|

Getting your Trinity Audio player ready...

|

High Yield | A-/Stable Rated | Minimum Investment: 10k Only

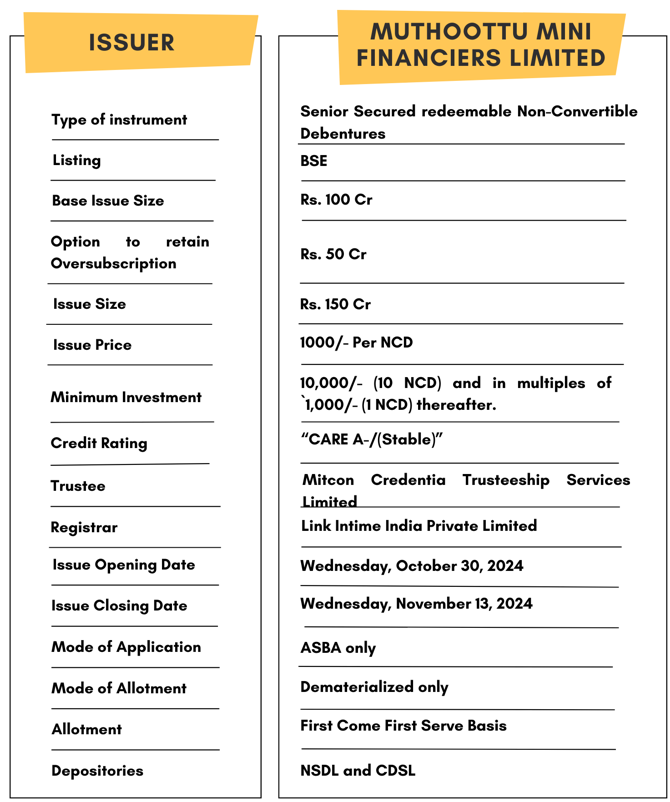

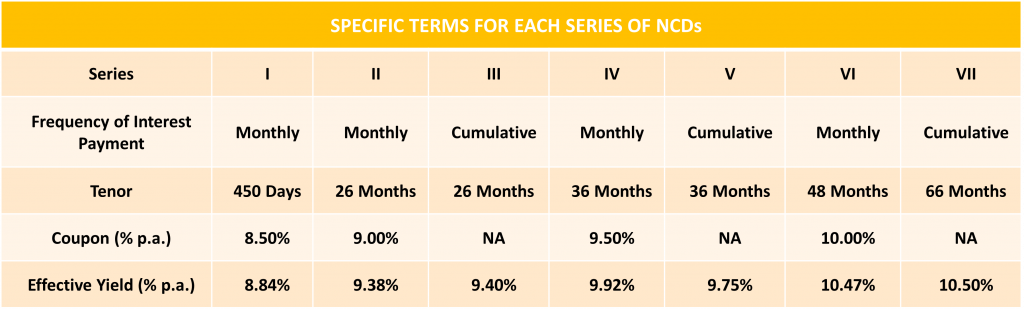

Muthoottu Mini Financiers Ltd is issuing Non-Convertible Debentures. These NCDs are A-/Stable by CARE. The NCDs are being issued in seven series: yield ranges from 8.84% to 10.5% p.a. and different tenures of 450 days, 26 months, 36 months, 48 months and 66 months. The NCDs are secured and redeemable in nature.

Muthoottu Mini Financiers Limited NCD IPO: Coupon rates and effective yield for each of the series

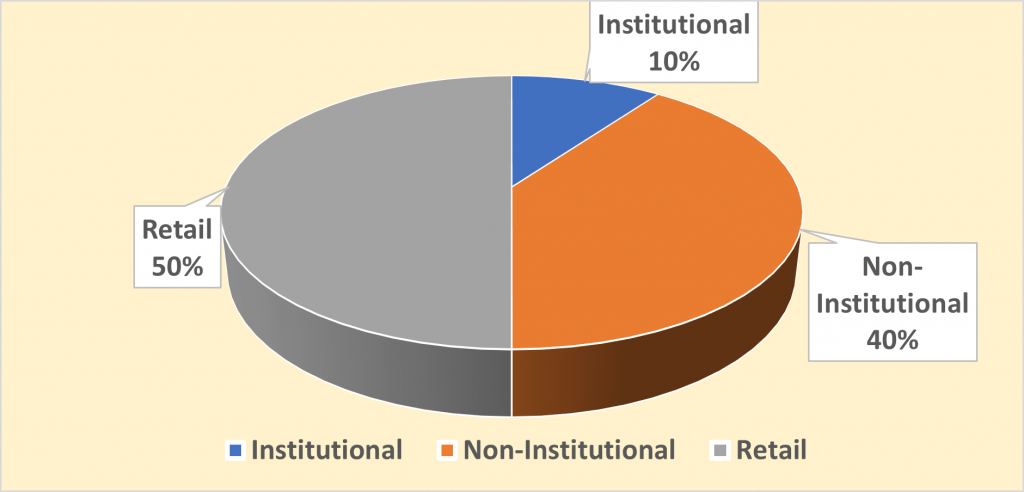

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Muthoottu Mini Financiers Ltd NCD-IPO.

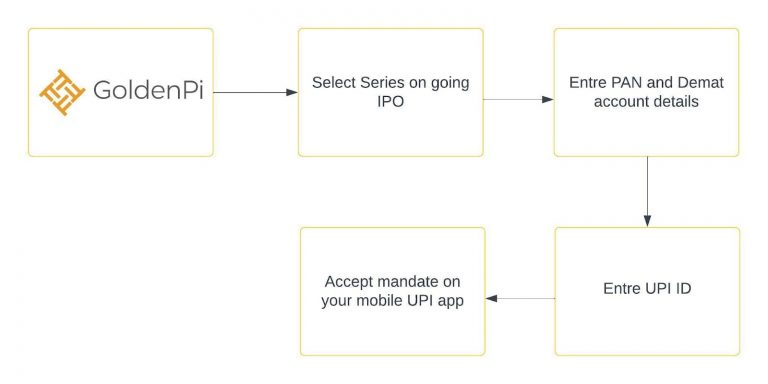

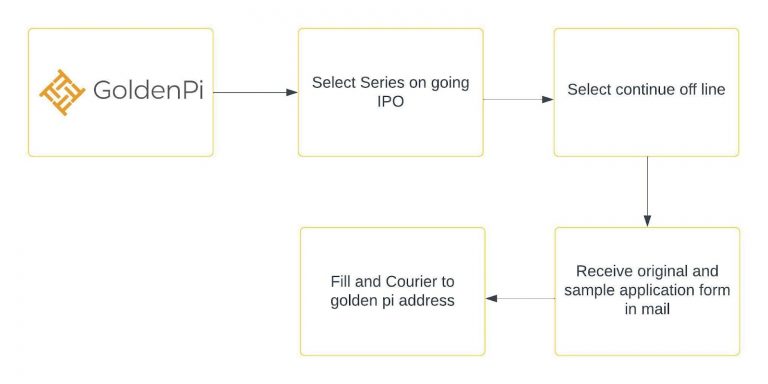

Investment Process for Muthoottu Mini Financiers Ltd NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

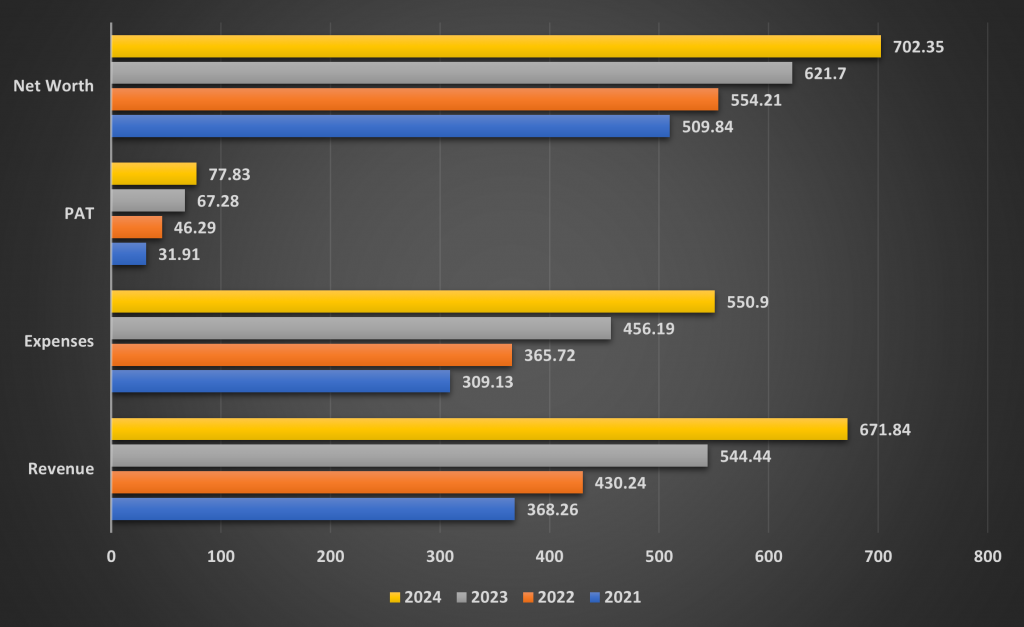

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT

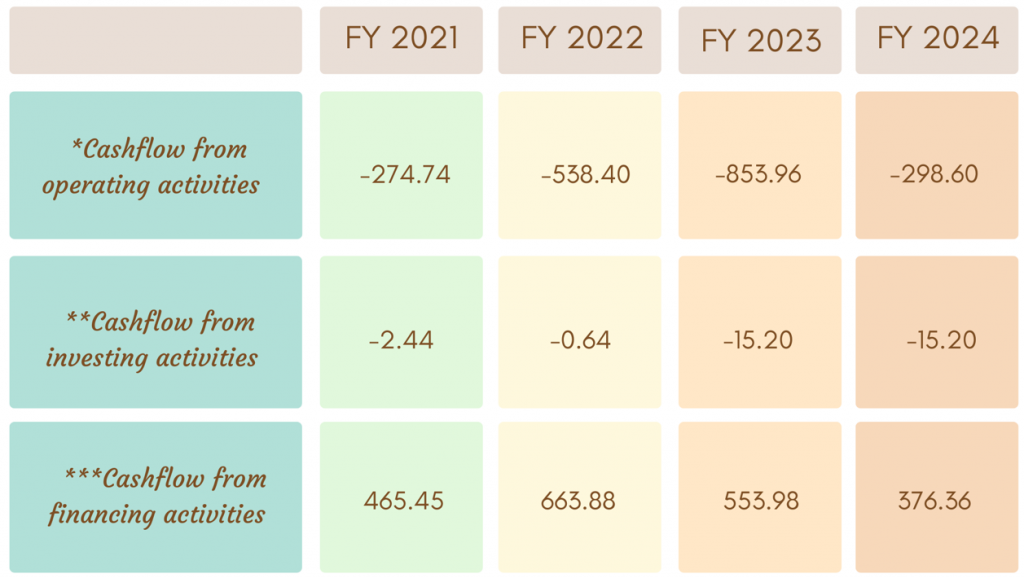

Cash flow for last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

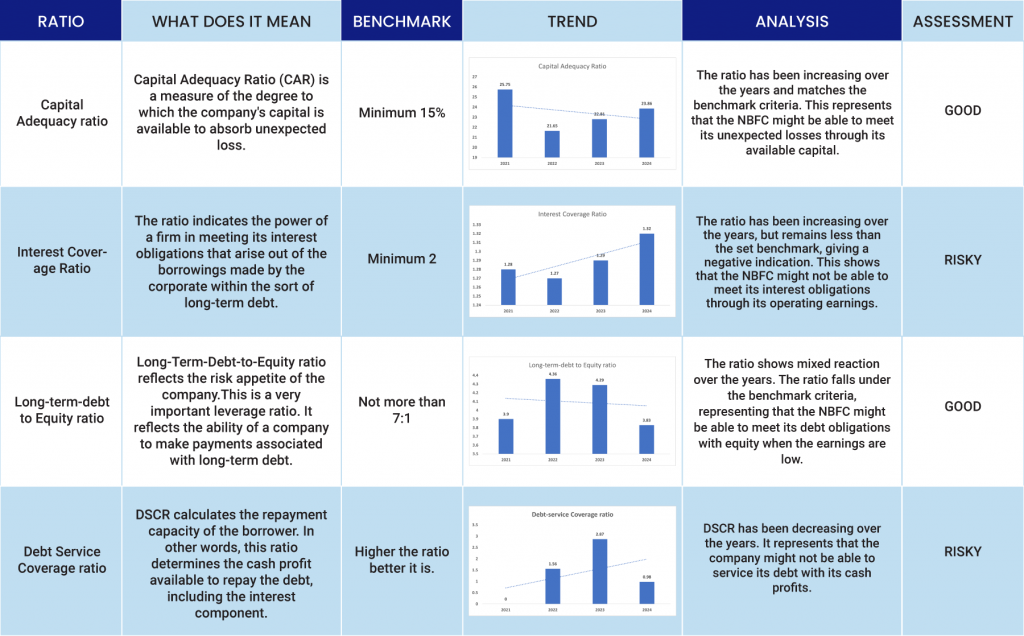

Ratio Analysis

Issue analysis

Pros

- The NCD is A- rated security with a stable outlook.

- The yield offered is 10.5% which is much higher than FDs.

Cons

- The operations of NBFC is geographically constrained. It is majorly operated in South India.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Muthoottu Mini Financiers Limited

Muthoottu Mini Financiers Limited (MMFL), founded in 1998, transitioned from an investment company to a leading non-banking financial company specializing in gold loans by 2007. Now operating through 907 branches across 12 states, MMFL has built a strong presence in South India, with a loan portfolio of ₹3,525 crore as of June 2024. The company also offers microfinance and property loans, alongside facilitating money transfer services for providers like Western Union, focusing on financial inclusion for diverse communities.

Strengths

- Established Brand: Over 60 years in the gold loan industry, particularly strong in South India.

- Solid Capital Position: High capital adequacy at 24.64% and improved gearing of 4.97x as of June 2024.

- Effective Risk Management: Strong appraisal and gold security systems, including regular audits and mark-to-market tracking.

- Consistent Profitability: ROTA above 1.5% over three years, with NIM up to 7.62% in FY24.

- Low NPA Levels: Maintains asset quality with a gross NPA of 0.88% in FY24, thanks to its secured gold loan focus.

Weakness

- High Concentration Risk: 92% in gold loans and 96% in South India, with 40% in Tamil Nadu, leading to regional risk.

- Heavy Fixed Asset Investment: Fixed asset-to-net worth ratio at 29%, potentially limiting growth capital.

- Intense Competition: Competes with larger NBFCs and banks; regulations on disbursements over ₹20,000 could affect loan processing.

- Higher Delinquency in MFI Segment: Microfinance segment has higher NPAs, with 90+ DPD rising to 2.22% in FY24.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus October 23, 2024

Disclaimer- The information is published as on date 10/31/2024 based on information available on Prospectus October 23, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors