|

Getting your Trinity Audio player ready...

|

High Yield | IND A+/Stable | Minimum Investment: 10k Only

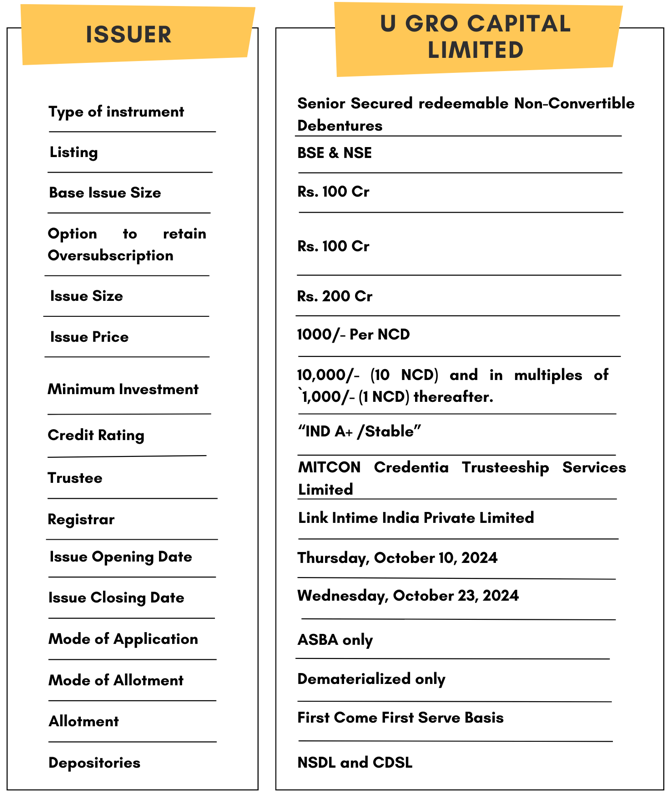

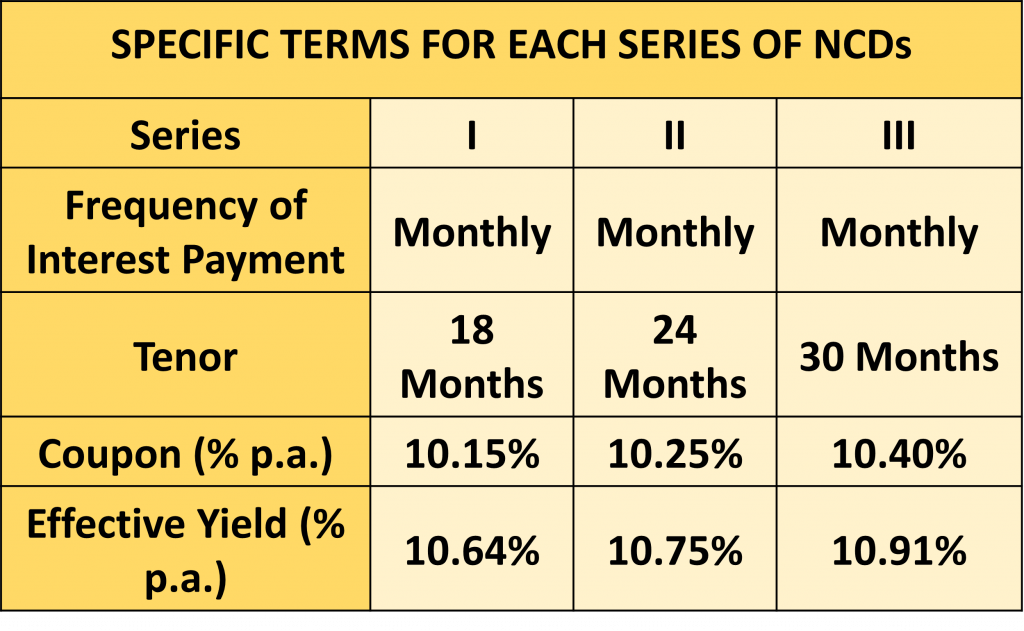

U GRO Capital is issuing the Non-Convertible Debentures. These NCDs are IND A+/Stable rated. The NCDs are being issued in three series: coupon ranges from 10.15% to 10.40% p.a. and different tenures of 18 months, 24 months and 30 months. The NCDs are secured and redeemable in nature.

U GRO Capital NCD IPO: Coupon rates and effective yield for each of the series

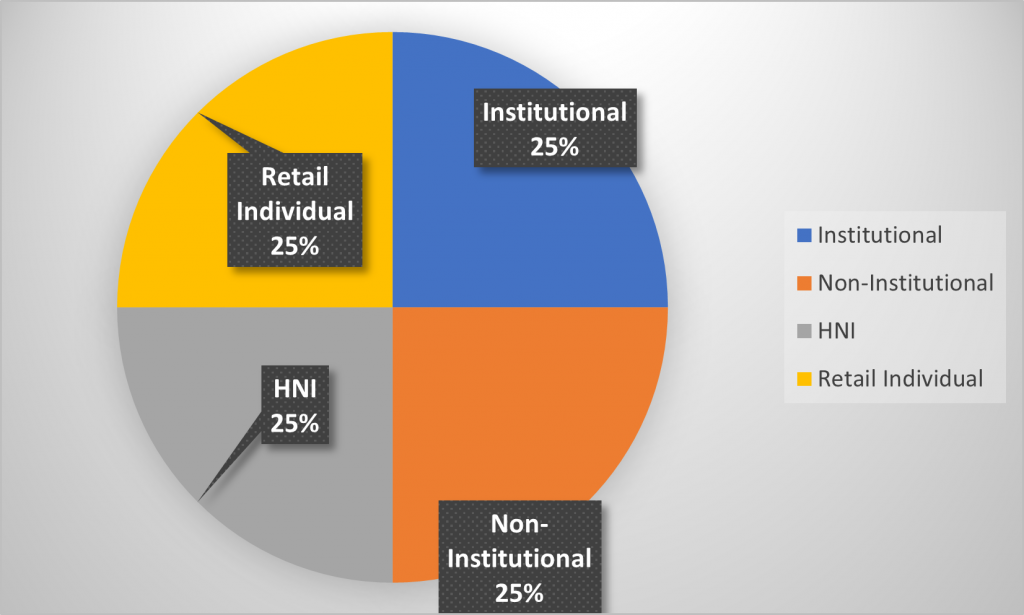

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for U GRO Capital NCD-IPO.

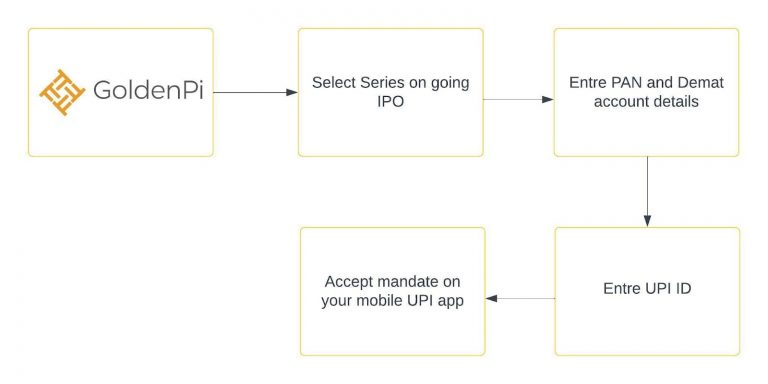

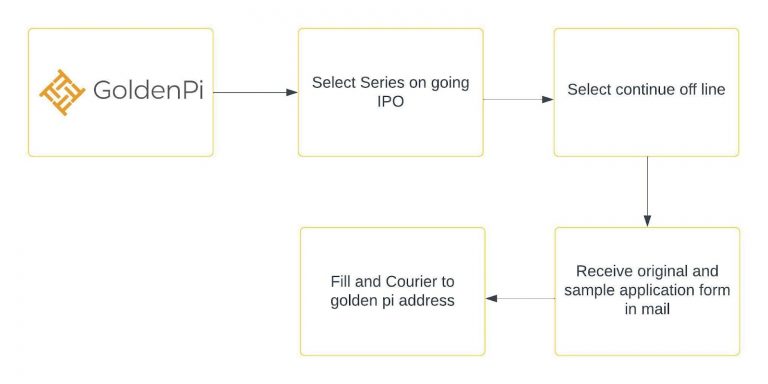

Investment Process for U GRO Capital NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

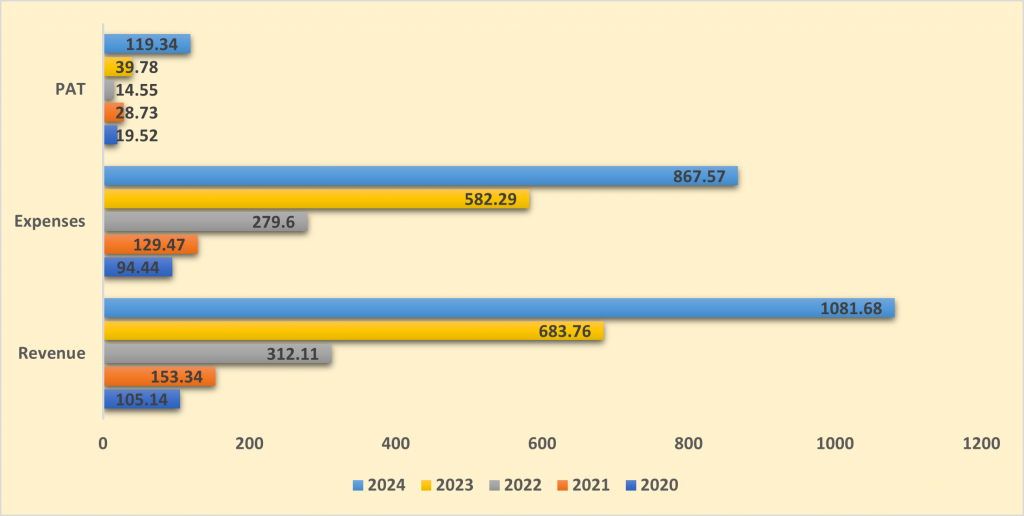

Financial Overview

Snapshot stating the Revenue, Expenses, EBIT, Net Worth and PAT

(Amount in Rs. Cr)

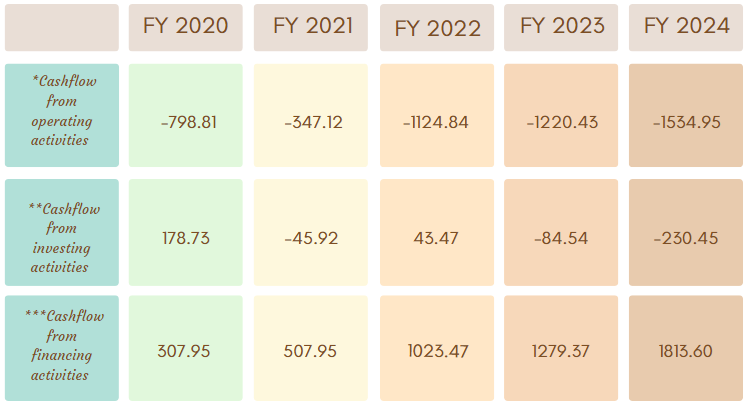

Cash flow for last 5 years

(Amount in Rs. Cr)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

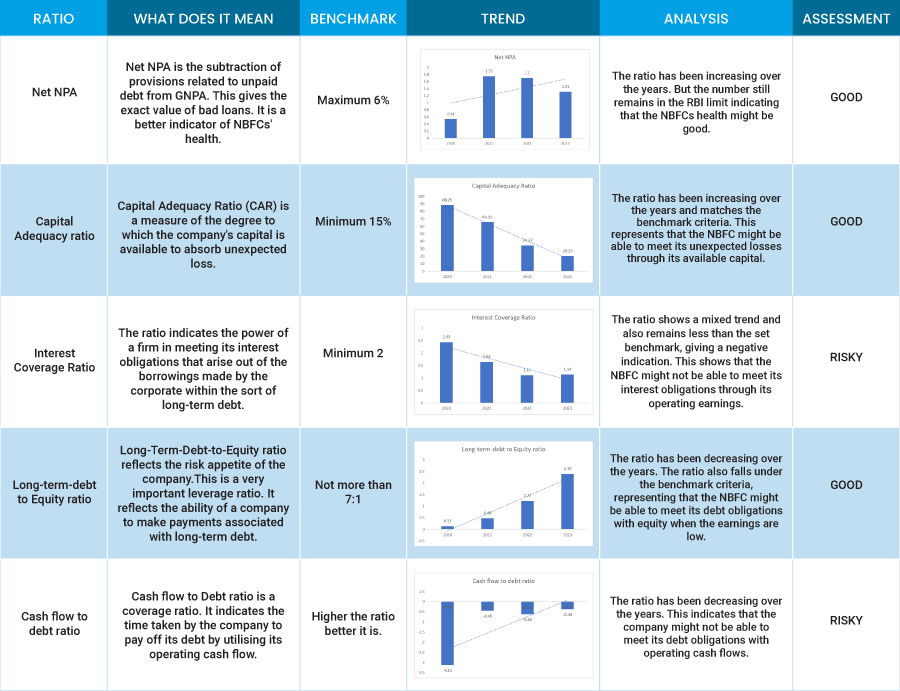

Ratio Analysis

Issue analysis

Pros

- The NCD is A+ rated security with a stable outlook.

- The coupon rate is upto 10.4% which is much higher than FDs.

Cons

- Interest Coverage Ratio has been decreasing over the years indicating that the company might not be able to service its debt obligation.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About U GRO Capital

UGro Capital Limited, formerly known as Chokhani Securities Limited, was acquired in 2018 by Shachindra Nath, its Vice Chairman and Managing Director. Since then, the company has focused on providing tailored financial solutions to India’s MSME (Micro, Small, and Medium Enterprises) sector. UGro offers a variety of lending products with diverse tenors and ticket sizes to cater to the unique needs of MSMEs. With a vast network of 164 branches across the country, UGro has rapidly expanded its Assets Under Management (AUM), which stood at INR 92.2 billion as of 1QFY25, with 45% of AUM managed through off-book volumes. The company is publicly listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), solidifying its position as a key player in MSME lending.

Strengths

- Strong AUM Growth: UGRO’s Assets Under Management (AUM) grew multi-fold, reaching INR 92.2 billion by 1QFY25 from INR 13.2 billion in FY21, driven by both on-book and off-book expansions.

- Diversified Exposure: UGRO operates across the MSME segment with a geographically and sectorally diversified portfolio. No state contributes more than 15% to its AUM, reducing regional risk.

- Adequate Capital Buffers: The company maintains a strong capital base of INR 14.38 billion as of FY24, and its capital adequacy ratio (CAR) is 20.75%, ensuring sufficient reserves to support future growth.

- Strong Co-Lending Partnerships: UGRO has built significant partnerships with 12 co-lending partners, including six public sector banks, allowing for risk-sharing and capital-light growth through off-balance sheet products.

- Technology-Driven: UGRO has invested in technology, data analytics, and automated lending processes, enhancing efficiency in sourcing, underwriting, and monitoring loans.

Weakness

- Limited Track Record: Established in 2018, UGRO has a relatively short operational history, and 62% of its AUM was generated in the last 12 months, indicating low portfolio seasoning.

- High Credit Costs: The company’s credit costs are elevated at 2.7%, and the gross NPA on a one-year lagged basis stood at 4.8% in 1QFY25, reflecting higher risk in asset quality.

- Moderate Profitability: While UGRO has been profitable, its cost-to-income ratio remains elevated at 54.06%, putting pressure on overall profitability.

- High Operational Costs: The expansion of its branch network (164 currently, with plans for 250 branches by FY25) and a focus on granular portfolios are expected to keep operational costs high.

- Leverage Risks: While leverage has reduced to 2.36x at the end of 1QFY25, the company targets to keep it within 4.0x, and any deterioration in funding or asset quality could strain its financial position.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus October 04, 2024

Disclaimer- The information is published as on date 10/08/2024 based on information available on Prospectus October 04, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors