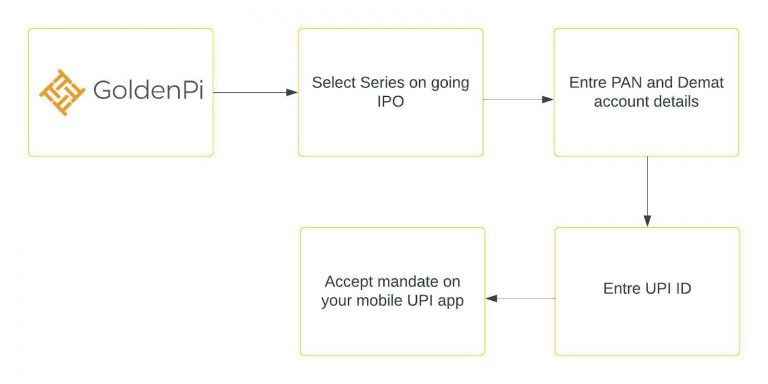

|

Getting your Trinity Audio player ready...

|

High Yield | BBB/Stable Rated | Minimum Investment: 10k Only

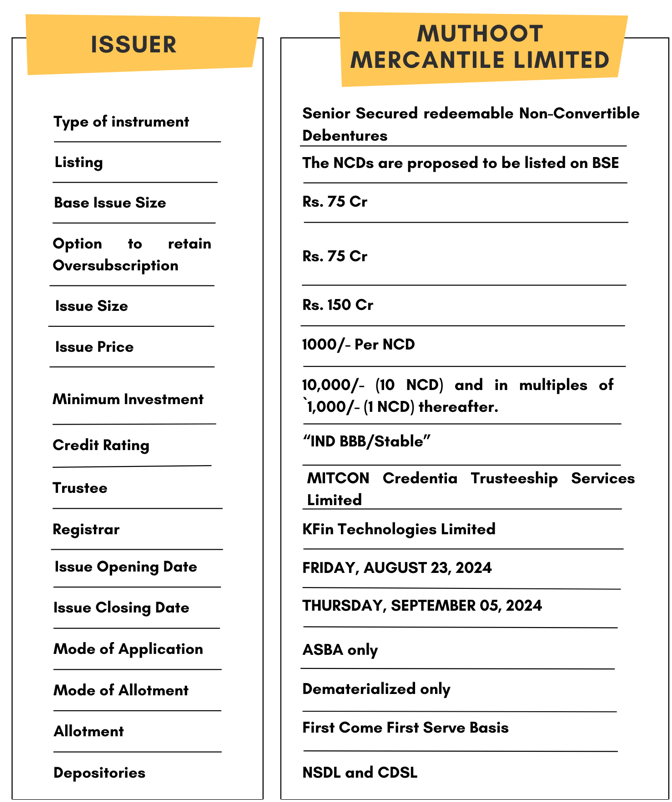

Muthoot Mercantile Limited is issuing the Non-Convertible Debentures. These NCDs are BBB/Stable rated by India Ratings and Research. The NCDs are being issued in nine series: coupon ranges from 10.70% to 11.50% p.a. and different tenures of 400 days, 20 months, 36 months, 60 months and 73 months. The NCDs are senior secured and redeemable in nature.

Muthoot Mercantile Limited NCD IPO: Coupon rates and effective yield for each of the series

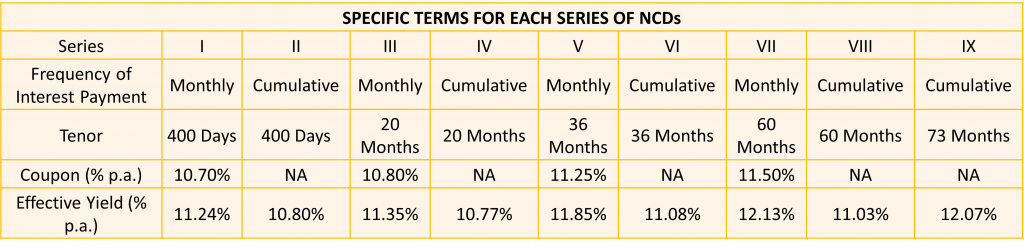

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Muthoot Mercantile Limited NCD-IPO.

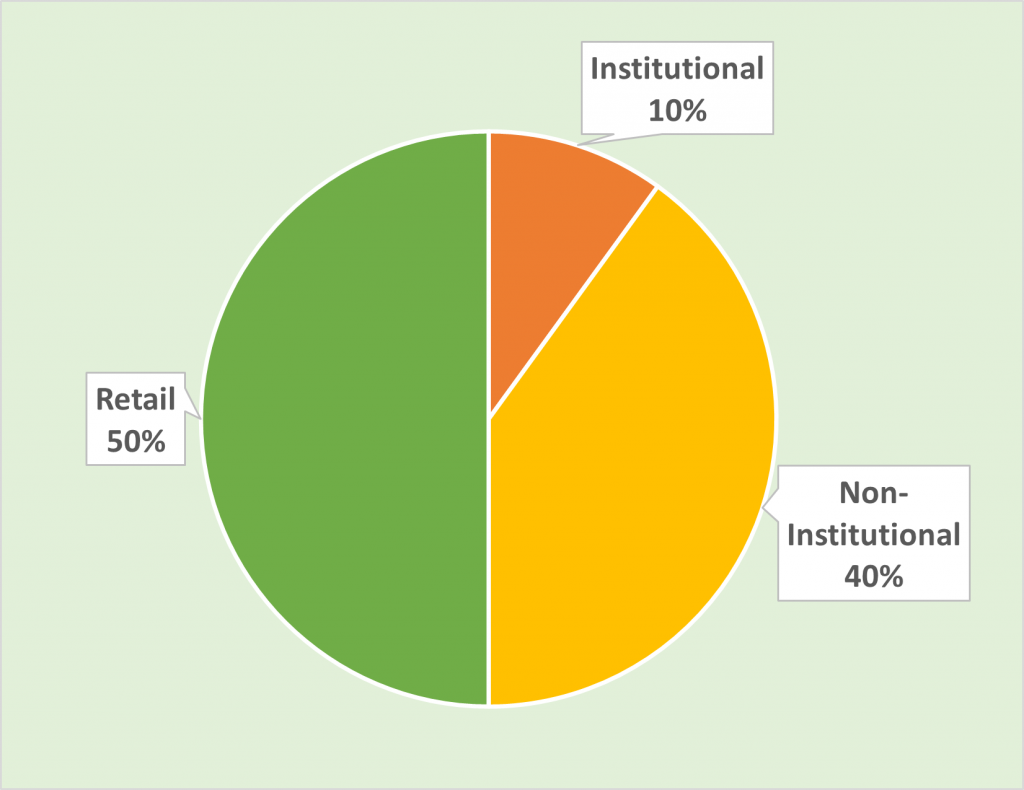

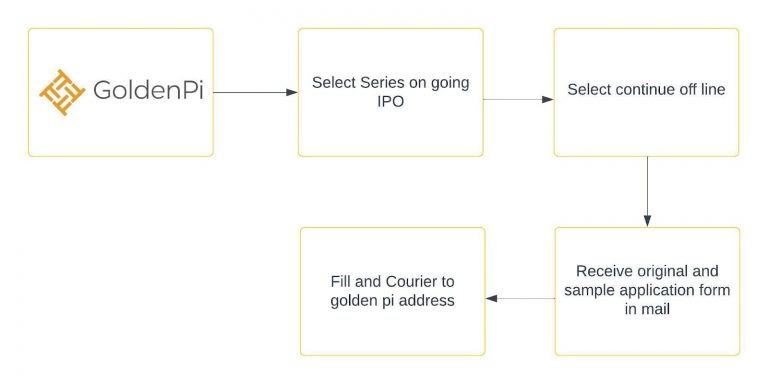

Investment Process for Muthoot Mercantile Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

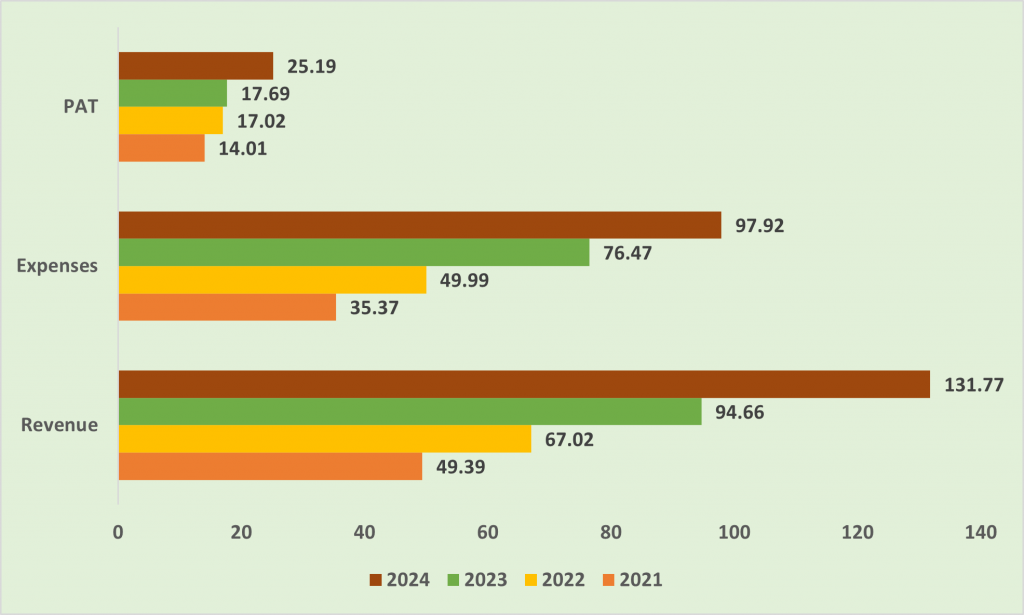

Financial Overview

Snapshot stating the Revenue, Expenses, and PAT (In crores)

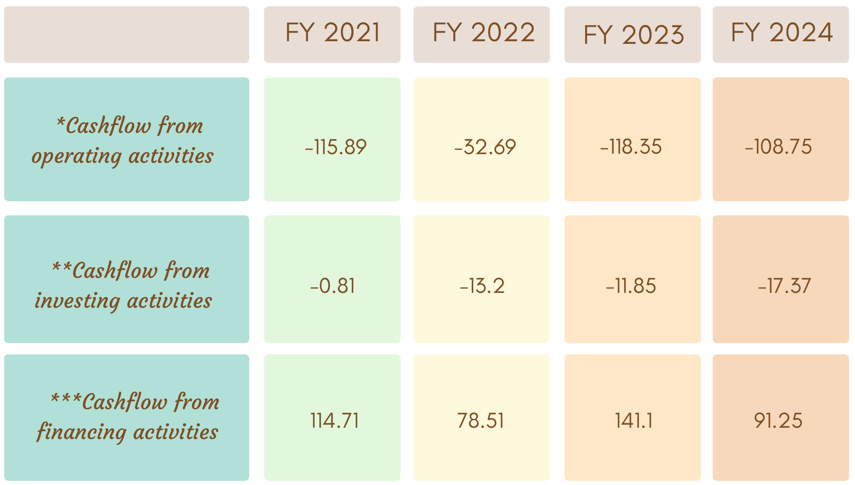

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

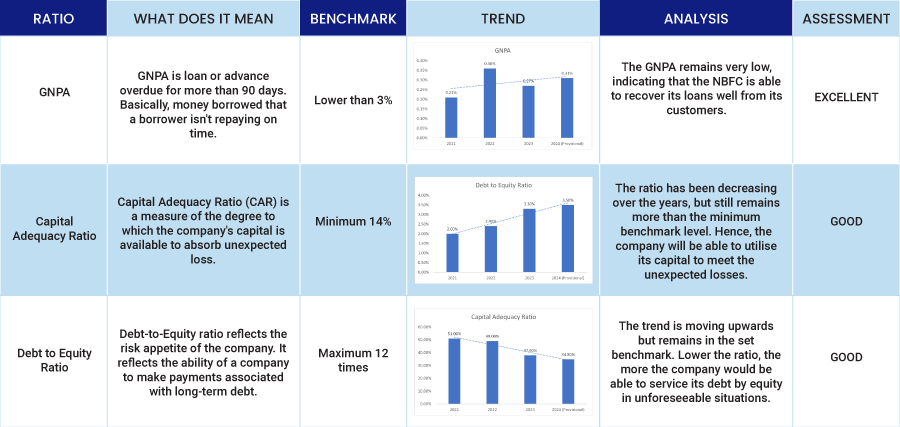

Ratio Analysis

Issue analysis

Pros

- The NCD is BBB rated security with a stable outlook.

- The coupon rate is between 10.7% to 11.5% which is much higher than FDs.

Cons

- Significant dilution in tangible net worth due to significant losses

- Deterioration in the asset quality

Liquidity

The company’s asset-liability position shows a positive surplus for the next year. Additionally, the cash reserves, bank balances, and fixed deposits totaling INR 320 million, along with unused bank lines of INR 174 million as of the end of June 2024, offer extra support to the liquidity profile, especially in relation to the debt repayment of INR 319 million due between July and September 2024.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Muthoot Mercantile Limited

Muthoot Mercantile Limited (MML) was established as a Public Limited Company in 1997 and obtained registration as a Non-Banking Finance Company from the Reserve Bank of India in 2002. As a prominent NBFC, Muthoot Mercantile Limited serves as the flagship entity of the Muthoot Ninan Group, founded by the late M. Ninan Muthoot in 1939. The company specializes in providing loans secured against gold.

Strengths

- Significant growth and expansion of franchise, enhancing geographic diversification: MML achieved notable growth in its gold loan business during FY23-FY24, with a 30% year-on-year increase in the loan book to INR 7 billion in FY24, driven by branch expansions.

- Reasonable profitability supporting growth: MML’s net interest margin increased to 12.15%, according to the audited financials for FY24 (FY23: 10.73% ; FY22: 12.14%), because of the improvement in yield.

- Stable asset quality: The gold loan segment exhibited resilience during COVID-19 disruptions, maintaining stable asset quality with a gross NPA of 0.3% in FY24 (up from 0.27% in FY23).

- Adequate capitalization: MML, wholly owned by the chairman and family, possessed a tangible net worth of INR 1,631 million as of March 31, 2024.

Weakness

- Business scalability and profitability under monitoring: Increased competitive pressures in south India from various sources, including Nidhi companies, moneylenders, microfinance institutions, and banks offering agriculture gold loans, have resulted in slower AUM growth per branch and pricing pressure.

- Concentrated funding profile: As of March 2024, MML’s funding mix comprised NCDs (26%), subordinated debentures (38.6%), and loans from public sector banks (35.4%), indicating concentration. The company’s leverage stood at 3.5x by end-March 2024.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus August 07, 2024

Disclaimer- The information is published as on date 23/08/2024 based on information available on Prospectus August 07, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors