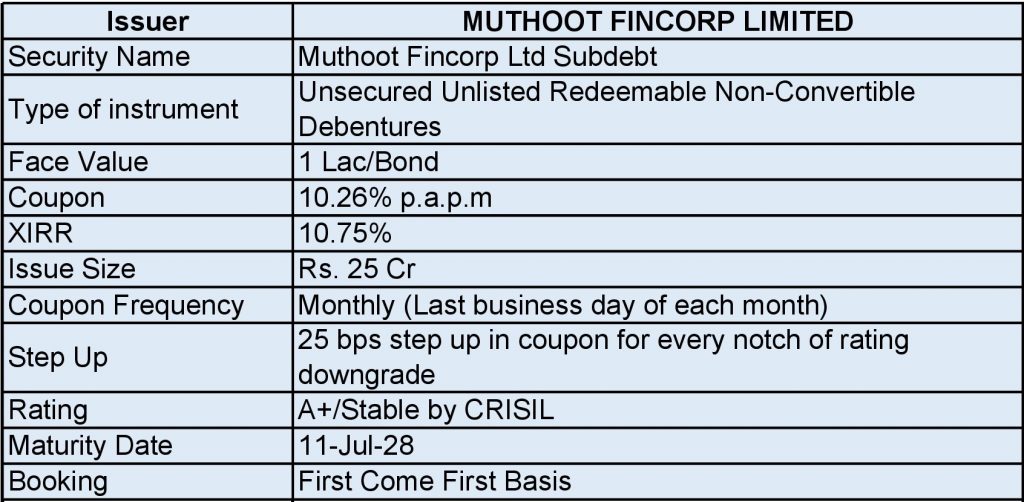

Muthoot Fincorp Ltd is issuing Non-Convertible debentures. These NCDs are A+ Stable by CRISIL. These NCDs can also be called Monthly coupon bonds, as they provide 10.26% interest monthly per annum.

Bond Overview

INVEST NOW

Issue analysis

Pros

- The NCD is A+ rated security with a stable outlook.

- The coupon rate is 10.26% which is much higher than FDs.

Cons

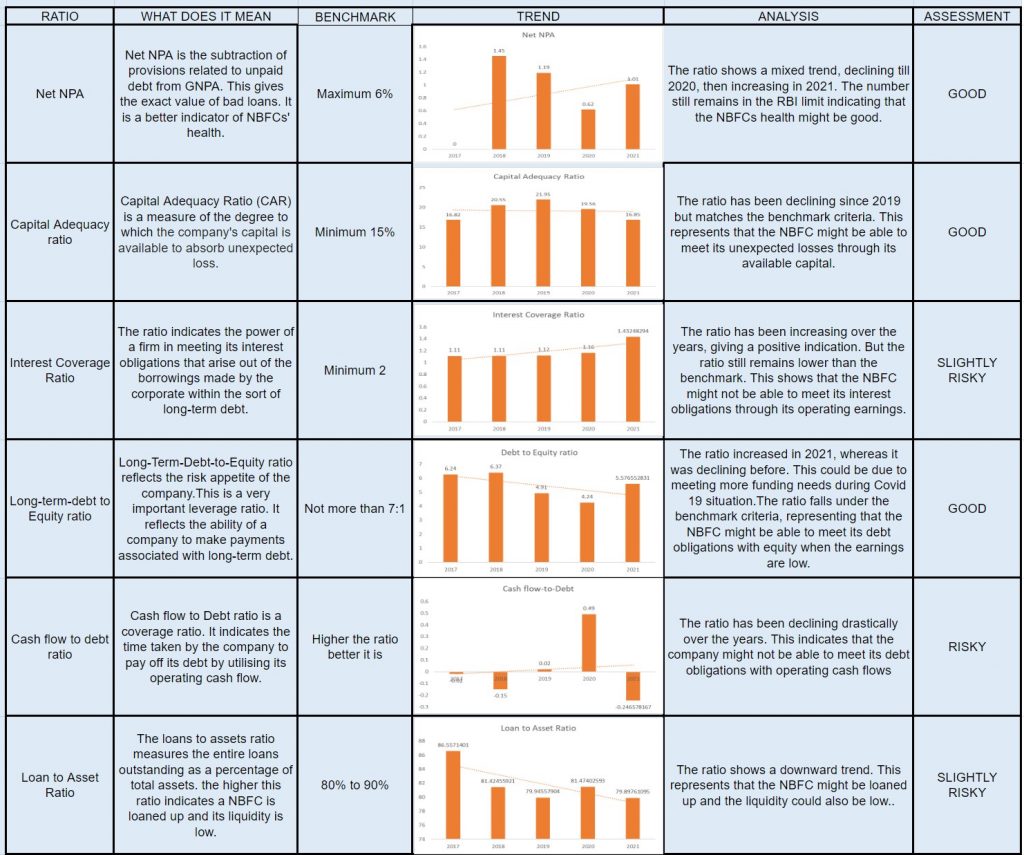

- Cashflows have been decreasing at a faster pace.

- The operations of NBFC is geographically constrained. It is majorly operated in South India.

About Muthoot Fincorp Ltd.

Founded in 1997, Muthoot Fincorp Ltd.(MFL) is a non-deposit taking, one of the leading NBFCs in the country. The NBFC primarily deals into lending against gold jewellery. It is the flagship company of the Muthoot Pappachan Group also popularly known as the Muthoot Blue Group, which has diverse business interests such as hospitality, real estate, and power generation.

Business Verticals-

- Gold loan

- Small business loan

- Home Loan

- Auto Loan

- Micro Finance

- Forex

- Money Transfer

- Wealth management services

- Insurance

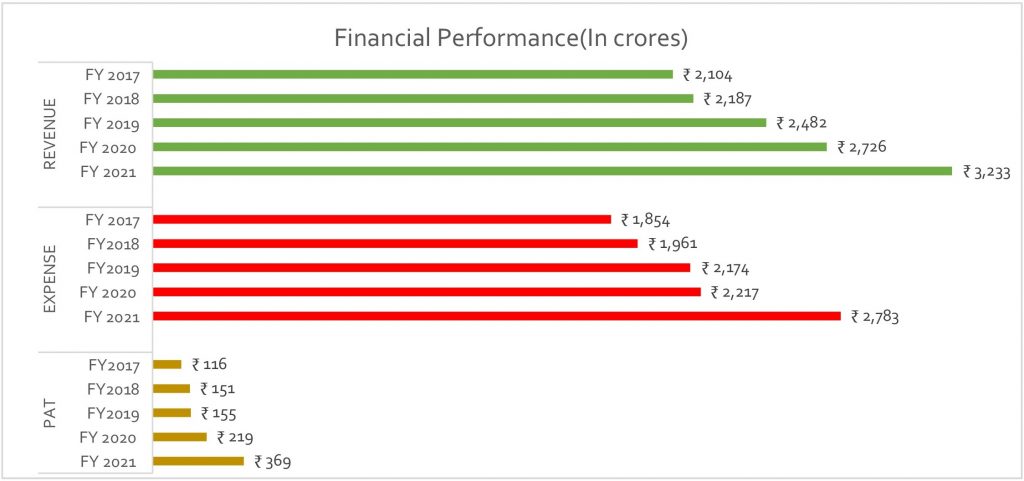

Financial Overview

Snapshot stating the Revenue, Expenses and PAT

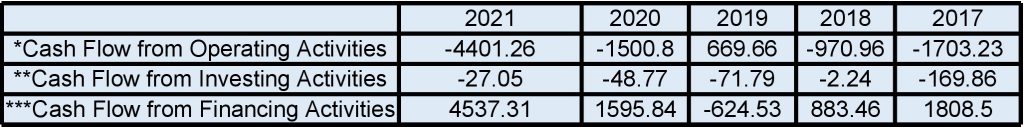

Cash flow for last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

To get better returns than Bank FDs, invest in NCD-IPOs online.

Ratio Analysis

Financial for 2021

Financial for 2021

- Total Customers- 5 million

- Total no. of branches- 4200+

- Asset under management- Rs. 18,701 cr

- Credit Cost- 0.2%

- 96% of the loan book is secured against gold.

Strengths

- Strong Gold loan business. MFL is the 3rd largest gold loan non-banking financial company (NBFC).

- Healthy earnings profile for the gold loan segment.

- Liquidity stays strong, with Rs 1347 cr maintained in the form of cash and unutilised bank lines.

Weakness

- Geographically restricted, MFL’s operations are largely concentrated in South India.

- Covid-19 disrupted the performance of non-gold segments.

DISCOVER BONDS

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Muthoot Fincorp NCD IPO September 2023 | 9.43% | 100 cr | CRISIL AA- / Stable | September 1, 2023 | Septmber 14, 2023 | More Details |

| Muthoot Fincorp NCD IPO April 2023 | 9.37% | 150 cr | CRISIL AA- / Stable | April 12, 2023 | April 26, 2023 | More Details |

| Muthoot Fincorp NCD IPO January 2023 | 8.83% | 400 cr | ICRA AA+ (Stable) | January 2, 2023 | January 27, 2023 | More Details |

| Muthoot Fincorp NCD IPO July 2022 | 10.75% | 25 cr | CRISIL A+ (Stable) | Data not available | Data not available | More Details |