|

Getting your Trinity Audio player ready...

|

Since its inception in 1996, the catastrophe otherwise called cat bonds has become a market worth $40 billion. This market is not left alone but rather tracked by Artemis as they have closer eyes on the insurance-linked securities and Cat is one of them.

Catastrophe might sound an alarm normally but to the surprise, this instrument has produced an overall return of 16.2% in 2023 and is the major attraction for investors.

For two good reasons: Double-digit yield and unaffected market by neither equities nor bonds but only by the catastrophe itself.

India is quite far from adopting catastrophe bonds as it isn’t fully aware of how to implement or solve the dynamics of supply and demand, but it is worthwhile for an investor to understand the subject.

Little about the History

In the event of any catastrophe like an earthquake or a hurricane, it can cause major damage to the economy and the loss is massive. Can insurance companies and the government alone handle this? It is questionable and of course not.

The major event that struck was Hurricane Andrew in 1992 which incurred an insured loss in total of about $15.5 billion. Around 11 insurance companies went into insolvency.

Soon after in 1994, another event of the Northridge earthquake caused an insured loss of $15.3 billion. 95% of the insurers were pulled from California completely.

These losses aren’t minute to be disregarded for a nation. Traditional reinsurance can’t help the situation and it needs a much more deeper alternative to stick around. Catastrophe bonds made their way to the market in such a scenario.

What are Corporate Bonds?

Cat retrieves the Catastrophe

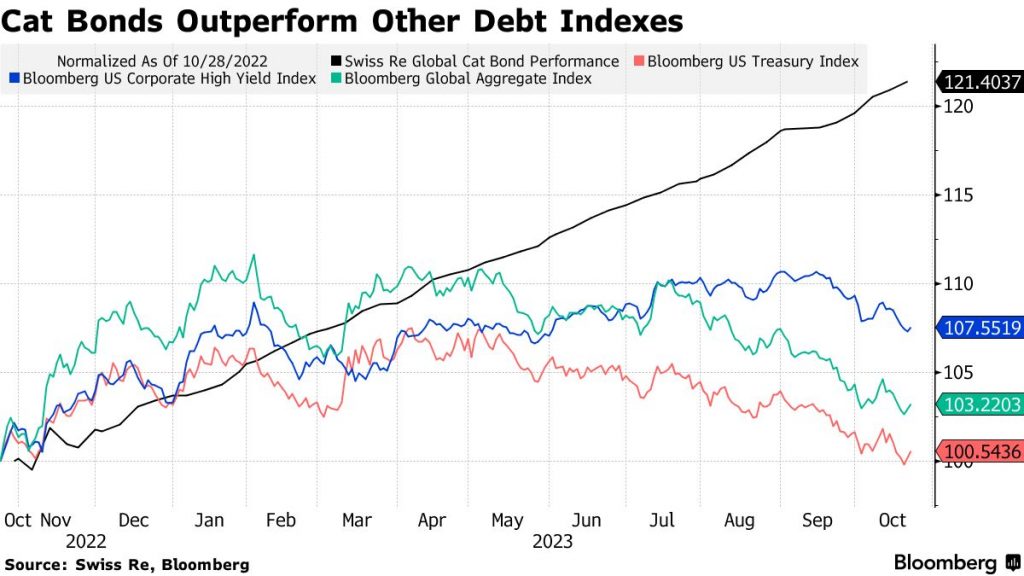

It can be witnessed, how the catastrophe market has performed so far and its return has easily surpassed debt markets in the US.

Source Bloomberg

However, the underlying need is raised from a strong phenomenon that needs to be addressed. The traditional reinsurance companies who insure the insurance companies can’t offer much coverage. The catastrophe bond aka cat bonds came into play to help the insurance companies to transfer the risk to those investors who are willing to take the risk and despite that they are compensated with attractive returns.

Like any other bond, catastrophe bonds give interest payments and the principal to the investors who invest the capital as long as no event has triggered and this is issued for a specific period of 3 to 5 years. But, if an event occurs (natural catastrophe) then the story could be different, it won’t be a green posture for the investors. The investor would receive an interest payment until such an event occurs but at the cost of forgiving the part of the principal or the entire principal.

But here’s how this instrument works. The special purpose vehicle on behalf of the insurance or the reinsurance company collects the money from the pool of investors through the issued security. The SPV receives the premium from the insurance companies for giving the coverage. The collected money from the investors then goes to the collateral account where the money is invested in high-yield funds in the money market.

If you wonder how the investors get their interest payments, it’s the money from the premium and the interest from the collateral. If there is no event triggered the principal on maturity will be returned to the investor and if there is an event, this money is liquidated to pay the insurance company.

But when is an event considered triggered? While issuing the predefined risk is made clear and only then this would be triggered. For instance, if a magnitude of 7 is reached by an earthquake.

Although three triggers are generally considered. Industry loss, indemnity triggers, and parametric triggers. An industry loss refers to the overall losses incurred by the insurance industry where a third-party modeler is used to estimate the covered losses. The indemnity trigger is the loss that has been incurred by the insurers whereas the parametric triggers are the losses that are measured based on parameters for instance the magnitude of the earthquake.

Generally, indemnity loss is considered one of the most issued trigger methods to establish the payout way for the bond issuer. Where an attachment point acts like a threshold for the bond issued and on reaching it, the insurer gets the payout for the damage.

What is a Government Bond?

Why is this all for?

When the world runs into a catastrophe, the damage caused is very huge, and the insurance industry for such damage has to insure the person in need more than the nominal which is an additional loss to them, and doing it to multiple people at such an event can wipe out the insurance industry. But how to help the insurance industry in such an event to continue insuring the victims is the question.

While that is one way to look at it, the other way is the revealed numbers. Tracking the events in the past tells us the number of how many such have previously occurred and the incurred loss reveals a pathetic damage which needs some action in prior.

Well, catastrophe bonds have helped the insurers in managing the risks.

Source: Weforum

Source: Weforum

In 2023, the US had about 23 disasters compared to the previous year’s record of 22 disasters. Wherein India has a total of 240 disasters that occurred in 2023 and still hasn’t considered catastrophe bonds. From 1998 to 2007 India lost about $79.5 bn altogether due to catastrophe and is the 5th country to have lost majorly in the world due to disaster. Although many disasters might have been recorded, not all the disasters trigger a payout to occur.

Shouldn’t it be one of the reasons for India to be focusing on this strategy?

What’s Coming?

The catastrophe bond outperformed the debt market in 2023, which depicts two things about the investor. One is the interest of the investors due to its lucrative returns over the risk it poses and the other is its zero impact from other instruments on the catastrophe market. While it currently considers disasters like earthquakes, and hurricanes, further it wants to expand to insure cyber threat events as well.

But how far is India from adopting the catastrophe bond? The time has to unfold this for us.