‘Don’t put all your eggs in one basket’. This might be a piece of overused but most significant advice given to an investor to minimise the risk in its portfolio. Every asset class has a certain amount of risk attached to it; therefore it is essential for an investor to hedge the risk by investing in different asset classes so that they could make the most out of it. This is called diversification. This helps you best in times of adverse situations when the markets are volatile and fluctuations are a common thing, like the financial crisis of 2008, Covid19, and many more.

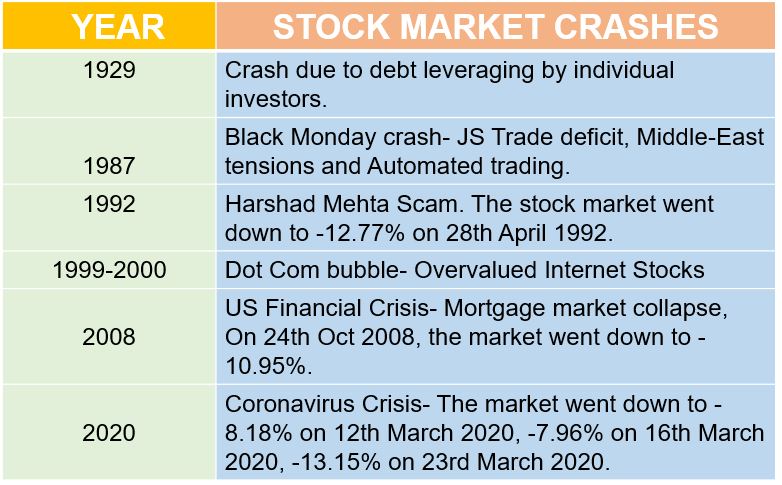

BIGGEST STOCK MARKET CRASHES IN INDIA

Events happening in one country have an effect on other countries around the world too, as the countries are either dependent on each other for trade or are geographically or politically connected. Threats like war, global recession, financial crisis, and trade imbalances, often bring uncertainty to the portfolio of well-informed investors, as this increases the government deficit, making it important for investors to put their hard-earned money into safer investments.

Impact of Hike in Repo Rate on the Indian Economy

Safe investments like bonds and debentures, help you to stabilise your portfolio and helps you to hedge your risk against other investments.

If you have money in your account and wish to earn some returns from it, then you must invest and yield returns in the form of income. Mainly there are 2 types of Investors in the market.

- Aggressive ones who believe in taking more risk, hence they have a stock-rich portfolio, and

- Conservative ones, who believe more in making safer investments hence investing more into fixed income such as Fixed Deposits, bonds, and other fixed income securities.

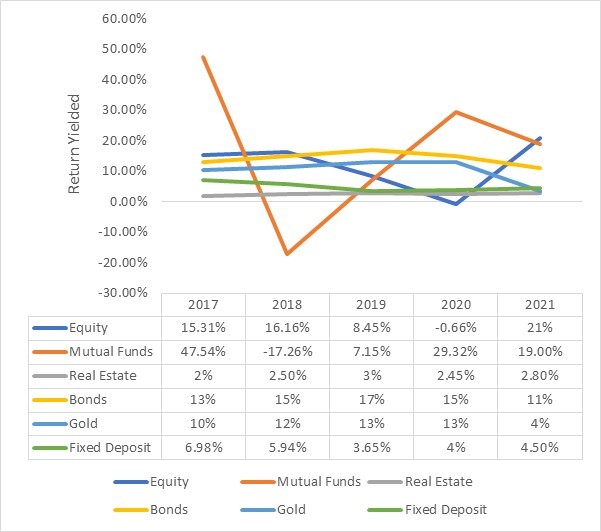

Returns yielded from different asset classes over the years-

Stated below are the returns that an investor would yield after investing into different asset classes per year.

Let’s understand this with an example-

Assuming that the investments are been bought in 2017 and sold/liquidated/redeemed in the year 2021. We have built 2 portfolios i.e. Portfolio 1 and Portfolio 2 each for Aggressive and Conservative Investors. Through these portfolios we are also going to discuss about the importance of diversification in an each of the investors portfolio.

AGGRESSIVE INVESTOR

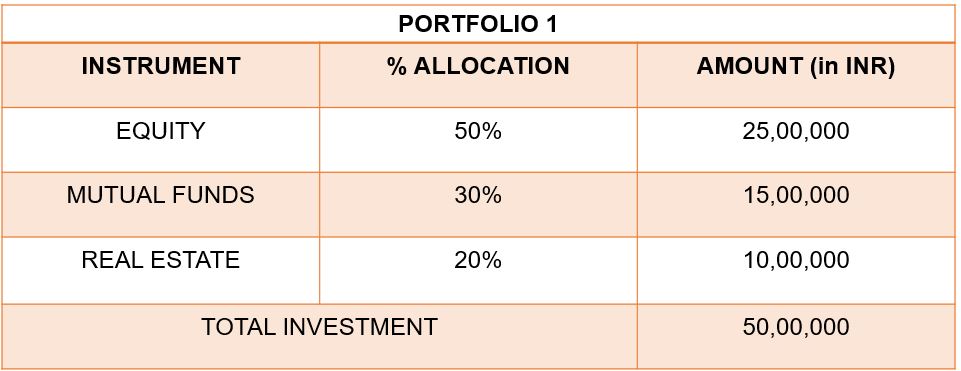

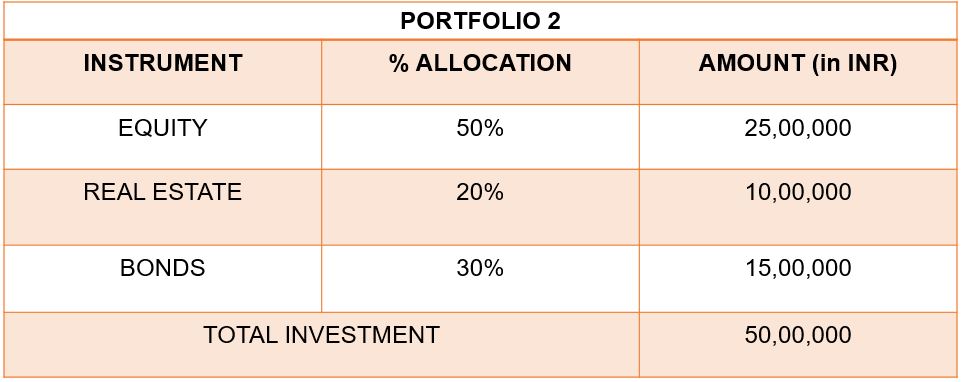

Taking Aggressive Investor first into consideration, we have built 2 portfolios taking Rs 50,00,000 as a total investment.

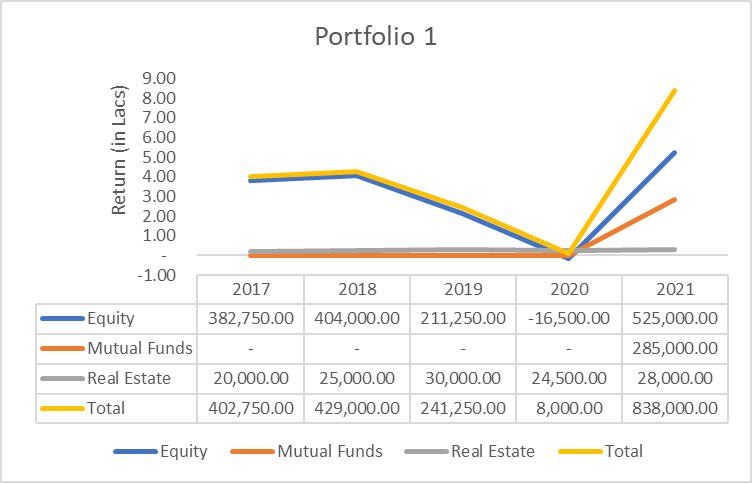

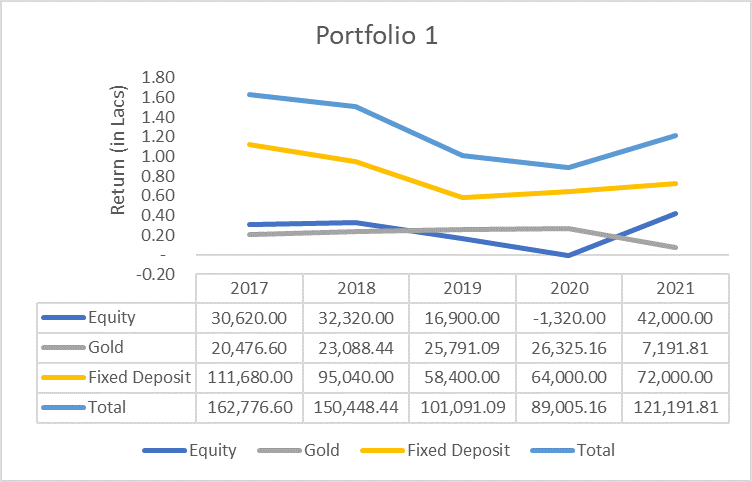

The above table shows the segregation that an aggressive investor has done while employing his money into different asset classes. The investor has invested a big chunk of money in Equities, perceiving that it would yield him/her the most, but he forgot about the adverse situations. In times of these adverse situations, the market can yield him/her, negative returns as well. The yields derived out of the portfolios are stated below, these are the yearly returns that each of the instruments has derived for an aggressive investor.

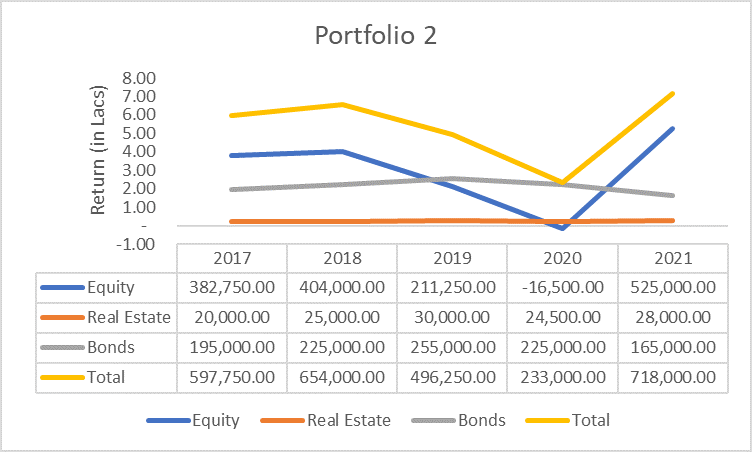

Considering the situation of Covid 19 in India, 2020 was the year when India faced a major impact of it. At that time of market volatility, when markets crashed, the return that the aggressive investor received through its equity investment was negative. Henceforth, no return or negative return was the outcome of it. The total return that the portfolio yielded an investor over the years was 8% in 2017, 9% in 2018, 5% in 2019, 0% in 2020, and 17% in 2021. The total return that the investor could yield out for the past 5 years was 38% of the initial investment made i.e. Rs. 19,19,000.

The only reason an investor invests in different asset classes is the returns. The only aim behind it is to multiply their investments and earn more and more. An aggressive investor invests most of his/ her money in Equity so that he/she is able to fetch the most out of it. But with more risk comes more returns and a possibility of no returns too. That’s what exactly happened with the aggressive investor in an unforeseeable or adverse situation like covid-19.

This is where an investor needs to plan their investments and convert their negative returns to positive ones in order to sustain in the market. This could be done through diversification.

Why Diversification?

The main motive behind diversifying the portfolio of an aggressive investor is to protect them against volatility in adverse situations. It helps in building an efficient strategy to grow wealth. It encourages investors to spread their exposure to different asset classes. When the volatility increases in one asset, your other investments provide stability.

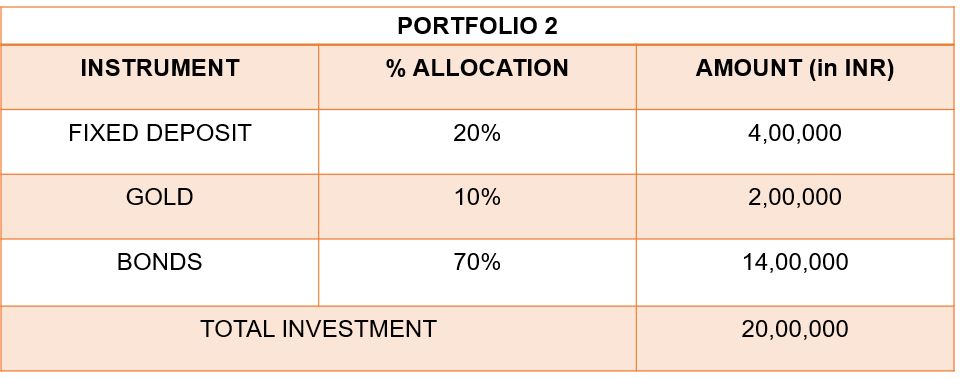

To bring stability and better returns to the portfolio of an aggressive investor, we have tried creating a portfolio with some proportion of investment allocated in bonds. Let’s examine the portfolio and analyse the results derived through it.

In this portfolio 2, we have replaced mutual funds with Bonds. Bonds share a low correlation to other asset classes. For eg, if the stock market is underperforming or going down due to certain reasons, it might not affect the bond market. Therefore bonds can reduce volatility due to their low or negative correlation with stocks.

Analysing the portfolio over the years, we see that with just the replacement of bonds with mutual funds has given approximately a 40% hike in the returns yielded by an investor. The overall return that the portfolio yielded in the last 5 years was 54% of the total initial investment of Rs. 50,00,000 which is much higher than the returns of Portfolio 1. The return derived every year from portfolio 2 are as follow- 12% in 2017, 13% in 2018, 10% in 2019, 5% in 2020 and 14% in 2021.

What’s a corporate bond? How to select one.

Even at the time of Covid-19, i.e. 2020, when there has been a negative return yielded out from equity investments, we see the portfolio being cushioned by the investments being made in bonds. Therefore, the investor was able to derive positive returns that specific year. Hence, it is suggested to invest in bonds for safeguarding your investments in adverse situations and to face market volatility.

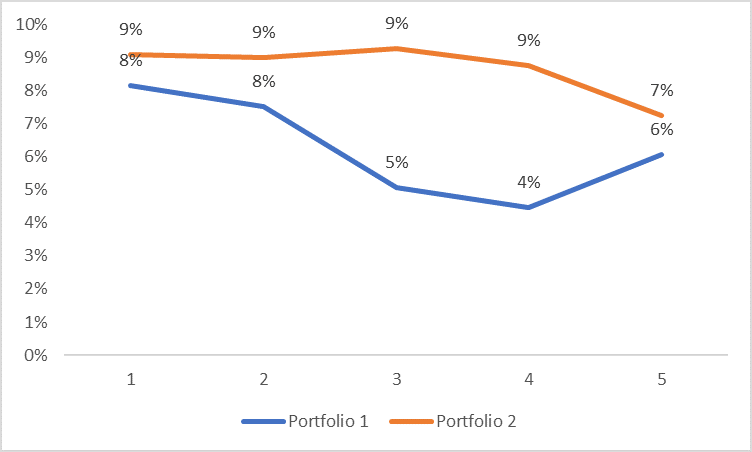

Total Return Comparison Chart

CONSERVATIVE INVESTOR

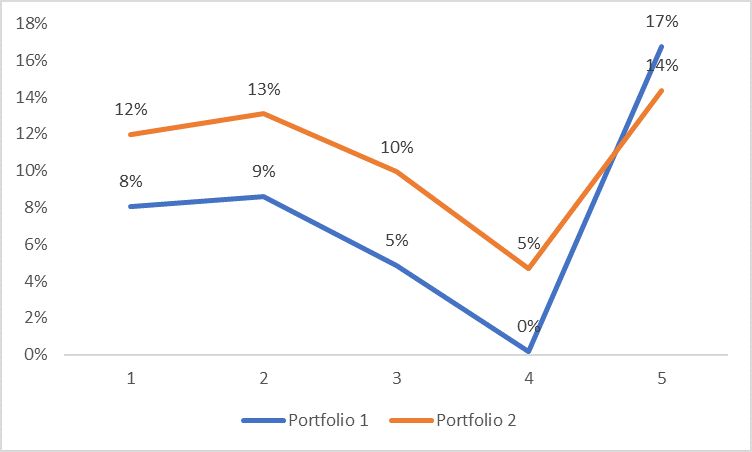

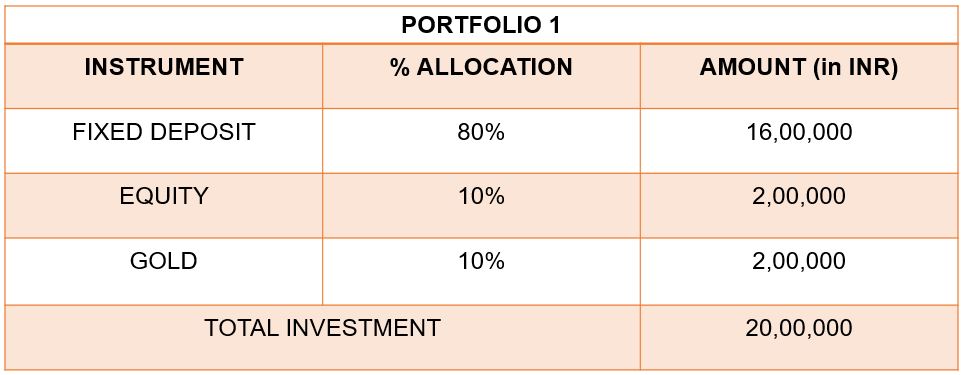

Taking into consideration, the portfolio of Conservative Investor, we have built 2 portfolios, with Rs 20,00,000 as a total investment.

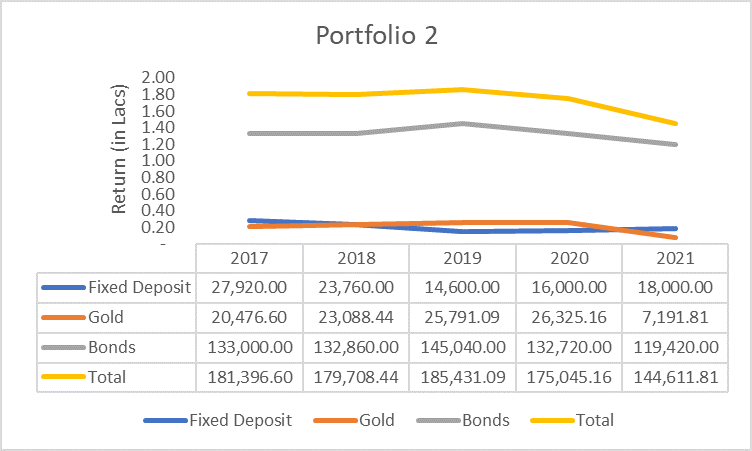

Conservative investor takes minimum risk and always try to keep their investments at a safer place. Hence, we have allocated 80% of their funds in Fixed deposits, 10% in Equity, and 10% in gold. The yields derived out of the portfolio are stated below, these are the yearly returns that each of the instruments has derived for a Conservative investor.

The yield that portfolio 1 derived to the conservative investor was 31% of the total initial investment made i.e. approximately Rs. 6,24,513.09. Herein the major amount of yields that the investor earns is through Fixed deposits. The maximum an investor could yield out of his/her investments in fixed deposits is 7% in FY2017, post that the interest rates have just declined. The returns derived every year were 8% in 2017 and 2018, 5% in 2019, 4% in 2020 and 6% in 2021.

In the adverse scenario of 2020, the total portfolio earning for that year was Rs 90,000 (4%), wherein the equity was yielding a negative return. The FD rates were approximately 4% then. These earnings could be increased if the portfolio was well diversified. The main motive behind diversifying the portfolio of a conservative investor is to make them derive maximum returns through their investments.

This is well explained in the portfolio stated below;

In the Portfolio 2 we have replaced the proportion of fixed deposits with the bonds and removed the equity investments. Bonds are considered safer investments as they are been backed by the physical assets of the company, whereas FDs are not. So, in case a company files for insolvency, bondholders can get their money back through the assets of the company. Bonds also offer higher returns than FDs, especially post-tax.

Compared with portfolio 1, portfolio 2 yielded approximately 9% in 2020 amounting to Rs. 1,75,000, which is much higher than portfolio 1 returns. The reallocation of funds has made the investor earn 43% i.e. approximately Rs. 9,00,000 from 2017 to 2021, increasing the returns by 38%. The returns derived every year were 9% from 2017 to 2020 and 7% in 2021.

Total Return Comparison Chart

Therefore, diversifying helps providing cushion to your portfolio in the times of need. It is hedging your portfolio against all the unforeseeable circumstances and ups-downs that happens in the market. It provides consistent growth to your portfolio.

What is the difference between Corporate and Governments Bonds?

1 comment

Thank you for your kind words and keep reading our blogs.

Comments are closed.