|

Getting your Trinity Audio player ready...

|

Before thinking of any investment, the first thing that pops up in the investor’s mind is “tax.”. Is this investment tax-free, or if there is any tax, how much is applicable, and knowing it is there, how is this tax filed? In this article, let’s talk about the tax on bonds, and you’ll get a complete understanding of this subject.

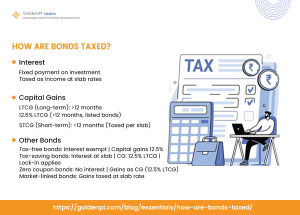

Interest on bonds is taxed at the individual’s income slab rate; no tax bonds are excluded.

How are bonds taxed in India?

Interest on bonds is taxed according to the individual’s income tax slab. Long-term capital gains (LTCG) from listed bonds are taxed at 12.5% flat rate on gains (sale price minus purchase cost), no indexation benefit since Budget 2024. Short-term capital gains (STCG) are taxed based on an individual’s income tax slab rate.

Taxation takes place when there is some sort of income coming from an investment. If you take bonds, the income comes from two sources. One is interest, and the other is capital gains, which investors should clearly understand before participating in an upcoming bond IPO.

What is Interest?

Interest is the fixed payment received on the principal invested initially, and the interest is paid to an investor based on the investor’s preference that would have been made while investing. It can either be monthly, quarterly, semi-annually, or annually.

What is a Capital Gain?

An investor would have bought the bond at face value during the purchase. If the investor decides to sell it at a better price in the secondary market, the net difference between the purchase and the sale is a capital gain. There are two types of it:

Long-term Capital Gain

If the investor holds the bond for more than 12 months in the case of a listed bond, the net difference made by the investor during purchase and sale is called long-term capital gain, also known as LTCG. If it is for unlisted bonds, then the holding period must be more than 36 months.

Short-term Capital Gain

If the investor holds the bond for less than 12 months, the net amount made from the difference between the purchase and sale of a listed bond is called short-term capital gain, also known as STCG. If it is for an unlisted bond, it must be less than 36 months.

What are Corporate Bonds?

How are Interest and Capital Gains Taxed?

The interest received is considered income received, and it is taxed as per the slab rate of an individual. For instance, if the capital of Rs 1,00,000 is invested at an interest rate of 9%, the interest earned is Rs 9000 from this investment, and it is added to the gross total income. Assuming the income of the individual is Rs 10,00,000 and adding the Rs 9,000, the investor will fall under the Rs 10L-12L slab, which is taxed at 15% as per the new regime (plus 4% cess), and for the old regime, it is 30% (plus surcharges and cess).

This may vary from person to person, depending on their income level. It’ll attract some surcharges and cess. If the income level is below the taxable bracket, interest is not taxed that way.

When it comes to capital gains, the short-term capital gains for both listed and unlisted bonds are taxed as per the applicable slab rates mentioned above, and the long-term capital gains of listed bonds are taxed at 10% without indexation and at 20% for unlisted bonds without indexation.

That’s pretty straightforward to comprehend; both interest and capital gains are taxed this way for any type of bond, but are all the bonds taxable? Not really.

Other Types of Bonds

Tax-free Bonds

It is popularly known for its tax-free benefits, which are commonly issued by governments and PSUs. As the name suggests, it is indeed tax-free but for interest income alone, which means the investor doesn’t need to pay any tax on the interest received from such bonds. The capital gains are still taxed as per the tax norms mentioned for LTCG and STCG in the above section.

Tax Saving Bonds

These bonds don’t work as similarly to tax-free bonds; they are tax-saving for a reason. They help you save tax on the long-term capital gains earned on capital assets you sell, like land or buildings. The investment can’t exceed 50 lakhs, and the gap between the sale and the investment in tax-saving bonds must be within six months. The investor receives a 100% exemption on LTCG held till maturity, but the interest is taxed as per the tax slab.

Zero Coupon Bonds

These bonds will not pay any interest but are bought at a discounted price and sold at face value. No interest means no tax on interest, but LTCG and STCG are applicable, respectively.

Market Linked Bonds

The bonds are linked to some index; if the interest rate is above the performance of the index only, then interest is paid and not otherwise. The interest is taxed as per the slab rate, and the capital gains are taxed accordingly as per LTCG and STCG.

What is a Corporate Fixed Deposit?

The Recent Update

The new amendment in Budget 2023 about tax deducted at source for listed bonds applies only to corporate bonds and is exempt from government and sovereign bonds. If the interest income is more than Rs 10,000, as per this amendment, the issuer would deduct the tax at the source of about 10% on the interest earned.

Those whose tax liability is nil for the total annual income, and if below age 60, can submit form 15G, and those above 60 can submit form 15H to the issuer to claim TDS. These forms must be completed at the beginning of the year to avoid TDS.

The Wrap

Now that the tax liability is clear, you can invest in bonds without having any questions in mind. Depending on your needs, you can invest in other types of bonds to benefit from their tax exemption. But regardless of what, bonds are those fixed-income assets that offer not slightly but higher interest rates compared to traditional FDs at lower risk.

Stocks might be eye catchy bonds are relaxing though

Key Takeaways

- Bond interest income is taxed at the individual’s income tax slab rate.

- Listed bonds are taxed depending on the individual’s income bracket. Unlisted bonds are taxed at the individual’s income level if carried for less than 36 months.

- Tax-free bonds are those whose interest income is tax-free.

- Tax-saving bonds provide a deduction for LTCG from the sale of other assets, such as land or a home.

- Zero-coupon bonds mean that no interest is paid, and there is no interest tax.

- As per the Budget 2023, TDS on bond interest stands at 10% if annual interest exceeds Rs 10,000 for listed debentures (post-April 2023 amendment) or Rs 5,000 for unlisted debentures

- G-Secs and sovereign bonds remain exempt. All capital gains on unlisted bonds (regardless of holding period) are taxed at your income slab rates, with no LTCG concession.

FAQs About Bonds Taxed

1. Are all types of bonds taxable, or are there exceptions like tax-free bonds?

Most bonds are taxable, but there are non-taxable bonds that eliminate interest income from taxation; however, capital gains are still taxed.

2. How are long-term and short-term capital gains taxed on listed and unlisted bonds in India?

Long-term profits from listed bonds are taxed at 12.5% flat rate, and no indexation benefit since Budget 2024.. Short-term profits are taxed at the current rate of income tax.

3. How are corporate bonds taxed?

Corporate bond interest is taxed at the investor’s eligible slab rate. Long-term capital gains that are kept for more than 12 months are taxed at 12.5%; on the other hand, short-term profits are taxed as per income tax slabs.

4. Are corporate bonds taxable?

Yes, corporate bonds are taxed. Interest income is included in your income and taxed at the relevant slab rate. Capital profits are taxed in accordance with the holding term and type.

5. Can investors below 60 years of age and with zero tax liability submit Form 15G to avoid TDS on interest income from bonds?

No, a Form 15G can only be filed if the total taxable income is less than the basic exclusion funds for not worrying about TDS on bond interest gained.