Most of us might be worried about paying high taxes on our investment returns and looking for investment options which may have tax-free. There are several tax-free bonds available.

What are tax-free bonds?

Tax-free bonds are financial securities issued by the government of India to raise funds for a particular purpose. It can be for the construction of a road or any other infrastructure. These bonds are absolute tax exempted under Section 10 of the Income Tax Act of India, 1961. The income generated through these bonds is only exempted from tax however the invested amount cannot be under come to the tax exemption (under 80C). These bonds are also considered as low risk bonds.

What are advantages of Tax-free bonds?

Tax-exemption

The interest income from tax-free bonds is completely exempt from taxes. These bonds are exempt from tax deducted at source (TDS), as well. The principal amount invested in tax-free bonds does not qualify for a tax deduction under Section 80C, so it is essential to record your interest income.

Zero Default Risk

Public sector organisations issue bonds that are exempt from taxes (if notified by CBDT circular). These tax-free bonds are generally considered low-risk, with a reduced likelihood of default, compared to other types of bonds.Investors may feel more at ease maintaining their investment over the long term due to the assurance of receiving their principal and interest payments.

Interest

Given that the interest on these bonds is not subject to taxes, the rate of interest given on tax-free bonds typically ranges from 5.50% to 9% which is quite appealing. The interest is paid yearly to the bondholder. The rates, however, are fluctuating since they depend on the price of government securities at the time they are quoted. Investing in tax-free bonds at the present yields might earn you upto 6% return that is not subject to taxation.

Long-Term Lock-in Period:

The lock-in term for tax-free bonds spans from 10 to 20 years or more, making them appropriate for investors with a lengthy investment horizon. In light of this, if you plan to invest for the long term, tax-free bonds outperform bank FDs and regular bonds in terms of tax-adjusted returns.

What are the Disadvantages of Tax-Free Bonds?

Low Liquidity

Despite being listed on stock exchanges, tax-free bonds have a low level of liquidity. Consider the situation where you invested in XYZ tax-free bonds in 2022 and need to redeem the bond due to an urgent situation. You are unable to return the bond to the issuer because it will mature in 2026.Selling it to another bond investor on the stock exchange is your only option for getting out. However, it is quite difficult to find buyers and sellers for these bonds due to their relatively low liquidity. The main drawback of tax-free bonds is hence their low liquidity.

Can use as collateral: Bonds such as sovereign gold bonds and other types of bonds may be maintained as security for debts. However, banks do not recognise tax-free bonds as loan collateral. As a result, investors are unable to use them as collateral for loans,

What are the taxation rules for tax-free bonds?

- If you hold the bond until it matures, the interest you get from tax-free bonds is tax-free. Therefore, the notion of tax deducted at source does not exist (TDS).

- However, you will be required to pay taxes if you sell the bonds on the secondary market.

- Gains from the sale of your bond on the secondary market after a year are subject to a 10% tax.

- If you sell your bond after one year from the date of purchase owing to an emergency, the profits will be subject to a 10% tax.

- If you sell your bond before a year from the date of purchase owing to an emergency, the profits will be taxed as per your income tax slab.

Tax-free Bonds Vs Fixed Deposit for those paying 31.2 percent Income Tax

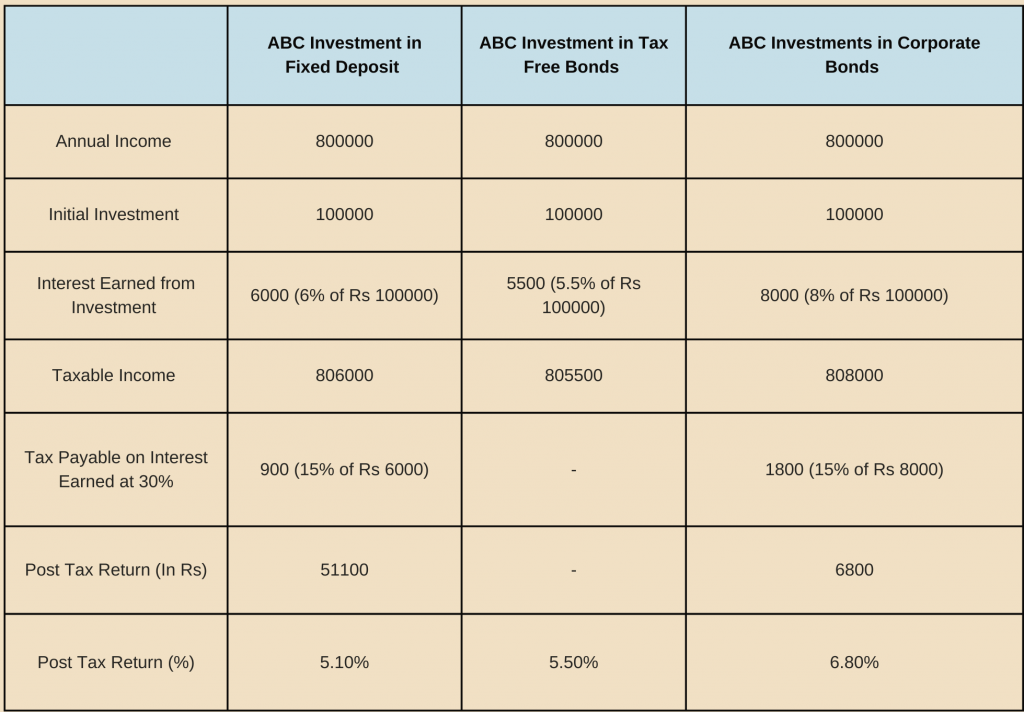

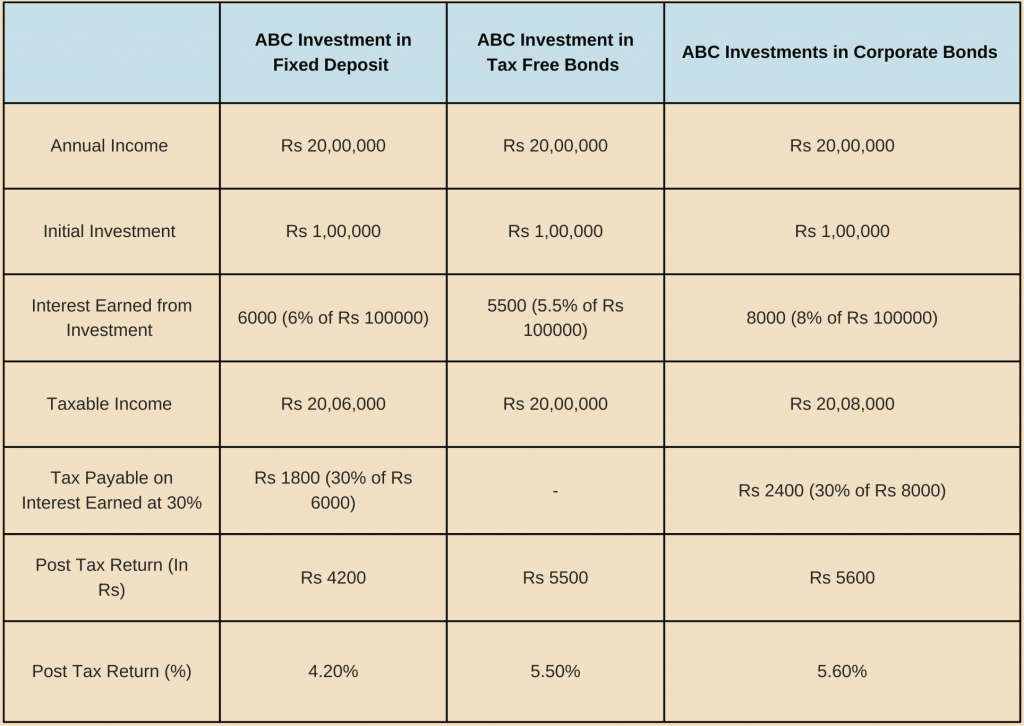

Let us take the example how a tax-free bond’s interest rate falls under the tax slab.

Below 10 lakhs earning

Above 10 lakhs earning

Tax-Free Bonds in 2022

- Indian Railway Finance Corporation

- Power Finance Corporation

- National Highways Authority of India

- Housing and Urban Development Corporation

- Rural Electrification Corporation

- National Thermal Power Corporation

- Indian Renewable Energy Development Agency

- National Bank for Agriculture and Rural Development

What is the difference between Corporate and Governments Bonds?

FAQ’S For Tax free Bonds

What happens when tax free bond matures?

When tax free bonds mature, the principal amount is paid back to the investor, along with any accrued interest. The investor is then free to reinvest the money in another tax free bond, or to use it for any other purpose. While the interest payments on tax free bonds are not subject to federal income tax, they may be subject to state and local taxes.

What are the returns on tax free bonds?

Tax-free bonds typically offer lower interest rates than taxable bonds, since the investor is not paying any taxes on the interest income. The interest on tax free bonds ranges between 7.3% to 7.5% per year. The returns on these bonds will vary depending on the specific bond and the current market conditions.