Apply online in few simple steps | Pay via UPI | Minimum investment is 10K only

Non-Convertible Debentures (NCDs) are debt securities issued by corporations. NCDs come with a fixed interest rate; hence investors get fixed income. And on maturity, the principal amount is paid back to the investor. You can invest in NCDs in the secondary market; else, you need to participate in the IPO in the Primary Market. The advantage of investing via IPO is that you get NCDs at face value, and the minimum investment is 10K only.

Retail investors can apply for an IPO both ways – online or offline. The investor has to physically submit the application and cheque in offline mode, which is very time-consuming. If the investment amount is 10 lakhs, you can simply submit two IPO applications online. You can participate in NCD-IPO online and pay via UPI, National Payments Corporation of India (NPCI) has set a transaction limit of 5,00,000 in the UPI-based payments. UPI integration reduces manual interventions at many stages hence applying via UPI is more reliable.

Note:

Bonds and Debentures are both debt securities offering fixed returns. Government entities issue bonds, whereas corporates issue debentures. Both bonds and debentures behave in the same way. Generally, bonds and debentures are collectively addressed as “Bonds.”

To understand the Perks of Investing in Bonds and Debentures, Click here.

GoldenPi is the India’s leading fintech company that enables investors to invest in NCD-IPOs via UPI. You can participate in NCD IPOs online with few clicks. Let’s see how this platform works.

Step 1 Of NCD IPO Investment- Select Product

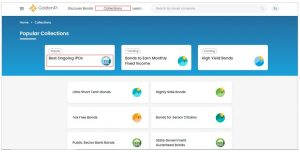

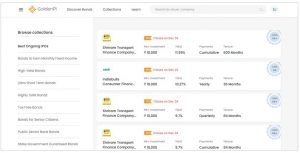

Visit GoldenPi.Com and log in. To view the collection of active IPOs, click on the toast message. Alternatively, you can go to <Collections>, select <Best Ongoing IPOs>.

Click on the issuer (company) in which you want to invest in. You will land on the Product Page. On the Product page, you can see the details about the issue and issuer that will help you make investment decisions.

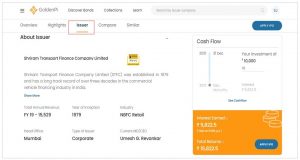

Here you can find the Credit Rating and Debit Quality of the issue. Credit rating indicates the safety of the instrument. AAA to BBB-rated instruments are considered safer than others.

Secured NCDs are NCDs that are collateralized by an issuer’s asset or future cash flows. If the issuer defaults, then investors can claim the asset or the cash flow generating source. Senior NCDs are paid before Junior NCDs. Listed NCDs enjoy few tax benefits. All these details you will find then under Debit Quality.

Under issuer details, you can find the synopsis about the Company’s history, business operations, and financial performance.

Here is a calculator to determine the difference in the returns earned from bonds and FD. You have to select the bank from the drop-down menu. The FD rate of the selected bank will be considered for comparison. The calculator provides both pre-tax and post-tax returns.

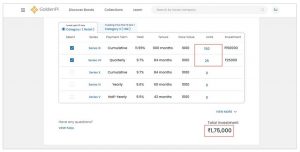

Step 2 Of NCD IPO Investment – Decide the investment amount

The maximum total application amount is ₹10 lakh per individual for an IPO. Each single application can be for a maximum of ₹5 lakh. If the investment amount exceeds ₹5 lakh, it is automatically split into multiple applications. A new application is created for every ₹5 lakh invested.

Example:

- ₹5 lakh investment → 1 application

- ₹10 lakh investment → 2 applications (₹5L each)

To invest more than ₹10 lakh, the offline application process must be followed.

Investment amount= Units X Face Value

Once you select the number of units, the investment amount is calculated and displayed.

Mention the contact details and get them verified. Once contact details are verified, you can see green ticks. Click on <Continue> to go to the payment page.

Mention the contact details and get them verified. Once contact details are verified, you can see green ticks. Click on <Continue> to go to the payment page.

To get the notifications on NCD-IPOs, sign up with GoldenPi.

Step 3 Of NCD IPO Investment- Pay via UPI

Provide the UPI handle. To generate the UPI, one has to download the UPI app and complete the KYC. For completing the KYC, a debit card is a must.

Regarding the mandate, you will receive a notification in the UPI app. The authorizing the bank to block the money equivalent to the application size in an IPO. If the application is selected for allotment, an amount equivalent to the allotted issues will be debited from the investor’s bank account. If the application is rejected, the entire amount will be unblocked. In the case of partial allotment, the amount corresponding to the allotment will be debited from your account, and the rest will be unblocked.

Regarding the mandate, you will receive a notification in the UPI app. The authorizing the bank to block the money equivalent to the application size in an IPO. If the application is selected for allotment, an amount equivalent to the allotted issues will be debited from the investor’s bank account. If the application is rejected, the entire amount will be unblocked. In the case of partial allotment, the amount corresponding to the allotment will be debited from your account, and the rest will be unblocked.

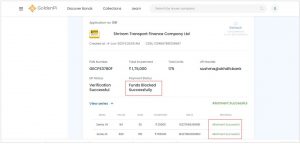

You can check the payment status and allotment status on the GoldenPi platform. You need to go to <profile> and then <orders>.

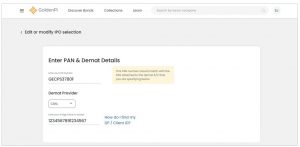

Note: Provide the PAN and Demat details. It should be an active Demat account. If the Demat account is not accessed for a long time, the account becomes dormant. By paying the required fees to the Demat Provider, you can reactivate the dormant account.

What is UPI?

UPI stands for Unified Payment Interface. UPI is an instant real-time payment system facilitating interbank transactions. It is developed by the National Payments Corporation of India and regulated by the RBI. UPI ID is a unique address that identifies you in the UPI system.

The typical format of UPI ID- customername@UPIhandle

Example- rekha@okhadfcbank

You need to download the UPI app of your choice. Once you complete KYC on the app, the UPI handle will be generated. Open your profile in the UPI app. You can see UPI handle in the profile.

The National Payments Corporation of India has permitted 18 UPI apps for IPO. Here is the list of those 18 apps and their handles.

| Sr. No. | UPI Apps live on IPO | Handle |

| 1 | BHIM Baroda Pay (only Android) | @BARODAMPAY |

| 2 | BHIM RBL Pay (Android & iOS) | @rbl |

| 3 | BHIM (android & iOS) | @upi |

| 4 | BHIM ALLBANK UPI (only Android) | @allbank |

| 5 | BHIM Axis Pay (only android) | @axisbank |

| 6 | BHIM IndusPay (only Android) | @indus |

| 7 | BHIM Lotza UPI (only Android) | @federal |

| 8 | BHIM SBIPay (only android) | @sbi |

| 9 | BHIM YES PAY (only Android) | @yesbank |

| 10 | Citi Mobile (android & iOS) | @citi & @citigold |

| 11 | DigiBank – DBS (Android & iOS) | @dbs |

| 12 | Google Pay (Android & iOS) | @okhdfcbank, @okaxis , @oksbi, @okicici |

| 13 | HSBC Simply Pay (android & iOS) | @hsbc |

| 14 | iMobile by ICICI Bank (android users) | @icici |

| 15 | Kotak Mobile Banking App (Android) | @kotak |

| 16 | Phone-Pe (android & iOS) | @ybl |

| 17 | SIB Mirror+ (only Android) | @sib |

| 18 | Paytm (Android and iOS) | @paytm |

Important Points To Invest in NCD IPO Online

- Demat account – In addition to having a bank account, the applicant should have an active Demat account.

- UPI app- Download the UPI app of your choice. Complete the KYC by giving account details and generate a UPI handle.

- To complete KYC with the UPI app, one should have a debit card.

- Only residential Indian citizens can participate in IPOs.

- Only retail investors can apply for an IPO online.

- In the online mechanism, you would be getting notifications on the cell number and email id given in the application. Once you initiate the application process, you are advised not to change the contact details until allotment is done.

GoldenPi is a marketplace for Bonds and Debentures (NCDs). GoldenPi is the only platform to conduct an online NCD IPO. With GoldenPi, you can participate in the NCD IPO with ease. With fewer details such as Demat account number, PAN, and bank details, you can apply online for an NCD IPO.

View IPO Collection

or

Talk to our Relationship Manager

NCD IPO Investment Frequently Ask ed Questions by Bond Investors

Q: What is UPI?

A: UPI stands for Unified Payment Interface. UPI is an instant real-time payment system facilitating interbank transactions. It is developed by the National Payments Corporation of India and regulated by the RBI.

Q: What is a UPI ID?

A: UPI ID is a unique address that identifies you in the UPI system.

The typical format of UPI ID- customername@UPIhandle

Example- rekha@okhadfcbank

Q: I don’t have a UPI ID, and How do I create one?

A: You need to download the UPI app of your choice. Once you complete KYC on the app, the UPI handle will be generated. Open your profile in the UPI app. You can see UPI handle in the profile.

Q: What are the charges to apply for an IPO?

A: There are no charges to apply for an IPO via GoldenPi.

Q: What is ASBA?

A: ASBA stands for Application Supported by Blocked Amount. It is an application authorizing the bank to block the money equivalent to the application size. If the application is selected for allotment, an amount equivalent to the allotted issues will be debited from the investor’s bank account. In the case of partial allotment, the amount corresponding to the allotment will be debited from your account, and the rest will be unblocked.

Resources for Bond Investors

- What is the bond market and how does it work?

- Taxation on Gains from Bond Investment in India

- Why you should consider investing in Bank Bonds?

- Debt Mutual Funds vs. Bonds

- Corporate Bonds: Features you need to know

1 comment

Hello Chellappan,

Please visit this page https://goldenpi.com/collections/highly-safe-bonds

These bonds are considered relatively safer.

Regards

GoldenPi Team

Comments are closed.