After the United States of America, China has the world’s second-largest bond market. Its bond market size stands at a staggering $17.5trillion dollars. The Chinese bond market was not open to foreign investors for a very long time. In particular, an economy as big as China was off-limit to foreign investors. This means local-currency Chinese bonds were not open to trade on major global bond indices.

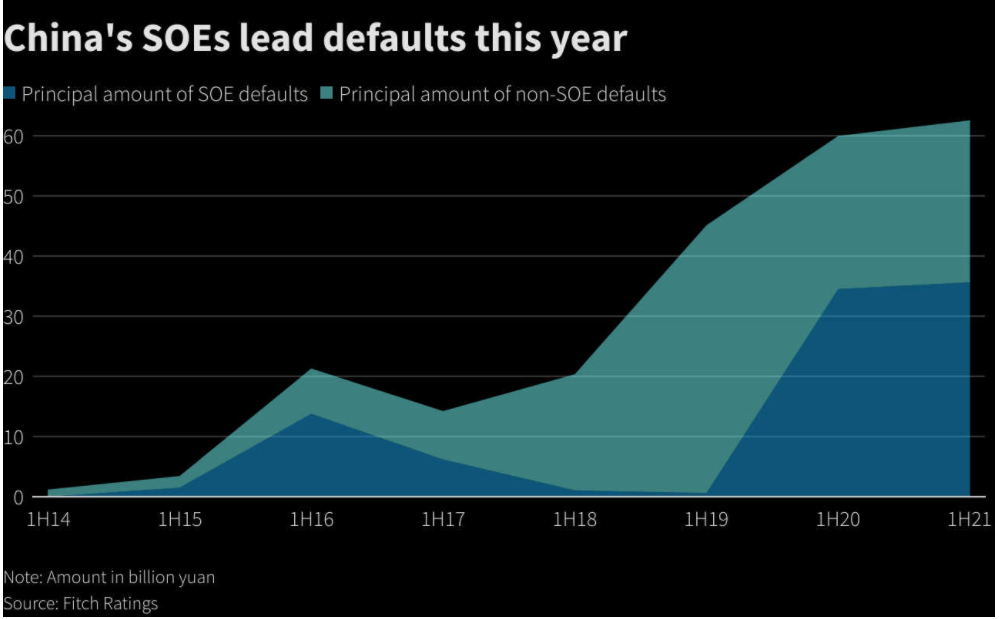

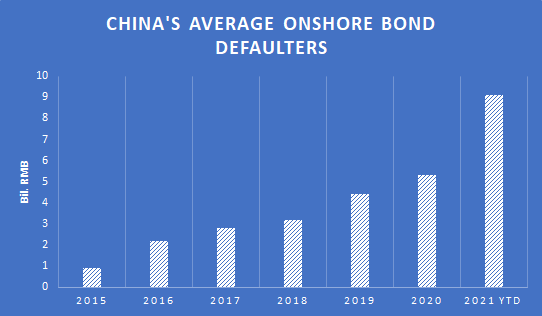

After the inclusion of Chinese bonds on global bond indices, China has seen major growth in its economy, as more foreign investments have been infused. But the past few years have not been really good for the Bond market. According to Fitch ratings, in the first half of 2021, Chinese corporate bond defaults have hit a record high of $18 billion with $1.31 billion onshore bonds outstanding on average. Looking at the current situation, this figure is expected to grow month after month.The default is now 1.6 times bigger than it was in 2020 and 3 times bigger than it was in 2017.

This massive bond default event has put the financial system in China and around the world in jeopardy. “Too big to fail” companies are the ones who caused this mismanagement. Huarong Asset Management Co. and China Evergrande Group are the two Chinese behemoths.

These real estate firms, asset management firms, and, in particular, state-owned firms, have wreaked havoc on the global economy. China’s State-owned enterprises (SOEs) individually accounted for almost half of the defaults made in 2021, standing at a figure of $5.79 billion.

Fact : In the first half of 2021, a total of 25 firms defaulted on bond payments, compared with 19 firms in the same time period in 2020.

These bond defaults highlight the tightening credit solutions and a reluctance toward troubled state-owned firms by the government to bail them out. All these defaults have resulted in China repricing its risk in the credit market and discouraging debt-fueled expansion.

How to beat market volatility through bonds?

How big is the problem?

Because of the private sector, Chinese defaults have decreased from $29.9 billion to $25 billion since 2020. This is largely due to pandemic-related relaxations that bond issuers enjoyed such as delaying repayments, swapping bonds, or canceling early repayment.

Evergrande, a real estate developer, is the world’s most indebted company, owing creditors more than $300 billion. The bad debt pandemic has spread far beyond Evergrande. Sinic Holdings failed to make bond payments of $246 million. Similarly, China Properties group couldn’t pay back $226 million worth of bonds. Also Fantasia holdings defaulted on $206 million payment.

However, there are few firms like Modern Land (China) co. who is willing to extend its payment on a $250 million dollar bond by three months. It further said that two key executives were intending to lend the company $125 million. Xinyuan Real Estate Co. also proposed paying only 5% of the debt’s principal and replacing it with 2023 bonds. As a result, its credit ratings were downgraded to C, which is a very unfavourable indicator.

Source – S&P Global

Which sectors of the economy are being harmed by defaults?

The Pandemic in 2020, has hurt many sectors of the Chinese economy like Transportation, tourism and retailing. As per the data on Bloomberg, 30% of the total defaults made by China in the bond market are by Real-Estate firms, accounting for $7.6 billion missed payments in onshore and offshore bonds. In the past, major default holders were from the private sector, whereas today State-owned enterprises play a major role in piling up the amount of default.

Yongcheng Coal & Electricity Holding Group Co. and Tsinghua Unigroup Co., which is affiliated with one of the country’s top university universities, are two of these companies that have run into problems. As China plans to introduce a real estate tax, to maintain a balance in the companies and their record of bad debts, Chinese property shares losses too. With that China’s Real Estate Index fell 2.6 percent, and the Hang Seng Mainland Properties Index slumped nearly 5 percent.

Impact of Hike in Repo Rate on the Indian Economy

Global implication of this collapse!

The Chinese economy’s real-estate industry is beset by issues that are leading to debt default, posing a serious threat to China’s financial stability and economic growth. This has shaken investor’s confidence over the year of its collapse. Some observers are drawing parallels between the Evergrande issue and the Lehman Brothers’ movement, referring to the collapse of the US investment market in 2008, which triggered the global crisis.

Whereas some analysts believe that this could be managed if the policymakers intervene and prevent systemic risk, it will also buy time to resolve this debt. This will affect China’s financial system, as approximately 41% of its banking system assets are associated with the property sector. This collapse is affecting other real-estate companies. As a result, value of the properties are suffering which altogether affects the housing sector. This will also hit the global markets as it will weaken the Chinese import market. Therefore slowing the demand for all kinds of raw materials too.

Present Changes

In order to streamline the highly indebted market and to avoid the debt bubble, the Chinese government has planned to implement a policy named as “three-red lines”. This is to regulate the leverage taken on by property developers, limiting their borrowing based on their performance in

- Debt-to-cash

- Debt-to-equity, and

- Debt-to-assets metrics. – the three red lines

In China, government bailouts have been a frequent practice. But today, the government itself is running a de-risking campaign, wherein it is shifting its focus towards more tolerance of defaults. In an effort to push more discipline and open the market, they are drawing a line between what is systemic and what is not. This is helping the central government to infuse more credit risk tolerance in the financial ecosystem. Hence, pushing investors to re-think about their risk appetite, instead of relying on the government in times of crisis.

You may also watch:

Summary : Where China stands currently.

China is moving towards reassessing its risk for its potential investors. The main attention has switched to developing new guidelines for rating agencies that deal with disclosure, commercial operations, and quality governance, for which they have named five major government entities. All of this will provide transparency to the investors and help them rely on the quality of Chinese issuers’ financial reporting. Rating agencies focus on a company’s creditworthiness since the Chinese market may witness a rising pool of sour debt and as a means of attracting new potential investors. This will remove the chances of default for high-rated bonds in the market and will also create discipline and a more efficient market.

Read More: How do Geopolitical issues affect debt market?

China’s debt market is erupting like a volcano, leaving scant traces of defaults. These defaults will eventually result in a bomb, which the Chinese have been attempting to keep hidden for a long time. China’s total debt has already surpassed 270 percent of its GDP.

Hidden debts have led to a major crisis in China. As no one is aware about the borrowing by the local government. The whole Chinese debt system lacks transparency. China’s outstanding foreign debt reached $2.4 trillion last year. Also, the biggest borrowers of the local government in China is the state itself, which mostly depends upon off the record borrowings.