Largest retail NBFC in India and fourth largest non-bank financier (including HFCs)

Shriram Finance Limited, a leading non-banking financial company (NBFC) in India, offers a lucrative investment opportunity for corporate investors – the Shriram Unnati Fixed Deposit scheme. Designed to provide stable returns and security, this corporate fixed deposit (CFD) offers a range of benefits that make it an attractive choice for investors.

ABOUT SHRIRAM FINANCE LIMITED

Shriram Finance Limited (SFL) is a leading non-banking financial company (NBFC) in India, specializing in providing financial solutions to individuals and businesses in rural and semi-urban areas. Established in 1974, SFL has a long and distinguished history of serving the underserved segments of the Indian population.

SFL offers a comprehensive range of financial products and services, including:

- Commercial vehicle finance

- Passenger vehicle finance

- Small and medium enterprise (SME) finance

- Retail lending (personal loans, gold loans, and two-wheeler loans)

SFL’s extensive network of over 1,500 branches and 54,000 employees ensures that its services reach even the remotest corners of India. The company is committed to financial inclusion and empowering individuals and businesses to achieve their aspirations.

WHAT ARE CORPORATE FIXED DEPOSITS?

Company Fixed Deposits (corporate FDs) are term deposits kept for a set amount of time at a set interest rate. Financial institutions, both banking and non-banking, provide Company Fixed Deposits (NBFCs). A few months to a few years are the possible maturities for different corporate fixed deposits.

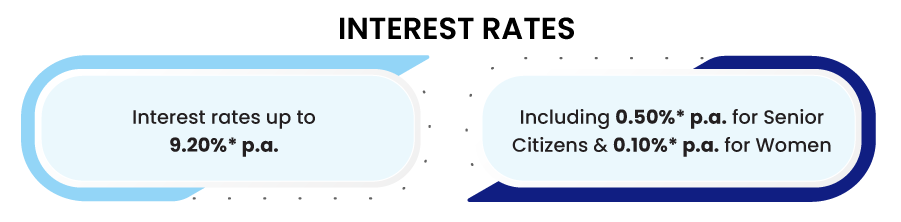

INTEREST RATE OFFERED BY SHRIRAM UNNATI FIXED DEPOSIT

Shriram Finance Fixed Deposit rates presently stand as an attractive choice in the market. They provide some of the most competitive FD interest rates when compared to similar financial institutions.

Shriram Finance Fixed Deposit presents a choice of two deposit options, and it proudly offers one of the most competitive FD interest rates available in the market.

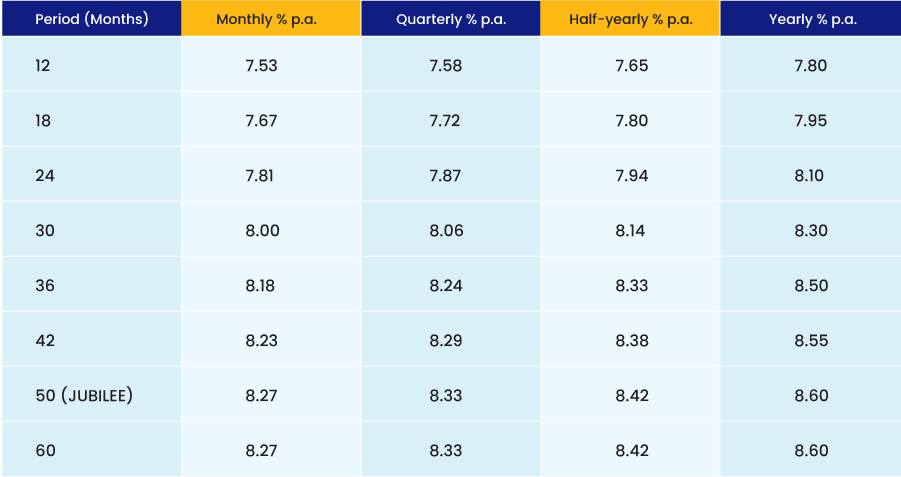

Non-Cumulative Deposit

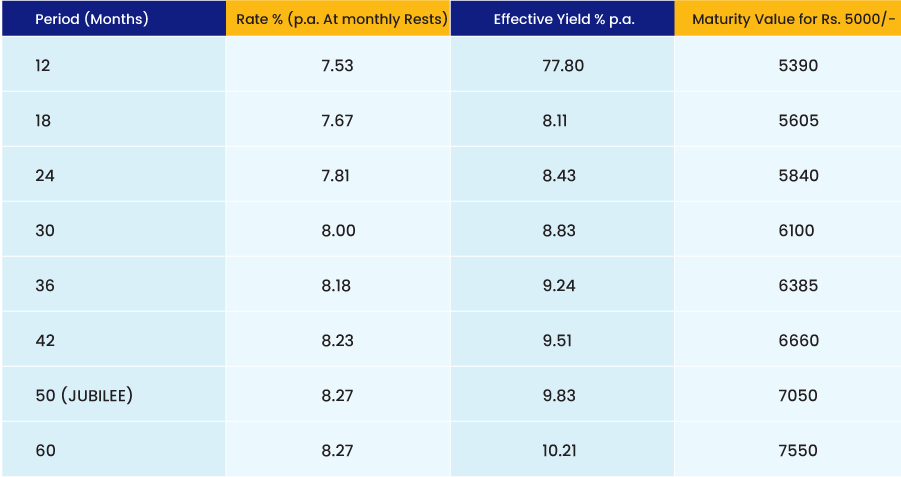

Cumulative Deposit

- Additional interest of 0.50% p.a. Will be paid to senior citizens (Completed age 60 years on the date of deposit/renewal.

- Additional interest of 0.25% p.a. Will be paid on all renewals, where the deposit is matured.

- Additional interest of 0.10% p.a. Will be paid to Women Depositors.

BENEFITS & FEATURES

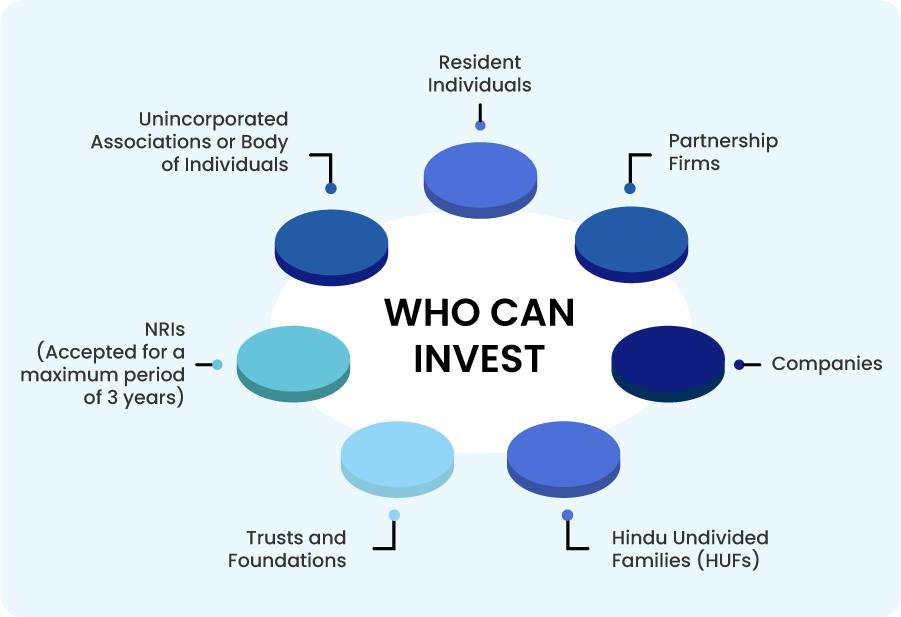

ELIGIBILITY

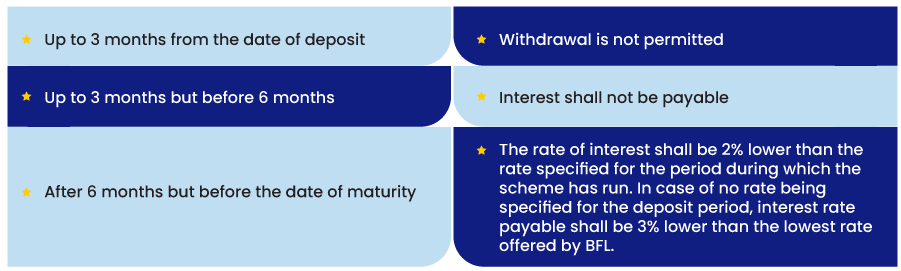

PREMATURE WITHDRAWAL

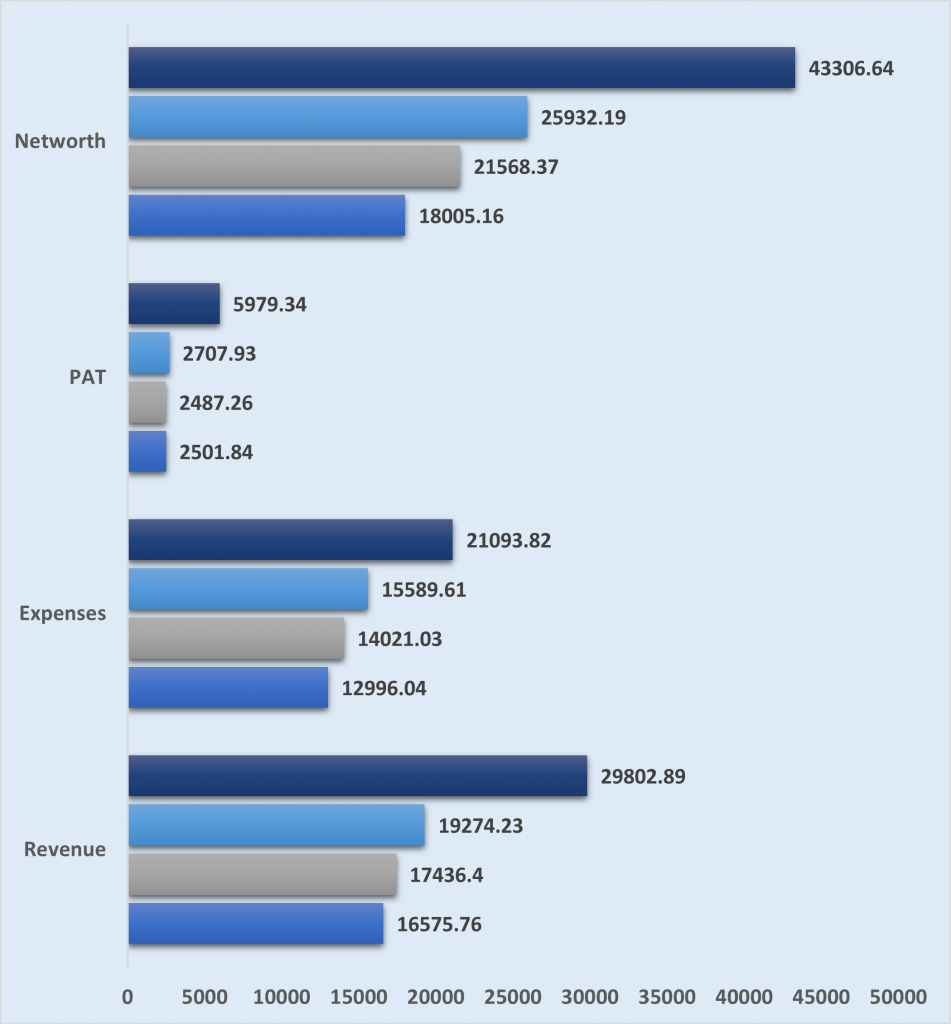

FINANCIAL OVERVIEW

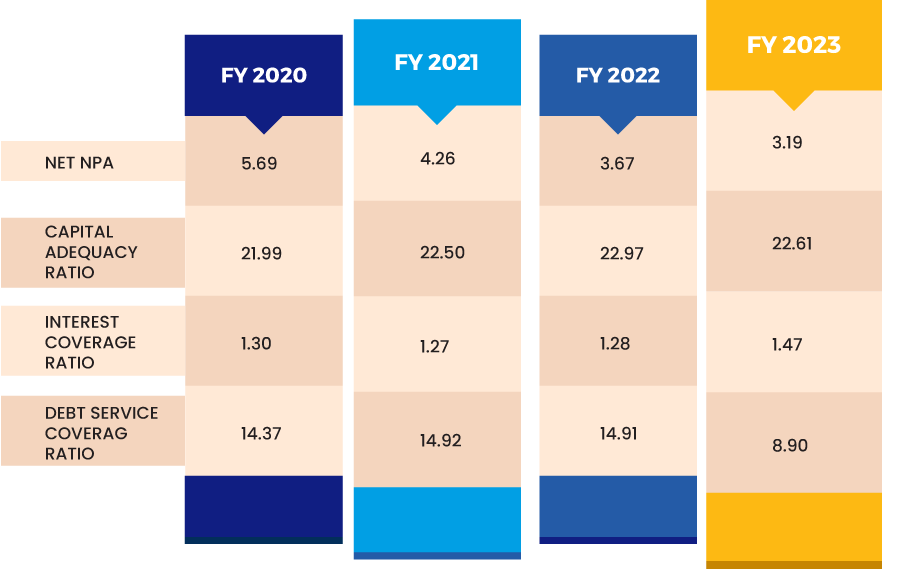

FINANCIAL RATIOS

STRENGTHS OF THE COMPANY

- Dominance in the Broader NBFC Landscape: Following the merger’s completion, SFL has solidified its position as the largest NBFC in India and the fourth-largest non-bank lender, which includes HFCs. Its assets under management (AUM) stood at Rs 193,730 crore (including SHFL) as of March 31, 2023, reinforcing its market leadership.

- Robust Capitalization and Earnings Profile: SFL maintains a robust capital base, boasting a consolidated net worth of Rs 43,800 crore and an adjusted gearing ratio of 3.8 times as of March 31, 2023, ensuring its financial stability.

- Seasoned Management Team: Shriram Finance Limited is backed by a highly experienced management team renowned for its achievements in the financial services sector. Their profound knowledge of the Indian market positions the company strategically to execute its growth strategies effectively.

- Solid Liquidity Position: Shriram Finance Limited enjoys a secure liquidity position, supported by substantial cash reserves, unutilized credit lines, and available cash equivalents. This financial strength grants the company the flexibility needed to fulfill its debt obligations and pursue its expansion plans

LIQUIDITY OUTLOOK

SFL has adequate liquidity. As of March 31, 2023, SFL had liquidity of Rs 19,205 crore (comprising of cash and equivalents and unutilized CC/WCDL lines) which comfortably cover 3 months of debt obligations of Rs. 16,644 crore.