If you have landed on this page, you must be exploring the options to make safe investments. You are in the right place.

Before discussing State Government Guaranteed Bonds let’s know what are Guaranteed Bonds. Guaranteed bonds are the bonds that guarantee repayment of principal amount and interest if the issuer defaults. A separate entity with a stronger credit history will act as a guarantor when the issuer has lower creditworthiness. This helps the issuer to raise capital and provides security to the investors.

State-Owned Enterprises(SOE) are legally formed by the state government to perform commercial activities. Examples SOE are for Oil and Natural Gas Corporation (ONGC), UP Power, etc. State-Owned Enterprises issue bonds to raise capital. If these enterprises are found with lower creditworthiness, then the State Government guarantees the bonds issued by State-Owned Enterprises. And these bonds are called State Government Guaranteed Bonds.

Credit rating is the rating given to the issuer whereas

Bond-rating is the rating assigned to the Bond, i.e., the issue. To know more click here.

Generally, the guarantor collects fees from the issuer for guaranteeing the bonds; hence Guaranteed Bonds pay less interest than the non-guaranteed bonds. In the case of State Guaranteed Bonds, the state government doesn’t collect any fees for guaranteeing the bonds issued by state-owned enterprises. Hence State Government Guaranteed Bonds pay on par with corporate bonds though they are relatively safer than corporate bonds. In nutshell, State Government Guaranteed Bonds are less riskier and may offer higher coupon rates than bonds issued by corporates

Generally, the guarantor collects fees from the issuer for guaranteeing the bonds; hence Guaranteed Bonds pay less interest than the non-guaranteed bonds. In the case of State Guaranteed Bonds, the state government doesn’t collect any fees for guaranteeing the bonds issued by state-owned enterprises. Hence State Government Guaranteed Bonds pay on par with corporate bonds though they are relatively safer than corporate bonds. In nutshell, State Government Guaranteed Bonds are less riskier and may offer higher coupon rates than bonds issued by corporates

A Quick Guide to the Bond Investment Process for

Retail Investor

Benefits of investing in State Government Guarantee Bond

There are several benefits in investing in State Government Guaranteed Bonds for both the issuer and the investors. Among the top benefits of government bonds is their high degree of security, offering a safe investment option with steady returns, especially appealing to risk-averse investors. Here are a few.

For issuer:

- Despite having lower creditworthiness, the issuer can raise capital via issuing State Government Guaranteed Bonds.

- As State governments do not collect the fee for guaranteeing the bonds hence borrowing cost reduces significantly.

For the investor:

-

- In the case of the State Government, Guaranteed Bonds state government will pay the interest and principal amount if the issuer defaults. This gives an extra layer of security to investors.

- Most of the time, the State Government Guaranteed Bonds pay higher coupon rates than their counterparts.

- State Government Guaranteed Bonds are considered as senior debt securities as the guarantee given by the State Government is unconditional and irrevocable. However, investors are advised to always refer to the information memorandum of any such bond to make sure that the state has put in its ‘unconditional and irrevocable guarantee’ in writing.

- A state-owned enterprise going bankrupt is very rare; nevertheless, if the issuer goes bankrupt, then bondholders of State Government Guaranteed Bonds are paid before the owners of non-guaranteed debts.

- The State Government Guaranteed Bonds are always in demand; hence liquidity of these bonds is very high. Investors can buy or sell these bonds with ease.

- These bonds pay coupons quarterly or biannually, helping investors with regular and frequent cashflows.

- Most State Government Guaranteed Bonds have staggered maturity. This means that on maturity, 25% of the face value is paid back to the investor per quarter over the entire year along with the outstanding interest payments.

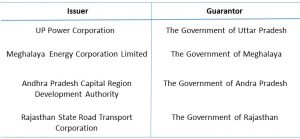

Examples for State Government Bonds

Here is the list of bonds issued by different State-Owned Enterprises where their respective governments act as guarantors. Refer to the table below.

UP Power Corp Bonds are offering yields of 10.18%. To know more, click here.

Who can invest?

- People looking for regular and fixed income can invest and support their families. Since the state government secures these bonds, these are suitable for senior citizens as well.

- Foreign institutional investors can also buy State Government Guaranteed Bonds.

How to Invest State Government Guaranteed Bonds?

In GoldenPi , we have curated high performing State guaranteed bonds to make bond selection easy for you. You can buy State Government Guaranteed Bonds in IPO (Initial Public Offering) or the secondary market.

Click here to view the collection of State Government Guaranteed Bonds.

Investors can purchase bonds in three simple steps. To know more, click here.

State Government Guaranteed Bonds come with

the irrevocable and unconditional guarantee from State Governments,

making your investments less riskier and stable .

Note: Please refer to the information memorandum of any State Government Guaranteed Bond to check this clause and do your due diligence before investing.

16 comments

AP Cpital Regional Devlopment Authority defaulted about 2-3 years back. Your article only paints the bright side of State govt bonds but does not highlight cases where they have defaulted or delayed payments. Please be more objective in publishing such articles and do not take an investor for a ride.

Mr. Bansal,

First and foremost, thanks for visiting our site.

Secondly, here is our answer to your query on bonds. Take a look.

State Government Bonds that carry the condition of ‘unconditional and irrevocable guarantee’ is very high in safety as they are State guaranteed. State guarantee is good as a sovereign guarantee. However, investors should check whether this clause is there in the Term Sheet of the Bond as all State Govt Bonds do not carry this clause. Can you share the reference to the APCRDA bonds that defaulted? As per our record, Amaravati Bonds, issued by APCRDA, that carry the ‘unconditional and irrevocable guarantee’ have not defaulted on any payment till date.

If this blog reads about guarantee & the safety of bonds, there are few blogs on our site that through light on ” bond risk.” Please read these blogs; you may like them.

-Bond Investments are a halo of safety or not?

https://goldenpi.com/blog/investment-guide/advanced/bond-investments-are-a-halo-of-safety-or-not

-A Deep Dive into Bond Risk

https://goldenpi.com/blog/investment-guide/advanced/a-deep-dive-into-bond-risk

Our sole purpose is to help investors deciding the right bonds for themselves. Please keep giving your valuable comments. You can also suggest topics you want us to write on a bond investment.

Regards

GoldenPi Team

Hi Subhash,

If you want to sell Bonds before maturity, you can put them up for sale on BSE/NSE. Alternatively, you can reach out to GoldenPi. GoldenPi team will help you to sell your bonds.

Hope this information will help you.

Thank you

GoldenPi Team

Thank you, Sudhiesh Kumar.

Mr. Vijay,

You can find the details about listed bonds on the respective websites. Here are the links.

https://www.bseindia.com/markets/debt/memorandum_data.aspx?expandable=3

https://www.nse-india.com/corporates/offerdocument/recent_issue.htm

GoldenPi helps its bond investors with the Information Memorandum(or any such related documents) of the bonds listed on our platform.

Regards

GoldenPi Team

Hi Sreevalsan,

We collect information regarding issuances of State Guaranteed Bonds from Merchant Banks. You can sign up on our website to receive timely notifications; alternatively, you can talk to the Relationship Manager at GoldenPi.

Regards

GoldenPi Team

Please inform me as of now which are the State Government Guaranteed Bonds available which are with the written clause of irrevocable and unconditional guarantee from State Governments,

.

Hello Piyush,

To find the State Government Guaranteed Bonds with the written clause of irrevocable and unconditional guarantee from State Governments, please click here https://goldenpi.com/investment-options/list-view?it=government&sortBy=yield-high-to-low

Regards

GoldenPi Team

Hello.. What about taxation Part?

Hi Samyak,

TDS will not be deducted on interest received from listed bonds and debentures. For interest earned from Taxable Bonds, the earnings are taxable. For interests earned from Tax-Free Bonds, the earnings are 100% tax-free. Also, capital gains earned from selling any Bond (taxable and tax-free) before maturity are subject to capital gains taxation rules. Here is a blog that explains Taxation on Gains from Bond Investments. https://goldenpi.com/blog/essentials/bond-market/taxation-on-gains-from-bond-investments/

Regards

GoldenPi Team

Hello Himanshu,

Please let us know which State Government Guaranteed Bonds you are interested in. We will share the details with you.

Regards

GoldenPi Team

Hi Sreemanunnni,

Yes, UP Power Bonds are Guaranteed by UP State Government.

Yes, The guarantee provided is unconditional and irrevocable.

Keep reading our blogs.

Thank you for your kinds words and Keep reading our blogs.

Hi, Very helpful post for beginners. Please advice about INE0M2307065 bonds are “unconditional and irrevocable” guaranteed by state government. .thanks

REPLY

Thank you for your kind words and keep reading our blogs.

Comments are closed.