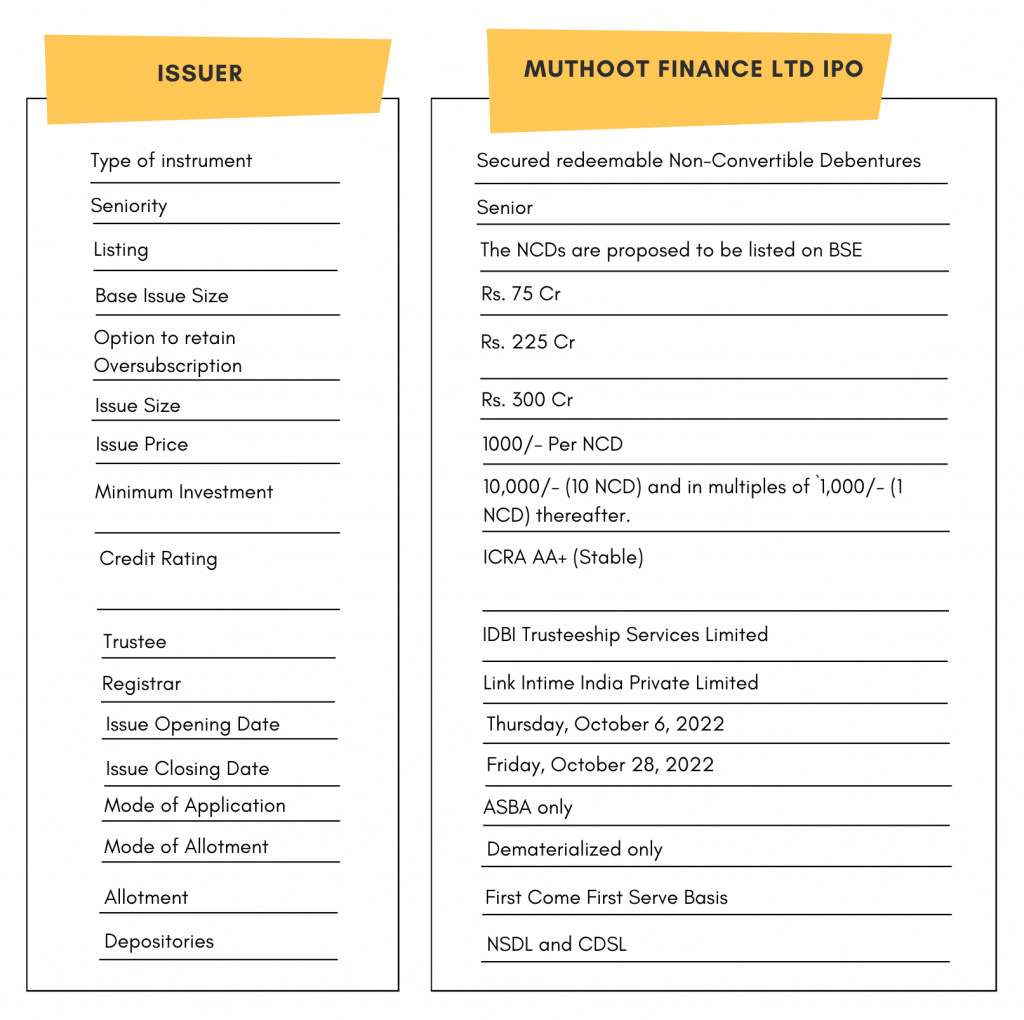

Muthoot Finance Ltd is issuing the Non-Convertable Debentures. These NCDs are AA+ Stable by ICRA. The NCDs are issued in three series: coupon ranges from 7% to 8% p.a. and different tenures of 2 years to 5 years. The NCDs are secured and redeemable in nature.

High Yield | AA+ Rated | Minimum Investment: 10k Only

INVEST NOW

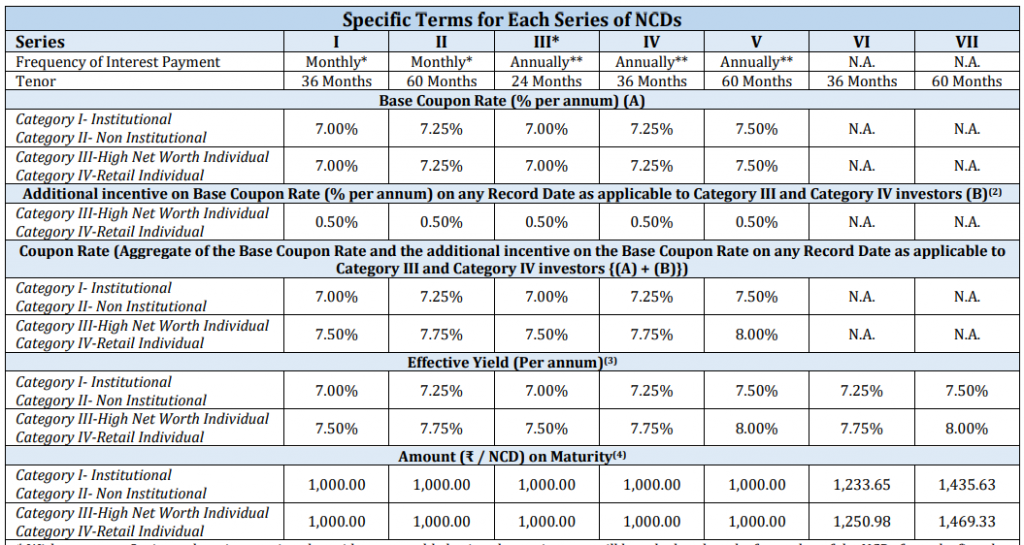

Muthoot Finance Ltd NCD IPO: Coupon rates and effective yield for each of the series

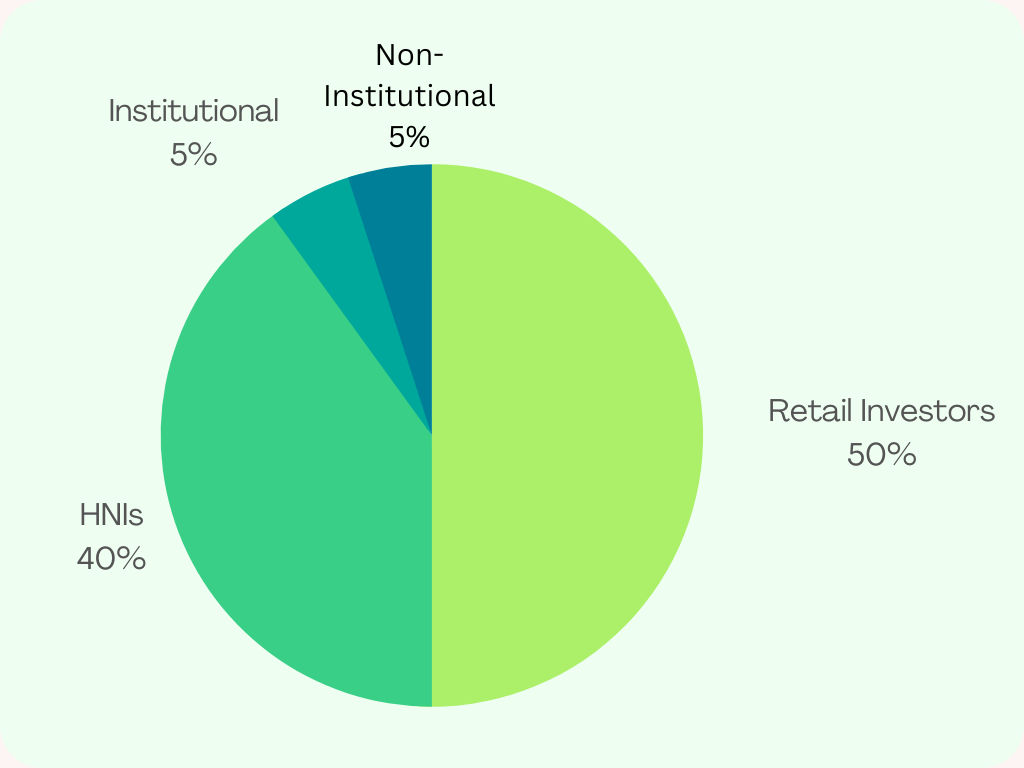

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Muthoot Finance Ltd NCD-IPO.

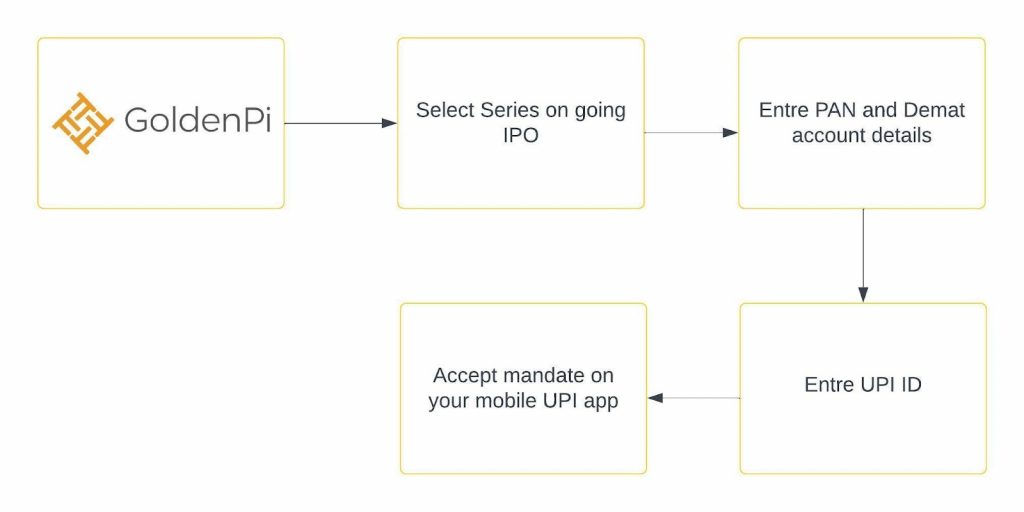

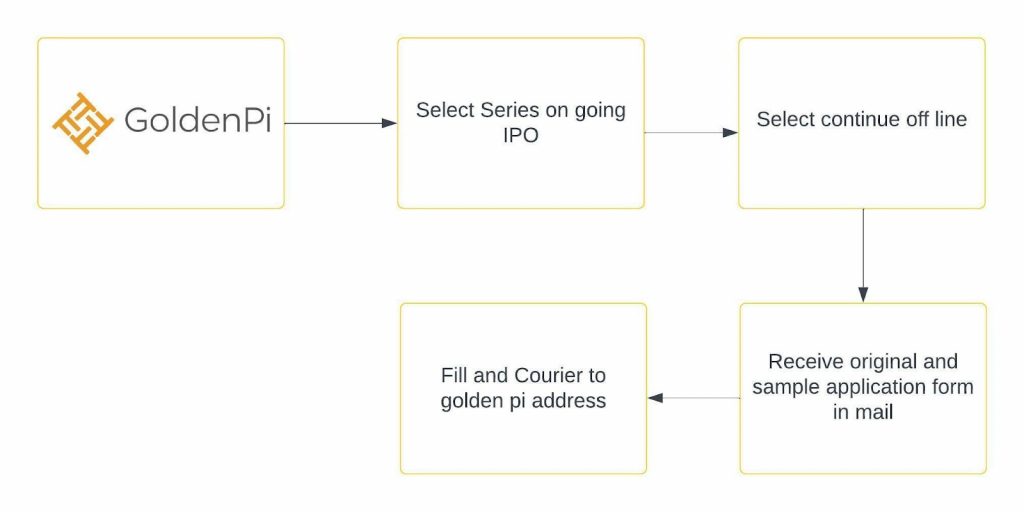

Investment Process for Muthoot Finance Ltd NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Invest in Bond IPO online in just 5 minutes

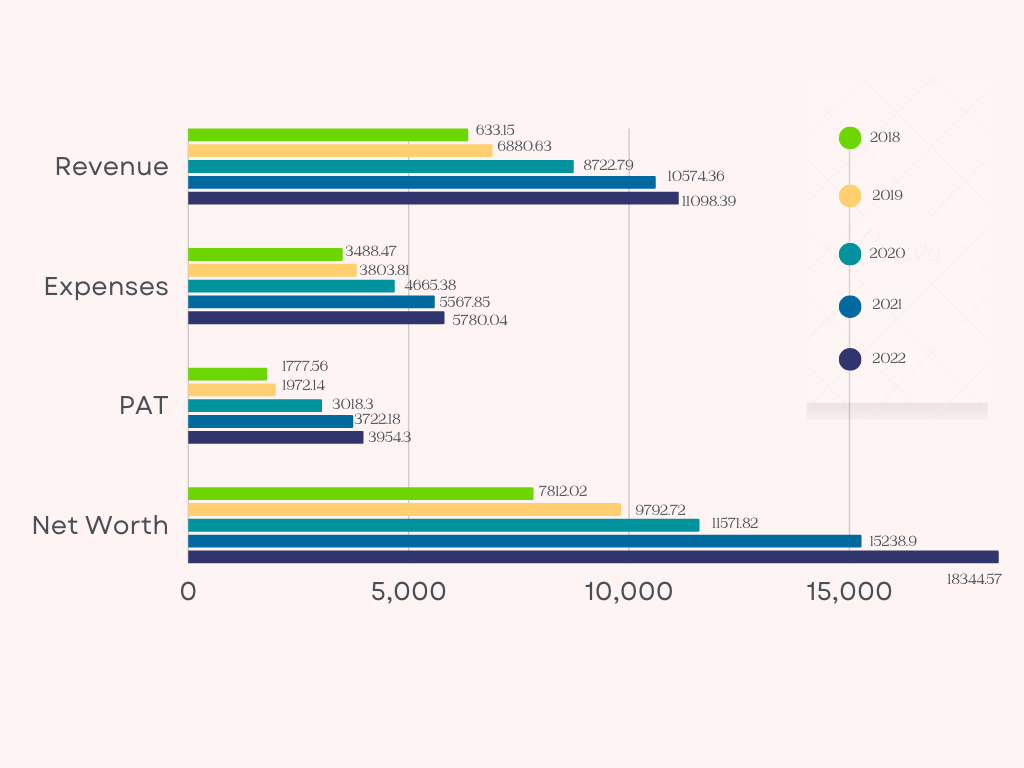

Financial Overview

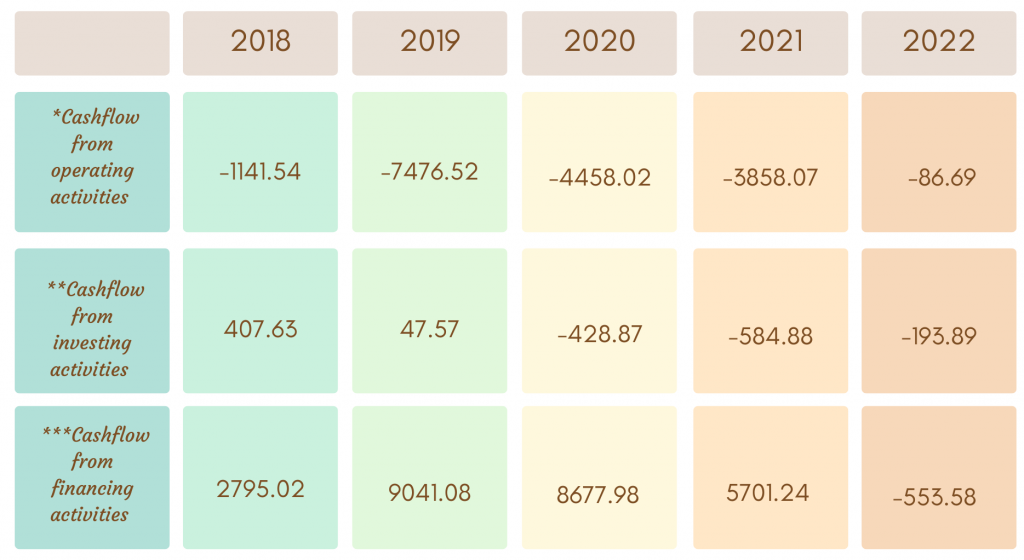

Cash flow for the last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product or services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like the purchase of assets, sales of securities, etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

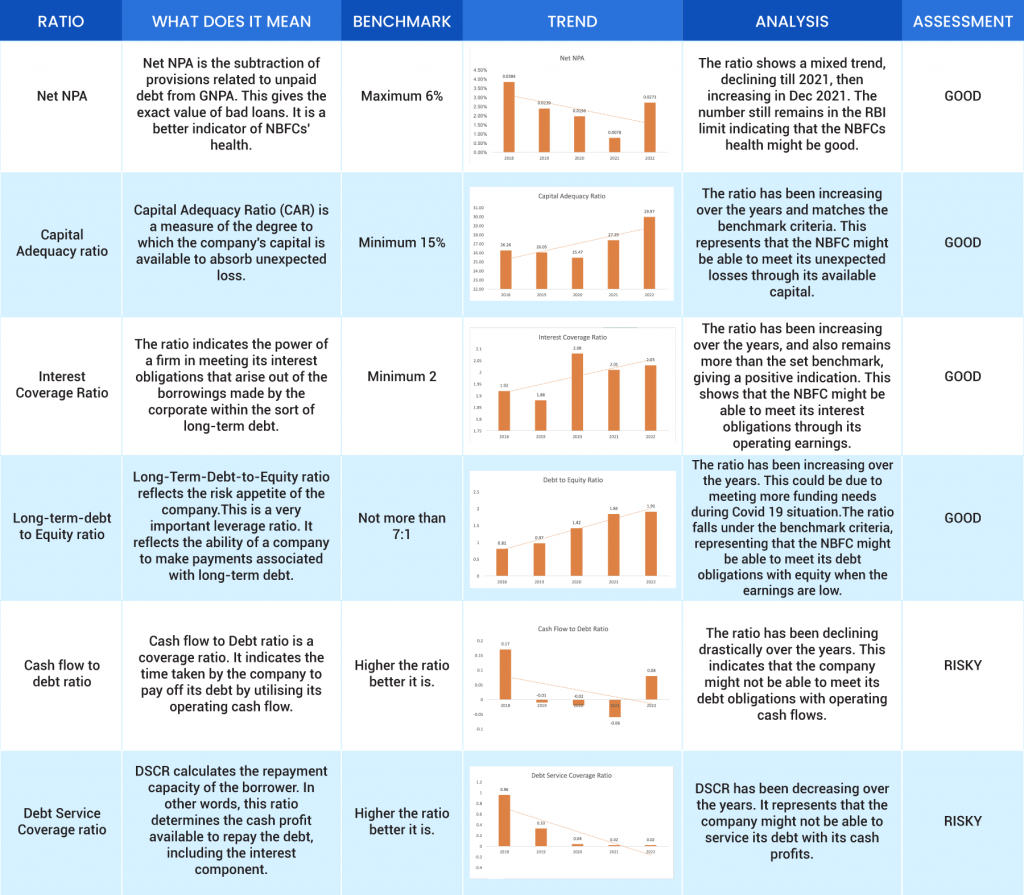

Ratio Analysis

Issue analysis

Pros:

- The NCD is AA+ rated security with a stable outlook.

- The coupon rate is between 7% to 8% which is much higher than FDs.

Cons:

- The debt Service Coverage ratio has been decreasing indicating that the company might not be able to service its debt through available profits.

- Net NPA has been increasing at a higher pace.

About Muthoot Finance Ltd

Founded in 1939, Muthoot Finance Ltd. is the largest gold loan NBFC in India. It is registered as a “Systemically Important Non-Deposit -Taking Non-Banking Financial Company” with RBI. The company is headquartered in Kochi, Kerala, and also has a presence in the UK, the US, and the United Arab Emirates.

Business Verticals:

- Foreign Exchange Services

- Money Transfers

- Wealth Management Services

- Travel and tourism services

- Sells gold coins

FY-2022:

Gold Jewelry kept as security – 178 tonnes

Pan India Branches – 4600+

Team Members – 26000+

Customers served every day – 200,000+

Loan Assets under Management – Rs. 56689.2 Cr

Retail investor base across debenture and subordinated debt portfolio – 100,000+

Strengths:

- Strong Gold loan business. The total Loan portfolio of the company includes 99% of the gold loan.

- Healthy earnings profile.

- Capitalization to remain healthy over the medium term

Weakness:

- Geographically restricted, MFL’s operations are largely concentrated in South India.

- Covid-19 disrupted the performance of non-gold segments.

To get better returns than Bank FDs, invest in NCD-IPOs online.

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Muthoot Finance NCD IPO April 2023 | 8.60%% | 75 cr | ICRA AA+ (Stable) | April 12, 2023 | April 26, 2023 | More Details |

| Muthoot Finance NCD IPO February 2023 | 8.60%% | 500 cr | ICRA AA+ (Stable) | February 8, 2023 | March 3, 2023 | More Details |

| Muthoot Finance NCD IPO September 2023 | 8.60% | 700 cr | ICRA AA+ (Stable) | September 21, 2023 | October 6, 2023 | More Details |

| Muthoot Finance NCD IPO November 2022 | 8.25% | 300 cr | ICRA AA+ (Stable) | November 28, 2022 | Dece,ber 19, 2022 | More Details |

| Muthoot Finance NCD IPO October 2022 | 8% | 500 cr | ICRA AA+ (Stable) | October 6, 2022 | October 26, 2022 | More Details |

| Muthoot Finance NCD IPO May 2022 | 8% | 300 cr | ICRA AA+ Stable | May 25, 2022 | June 17, 2022 | More Details |

| Muthoot Finance NCD IPO April 2022 | 8% | 500 cr | ICRA AA+ Stable | April 7, 2022 | April 29, 2022 | More Details |

| Muthoot Finance NCD IPO December 2020 | 7.75% | 100 cr | CRISIL AA | December 11, 2020 | January 5, 2021 | More Details |