One of the most interesting, and prominent topics of the Bond market is the recent Inclusion of Indian bonds in the Global Bond Indices. The data table indicates the GoI’s outstanding debt. These are the indications that India’s debt market is growing. But, Policymakers may not be excited about India’s inclusion in global bond indices, and economists may not be happy with an increase in the Government’s debt.

Before deciding about investing in Government bonds, you need to understand Government bonds. The article will apprise you of the various types of Government bonds and how they are issued. And then its advantages and disadvantages of investing in them, and how to buy them.

What are Government Bonds?

Bonds and debentures are debt investment instruments with a Fixed Rate of Return and Fixed Maturity Period. While Bonds are securities that are mostly issued by the central and state governments, debentures are always issued by corporations. The government of India issues bonds to meet its financial requirements such as development, commercial or non-commercial operations, and management of the Government’s debt obligation.

Treasury Bills

Treasury Bills

Treasury bills are issued by the central government to meet its immediate financial requirements. The tenure of T-bills is less than 365 days. These are zero-coupon bonds, hence, they do not provide interest payouts. They are sold at a discount price. The difference between the face value and maturity amount is the investors’ gain. They come with tenures such as 91 days, 182 days, and 364 days.

Cash Management Bills (CMBs)

In 2010 GoI started issuing CMBs to manage mismatches in the cash flows. The Cash Management Bills have a tenure of less than 91 days. Other than tenure in all other aspects Cash management bills are similar to Treasury Bills.

Dated Government Securities

Dated securities are the Government Bonds that carry fixed/ floating rates, and interest will be paid as per the schedule and the principal will be returned on maturity. Generally, dated securities come with a fixed rate of interest. Most of the time, tenure of these dated government securities ranges from 5 years to 40 years.

Types of the Dated Government Securities (Sovereign Guarantee Government Bonds)

- Zero-Coupon Bonds

- Fixed-Rate Bonds

- Bonds with Call or Put Option

- Capital Index Bonds

- Sovereign Gold Bonds (SGBs)

- Inflation-Indexed Bonds

- STRIPS

- Special Securities

- 75% Savings (Taxable) Bonds, 2018

Advantages of Investing in Government Bonds

The following are the advantages of investing in government bonds.

- Since G-Secs are issued by Central or State Government credit risk is zero.

- Most of the G-secs carry coupons of more than 6% p.a.

- Tenure ranges from 14 days to 40 years. The investor can choose the one that matches his/her requirement.

- G-secs can be used as collateral to take loans.

- By investing in tax-free bonds investors can save taxes under Section 10 (15) (iv) (h) of the Income Tax Act, 1961.

Explore corporate bonds to get higher fixed return

Disadvantages of Investing in Government Bonds

The following are the disadvantages of investing in government bonds.

Low Returns

Compared to corporate bonds and mutual funds, G- secs offer low returns.

Interest Risk

In the case of Government bonds, there is no credit risk but as most of the government bonds come with longer tenures there is a chance of interest rate risk.

In the case of Government Bonds, there is a sovereign guarantee hence there is no credit risk. But there are a few other risks associated with government bonds that investors must be aware of.

- Interest Rate Risk: If interest rates increase, the price of the bond decreases. In such conditions, if the investor wants to sell the bonds, he/she has to sell at a discount price.

- Reinvestment Risk: You might have earned good returns either by holding bonds till maturity or by selling them before maturity. When you proceed to reinvest this capital, you can run into the risk of getting bonds in the market with lower returns than what you earned previously. This risk is possible if it’s a decreasing interest rate economy.

- Liquidity Risk: Liquidity risk arises only when you want to sell off the bond before it matures. Factors that influence liquidity risk are demand, market price, and lack of information.

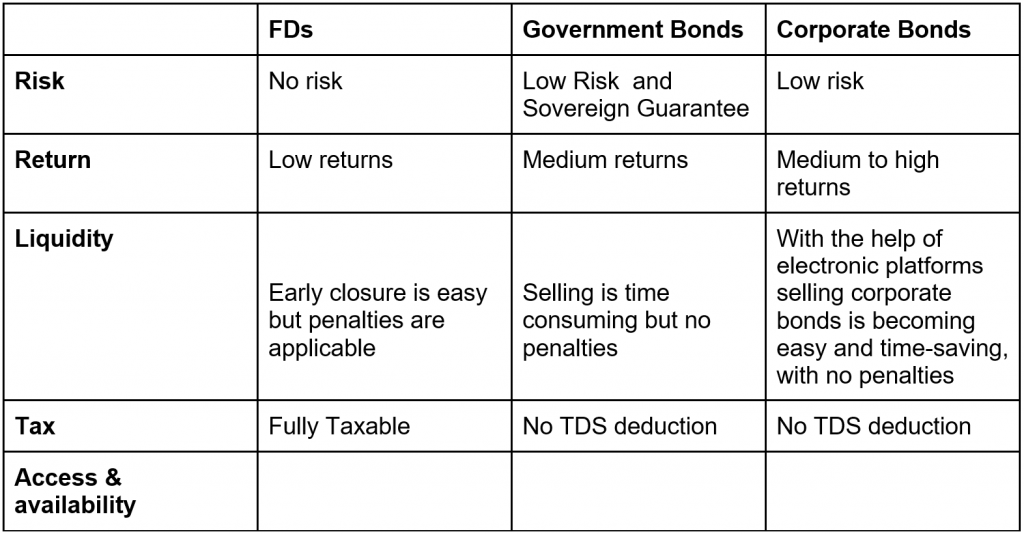

Comparison of Government Bonds with other securities like FD and Corporate Bonds

Guide to Buying Government Bonds

NSD-OM

Negotiated Dealing System- Order Matching(NSD-OM) is an active secondary market for government bonds.

Financial institutions have direct access to NSD-Om to buy or sell government bonds. Retail investors can trade over the NSD via their respective custodian or they can open a Gilt account to participate directly.

Over the counter

Investors (retail and institutional) can get in touch with financial institutions to buy government bonds.

Stock Exchange

Exchange is advised to have a dedicated segment for debt where all Demat account holders can buy/sell the bonds.

FAR

Foreign Investors can invest in government bonds via FAR (Fully Accessible Route).

How Government Bonds Are Issued?

On behalf of the Government of India, the Reserve Bank of India issues Government Bonds on an electronic platform known as e-Kuber. All members of e-Kuber, non-members of e-Kuber, and retail investors can participate in these auctions. The organizations holding SGL (Subsidiary General Ledger) accounts with RBI can be the members of e-Kuber.

Non-members have to open a Gilt account with a bank or Primary Dealer to participate in these auctions. Retail investors are also expected to have a gilt account. Retail investors can participate in selected auctions via the “Non-competitive Bidding” mode.

In the case of SDLs, after State Governments take permission from the Central Government RBI will issue bonds on behalf of state governments, which are called State Development Loans (SDLs). RBI publishes auction-related calendars and schedules on its website and leading newspaper (English and Hindi only).

Clearing and Settlement of Government Bonds

In the secondary market, Government Bonds are settled in Delivery versus Payment mode, where delivery of existing securities and transfer of amount happen simultaneously. Here, CCIL is the clearinghouse that acts as the counter party for both seller and buyer. For this purpose, CCIL collects margins from all participants and maintains a ‘Settlement Guarantee Fund’.

Who can buy Government Bonds?

Anyone looking forward to diversifying their investment portfolio, and invest their idle funds can buy government bonds. This includes –

- Financial Institutions

- Foreign Investors

- Institutional Investors

- Retail investors

FAQs About Government Bonds

What is Non- Competitive Bidding?

On behalf of the government, RBI issues Government Securities via auctions. Non- Competitive Bidding allows a retail investor to participate in selected auctions (mostly dated government securities). Here, the bidder need not specify yield or price and securities will be allotted (partially/fully) to the investor as per the scheme.

What is a Gilt Account?

A gilt account is an account to hold Government Securities. This account must be opened with a custodian permitted by RBI to maintain Constituent Subsidiary General Ledger Account with Public Debt Office. The Gilt account can be opened by all residents of India and residents outside India.

Gilt Account Holders can participate in the auctions held by RBI issuance of Government bonds. Gilt Account Holders have access to the NDS-OM platform as Primary Members hence they can control their orders efficiently.

What is CCIL?

CCIL is the clearing body agency for G-Secs. It acts as a counterparty for both parties. All transactions that happen in the OTC market and on the NDS-OM platform are cleared by CCIL. In these transactions, if the seller/buyer defaults then CCIL will provide funds/G-sec. To maintain the “Settlement Guarantee Fund” CCIL collects margins from all participants.

What are NSDL and CDSL?

NSDL and CDSL are the depositories to maintain ownership records of financial securities. Depository Participants are registered with depositories and investors have to have a Demat account with DPs to avail of the services of NSDL/CDSL.

What are the various websites that give information on G-Secs?

- RBI financial market watch

- NDS-OM market

- Reported deals on NDS-OM

- Financial Benchmark India Private Ltd (FBIL)