Let’s start with what is a bond in the first place:

When you invest in bonds, you’re actually loaning the money to the bond issuing company/ government entity / central or state governments. And in return, the bond issuing entity pays you a certain interest at regular intervals, till the date of maturity of the bond.

As an investor, one can choose bond investments after considering their payment schedules and maturity dates including upcoming bonds in India. A good investor will select bonds that help him meet his financial requirements in a timely manner.

In this article we look at some ways in which bonds help you make money:

A. There are a couple of powerful ways you can benefit from coupon paying bonds, especially when investing in high yield bonds that offer attractive coupon rates and regular income. Coupon paying bonds are bonds that offer a fixed amount of payment regularly till the date of maturity. You will receive these payments as per a fixed schedule every year; monthly, quarterly, semi-annually, or annually. This is a smart way of making your investment work to give you.

Example:

Bond Name: UP Power Corporation Ltd. Bond

Minimum Investment Quantum: Rs 10 Lakhs

Coupon Rate: 10.15%

Payment Frequency: Quarterly

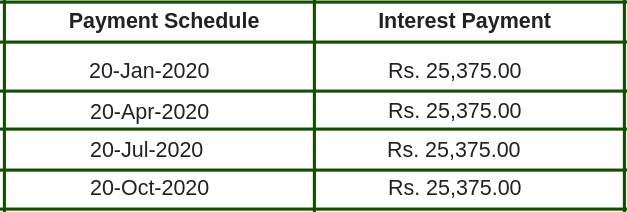

The interest payouts in any year will as follows:

B. The other option to earn money from coupon paying bonds is by keeping a close eye on the interest rates in the market. Bonds are regularly bought and sold in the secondary market. Bond prices fluctuate on the basis of market interest rates. If the interest rates are expected to fall, then you could sell your bonds for a profit in the secondary market. Interest rates and the price of bonds are inversely related. When interest rates fall, the price of Bonds rises. You can take assistance from GoldenPi to know the current selling price in the market and take a call.

Example:

A buyer purchased 10 units of South Indian Bank Bonds at Rs 10,11,931 on 1st April 2019. 5 months later, on 30th September 2019, the bond price was at Rs 11,19,034. On selling at this price, he makes a capital gain of Rs 1,07,103 which amounts to 10.58% gain over a period of 6 months.

Details of this transaction:

The market price of South Indian Bank on given dates :

Purchase price as on 1st April’ 19 = Rs 101

Sell Price as on 30th September’19 = Rs 105.9

Capital appreciation if Rs 10,00,000 is invested in South Indian Bank :

Buy Side:

Principal- Rs 10,10,000

Accrued Interest- Rs 1931.51

Settlement Amount- Rs 10,11,931.51

Sell Side:

Principal- Rs 10,59,000

Accrued Interest- Rs 1284.14

Interest Payment – Rs 58,750

Settlement Amount- Rs 11,19,034.14

Total Gain of 10.58% on initial capital of Rs 10,11,931.51 in 6 months.

C. Investors can enjoy 100% tax benefits on interest earned from a specific category of Bonds called Tax Free Bonds. These bonds are issued by government entities like the National Highway Authority of India, Indian Railways, etc. The coupons or interest payments earned from these bonds are 100% exempted from taxation. However, the returns on these bonds are lower than taxable bonds. So this category of bonds will be beneficial for investors in the highest tax bracket.

Conclusion

Bonds are one of the less riskier investment options available to investors. However, investors need to take into consideration several factors that affect bond pricing and payment schedules so that they choose one that matches their financial goals.

Browse through bonds & debentures on www.goldenpi.com to find options that suit you.

2 comments

Can you help me in knowing how do bonds generate returns?

Liked the content of this blog, really helpful. I strongly feel bonds are going to be a good investment in 2021!

Comments are closed.