High Yield | AAA Rated | Minimum Investment: 10k Only

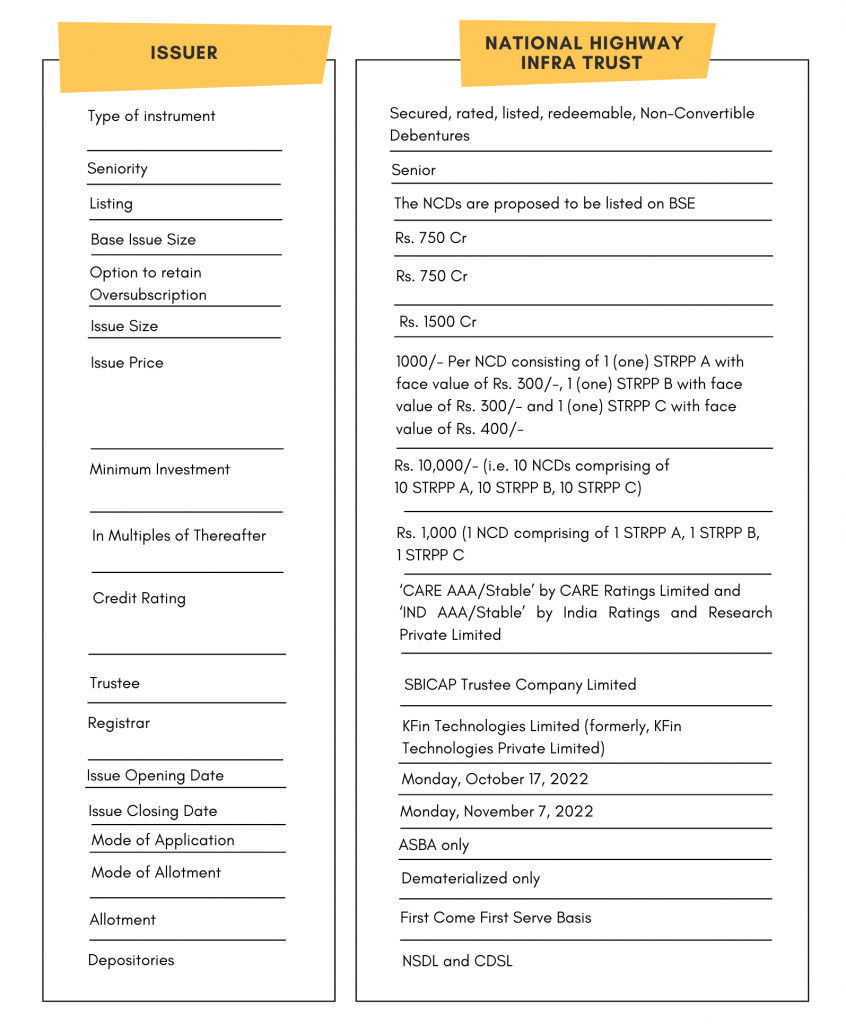

National Highway Infra Trust is issuing the Non-Convertible Debentures. These NCDs are AAA/Stable by ICRA and India Ratings and Research Limited. The NCDs are issued with staggered maturity ranging from 13 to 25 years. The coupon offered by this tranche of NCD is 7.9% and effective yield is 8.05%. The NCDs are secured and redeemable in nature.

STRPP – Separately Transferable and Redeemable Principal Parts

STRPP – Separately Transferable and Redeemable Principal Parts

INVEST NOW

Goldenpi organized a webinar on “an Exclusive chat with the Executives from National Highways Infra Trust (NHAI InvIT) and The Trust Investment Advisors Pvt. Ltd about the NHAI InvIT NCD IPO.

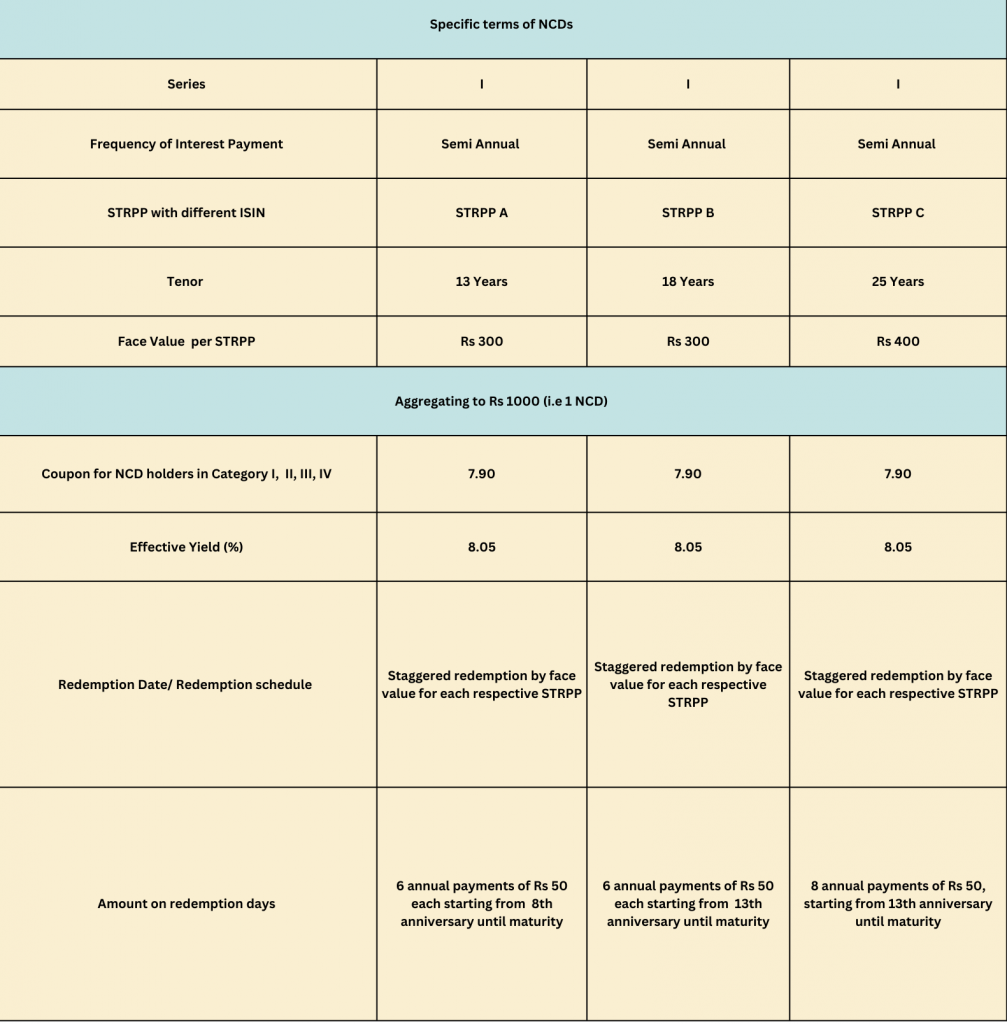

National Highway Infra Trust NCD IPO: Coupon Rates and Effective Yield for Each of the Series

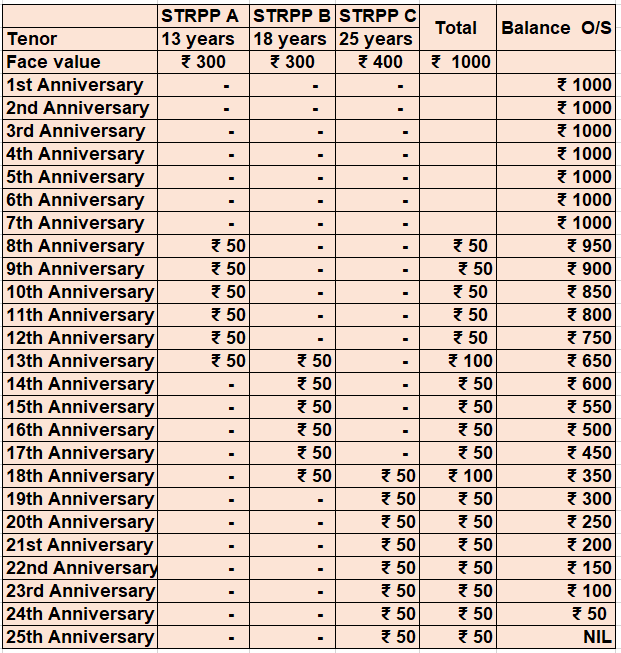

Principal Redemption Schedule and Redemption Amounts

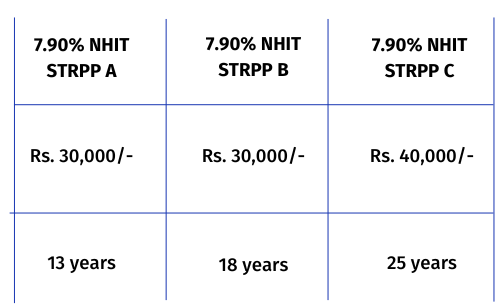

Each of these STRPPs has a distinct maturity date, which is known as staggered maturity. For instance, the allocation if you invested Rs. 1,00,000/- would be as follows:👇

Each of these STRPPs has a distinct maturity date, which is known as staggered maturity. For instance, the allocation if you invested Rs. 1,00,000/- would be as follows:👇

All three of these STRPPs will have their own ISINs when they are allotted and listed on BSE and NSE. So enabling investors to trade them independently. Providing liquidity moving forward.

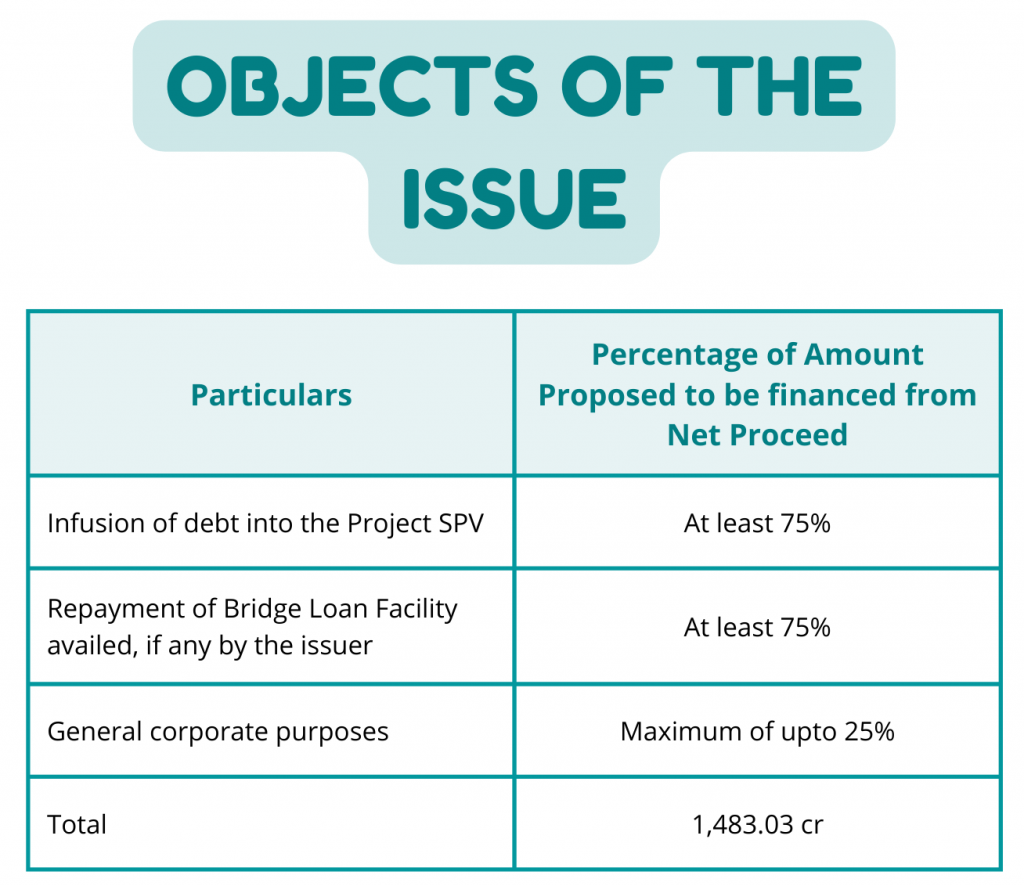

Objects of the Issue

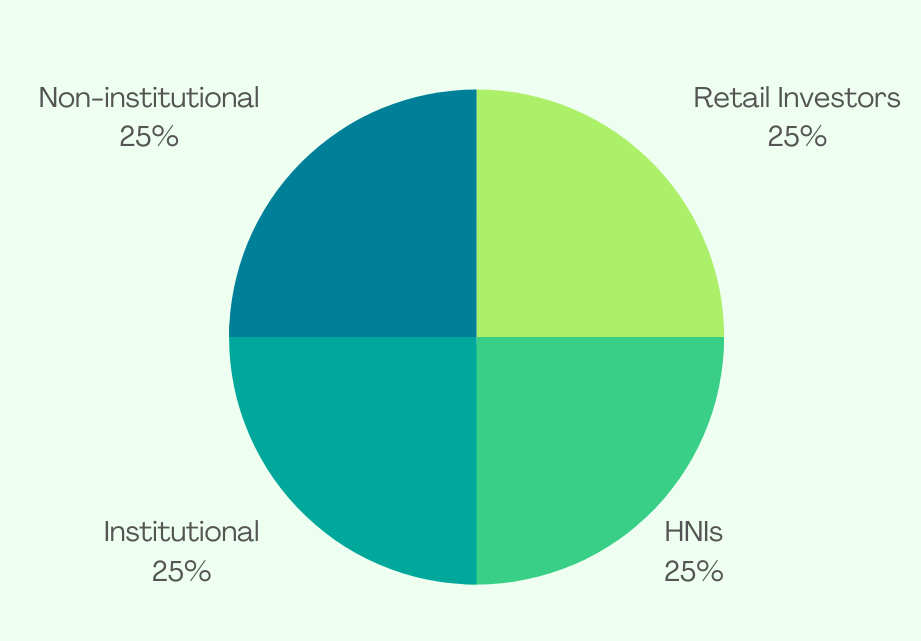

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for National Highway Infra Trust NCD-IPO.

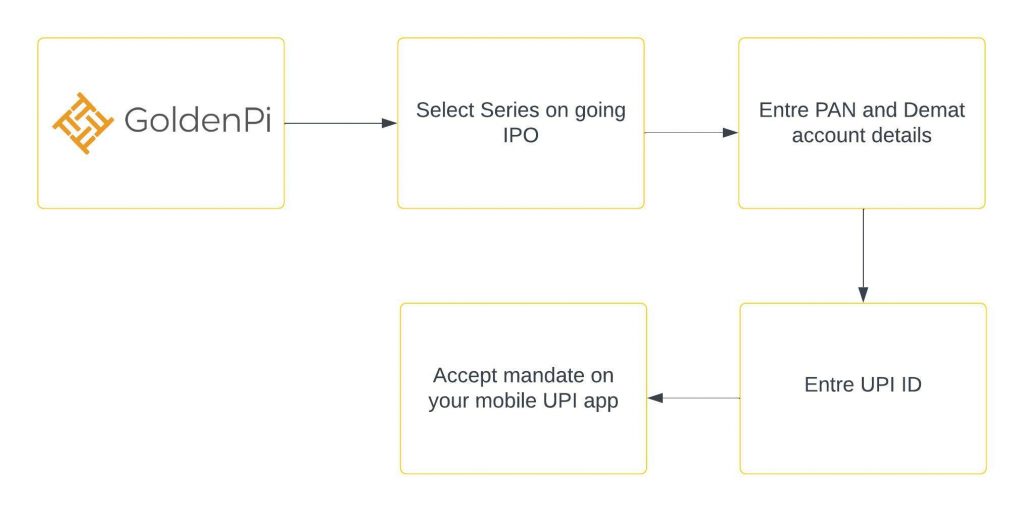

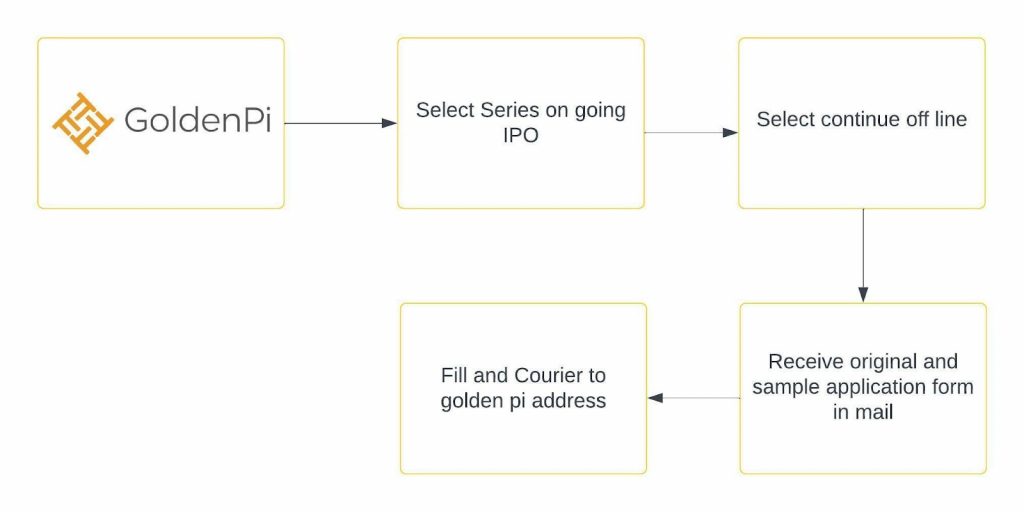

Investment Process for National Highway Infra Trust NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Invest in Bond IPO online in just 5 minutes

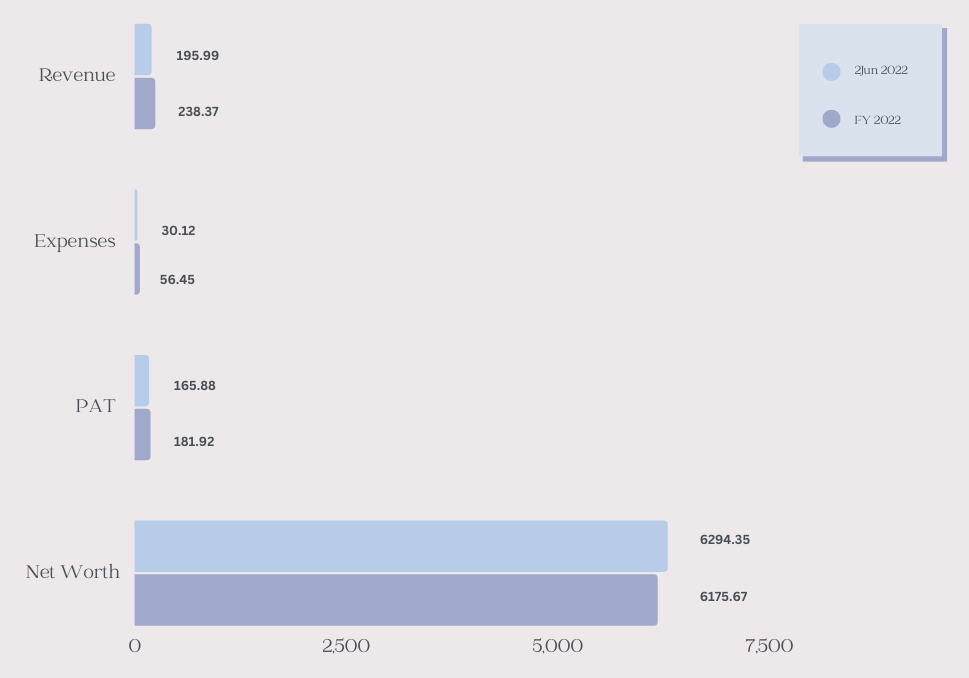

Financial Overview

(Amount in Rs. Cr)

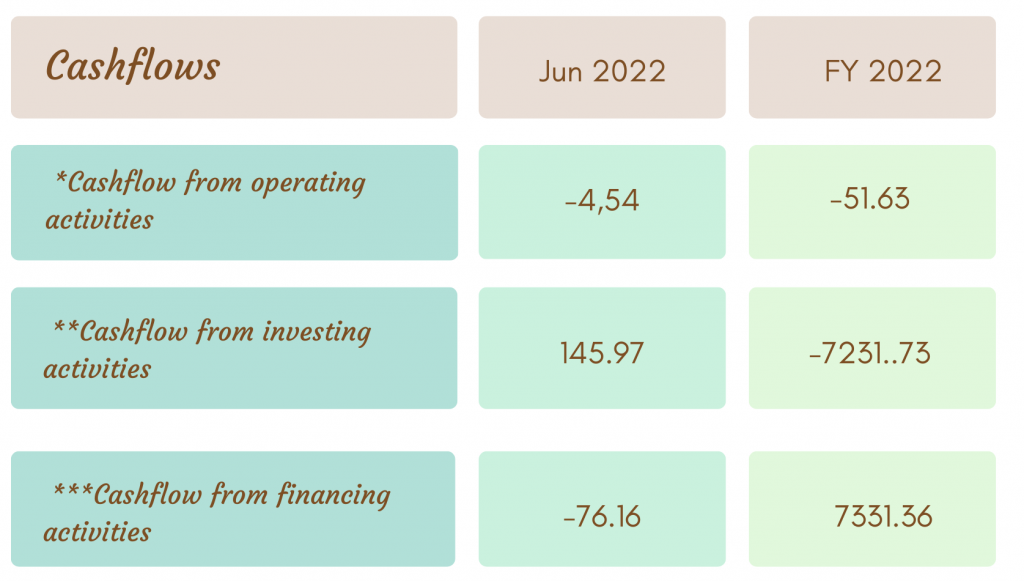

Cash Flow for Last 5 Years

(Amount in Rs. Cr)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product or services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like the purchase of assets, sales of securities, etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

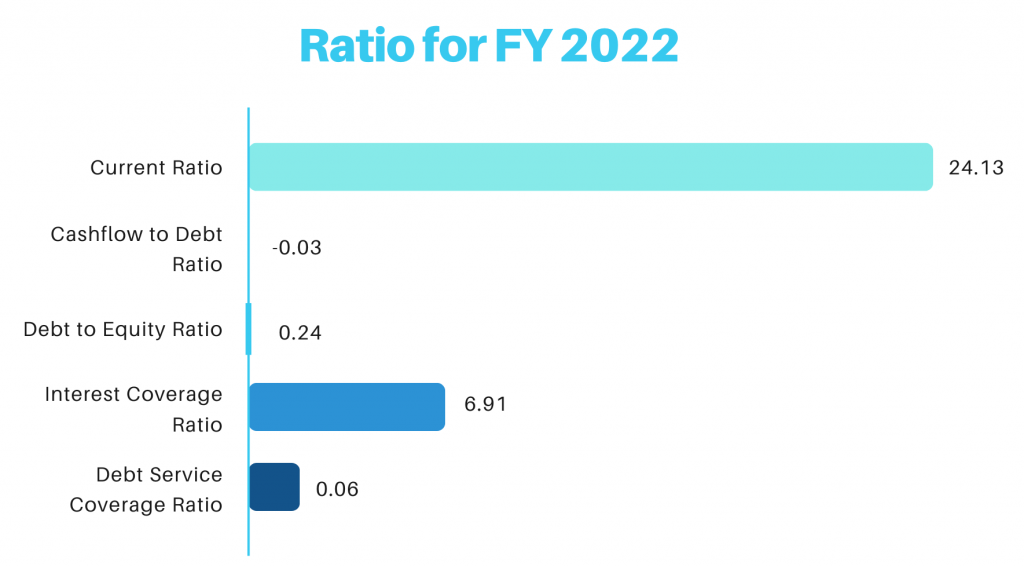

Ratio Analysis

Overview

- The current Ratio and Interest Coverage Ratio remain positive stating that the trust might be able to meet its current interest obligations through its operating profits.

- Debt to Equity ratio also remains very less, giving it a positive indication. It states that the trust might be able to meet its debt obligations through equity in a time of need.

- The debt service coverage ratio and Cash flow to debt ratio remain low, stating that the trust might not be able to service its debt obligations through cash flows and cash profits.

Issue Analysis

Pros

- The NCD is AAA rated security with a stable outlook.

- The coupon rate is 7.9% which is much higher than FDs.

Cons

- The debt service coverage ratio is less than 1.5 which indicates lower toll collections therefore less revenue.

- Negative Cash flow, which indicates that they will not be able to service its debt with the available cash flows.

About National Highway Infra Trust

Founded in 2020, National Highway Infra Trust is a registered infrastructure investment trust under the InvIT regulations. It is sponsored by the National Highway Authority of India (NHAI). The trust is established for making investments in special purpose vehicles. The projects include Abu Road Project, Swaroopganj Project, Kota and Chittorgarh Bypass Project, Kurnool Highway Project, and Belgaum Project.

Strengths

- Sponsor with extensive experience operating and maintaining projects in India’s roads and highways sector and a solid track record in the field.

- A sizable portfolio of diversified toll road assets that could generate income over the long run.

- Strategic regional positioning of portfolio assets or presence therein.

- Experienced management group with business expertise.

- Access to the portfolio of the sponsor and potential for growth.

Weakness

- The execution risk associated with regular and periodic maintenance that needs to be performed in each SPV throughout the concession period affects the underlying SPVs.

- Toll rates and traffic volumes affect toll revenues. Traffic volumes are influenced by a variety of variables, including the project’s location and placement of the road.