While the inception of the cosmos remains a continuous discourse, there seems to be no concern on the annihilation of the exquisite aspects of our beautiful world. Though there are innumerous species that prevail, humans have been the exceptional one who have always desired to conquer the world. Human existence can be a blessing in disguise because the world has witnessed various revolutions and destructions over time. The advancements that are meant to be for the betterment of society, have sometimes taken a U-turn to a destructive perspective.

Primitive humans fought for food to survive, the survival of the fittest. But technological advancement has brought a rigorous destructive mind-set to the contemporary human being. This can be witnessed in the various wars that try to prove who is the most powerful in the world. The consequences of war have not been given any significant thought, and the main objective is be the king of the cosmos. The war has brought umpteen losses to the economy and fundamental life has been brought to a halt, yet, humans consistently strive to conquer one another. Thus far, there have been several wars have taken place right from the French war to world war I & II, and the losses have been enormous. It is also an expensive affair as well. It is nearly impossible for countries to set aside funds for these extraneous circumstances. Hence, Countries raise money to fund these wars when the need arises. These countries may not be able to raise money via taxation because it could worsen the economic recession. Therefore, countries turn towards their public and seek financial assistance through war bonds.

The list of wars Occurred in the world.

What is a War bond?

Nations tend to raise funds through bonds to help with the expenses of war. These types of bonds are known as war bonds. In times of war, the government will issue debt securities to fund military operations and cover other expenditures. During war, these bonds also aid in the control of inflation by restricting the circulation of money in the economy. War bonds are categorised into two types: retail bonds and wholesale bonds. The first is sold directly to the public, which has a lower yield than the market. Whereas, the second is traded on a stock exchange. People purchase war bonds out of patriotism. Retail war bonds are frequently made available in a variety of denominations and are sometimes issued at a discount to make them affordable to all citizens.

How to beat market volatility through bonds?

The history of war bonds Issuance

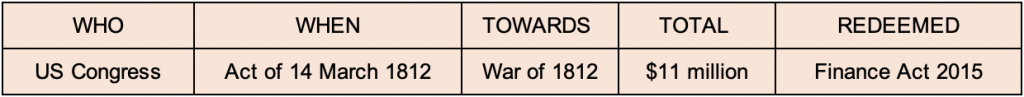

Several wars have occurred in the world, during which most of the countries financed the war by raising funds through war bonds. This was done to prevent an economic collapse. Following is the list of events and the countries that raise funds through bonds.

Prior to world war I

During World War I

During World War I

1. Austria and Hungary

- In November 1914, the first Austrian bonds paid 5% interest and had a five-year term. The bond issue amounted to $ 440 million.

- In 1919 Hungary issued bonds at a fixed rate of 6% for 1 year. The bond issue amounted to $ 235 million

2. Canada

- Canadian war bonds were called “Victory Bonds” after 1917.

- The First Victory Loan was a 5.5% issue of 5, 10, and 20-year gold bonds in denominations as small as $50. It was quickly oversubscribed, collecting $398 million or about $50 per capita.

- The Second and Third Victory Loans were floated in 1918 and 1919, bringing another $1.34 billion.

3. Germany

- Nine bond drives were conducted over the length of the war, issued at 6 months’ intervals.

- Sold through banks, post offices, and other financial institutions, most bonds had a rate of return of 5% and were redeemable over a ten-year period, in semi-annual payments.

- Raised approximately 10 billion marks.

4. The United Kingdom

- The first interest-bearing War Loan was issued in November 1914 at an interest rate of 3.5%, to be redeemed at par value in 1925–28. It raised £333 million; £350 million at face value as it was issued at a 5% discount.

- It was followed by £901 million of a second War Loan in June 1915, at 4.5%. £17.6 million of this was accounted for by conversion of the 3.5% issue, and a further £138 million by holders of 2.5% and 2.75% Consols, who were also allowed to transfer to the higher interest rate.

- Launched in January 1917, the Third war loan was issued at a 5% discount to face value, paying 5% interest (or 4% tax-free for 25 years), raising around £845 million in new money.

5. The United States of America

- In 1917 and 1918, the United States government issued Liberty Bonds to raise money for its involvement in World War I.

- Between 1917 and 1919, the US Govt raised around 20 billion US dollars through the issuance of 4 different liberty bonds.

Government Bonds: Should You Invest? Where to Buy?

During World War II

1. Canada

- In May 1940, War Saving Certificates were issued, maturing after 7 years, and raised around $318 million in funds.

- Bonds were issued with maturity period ranging between six and fourteen years, and interest rates ranging from 1.5% for short-term bonds and 3% for long-term bonds. Issued at a denomination of between $50 and $ 100,000.

- The first issue of Victory Bonds raised $20 million in February 1940, whereas the Second issue raised around $30 million in September 1940.

2. Germany

- The government financed its war by directly borrowing it from financial institutions using short-term war bonds as collateral. Due to this 40 million banks and investment accounts were converted into war bonds.

- By the end of the war, German bank commissioners compelled Czechoslovakia to buy up German war bonds, and hence, the German war bonds accounted for 70% of their investments in the Czechoslovakia bank.

3. The United States of America

- Defence bonds were issued during World War II, later renamed war bonds. It raised about US$185 billion and was bought by over 84 million Americans.

Contemporary war – between Ukraine and Russia

As Ukraine tries to repel Russian forces, it would need a lot of help from both domestic and international sources. Even before the invasion, the country’s finances were deteriorating, and the Corona virus pandemic has played a significant role in that. Ukraine was already relying on IMF funds. Following the Russian invasion, the country’s credit ratings were further reduced to non-investment grade or junk. So far, they have raised $270 million in war bonds with an 11% yield and a one-year maturity. The government raised $7 million in bonds with a two-month maturity and a 10% yield.

According to the Wall Street Journal, the bond sale was conducted through dealers such as Citigroup, Austria’s Raiffeisen Bank, and Budapest-based OTP Bank Nyrt, citing a call between a Ukrainian official and investors.

In recent days, in order to finance the increased needs of the military, the government prints more money, which leads to an increase in the economy’s money supply, resulting in inflationary pressure. To mitigate its effects, the government reduces the money supply in the economy by issuing bonds. It enables the government to facilitate its military spending by providing ready capital.