|

Getting your Trinity Audio player ready...

|

High Yield | AA+/Stable Rated | Minimum Investment: 10k Only

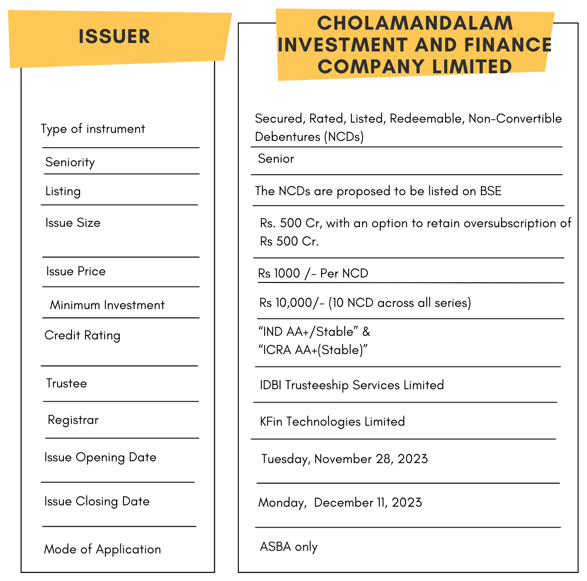

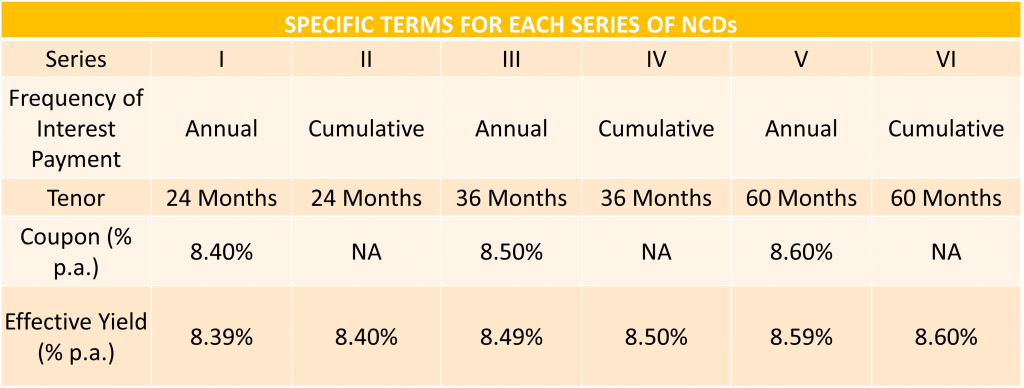

Cholamandalam Investment and Finance Company Limited is issuing the Non-Convertible Debentures. These NCDs are AA+/Stable by ICRA and IND ratings. The NCDs are being issued in six series: yield ranges from 8.39% to 8.60% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

Cholamandalam Investment and Finance Company Limited NCD IPO: Coupon rates and effective yield for each of the series

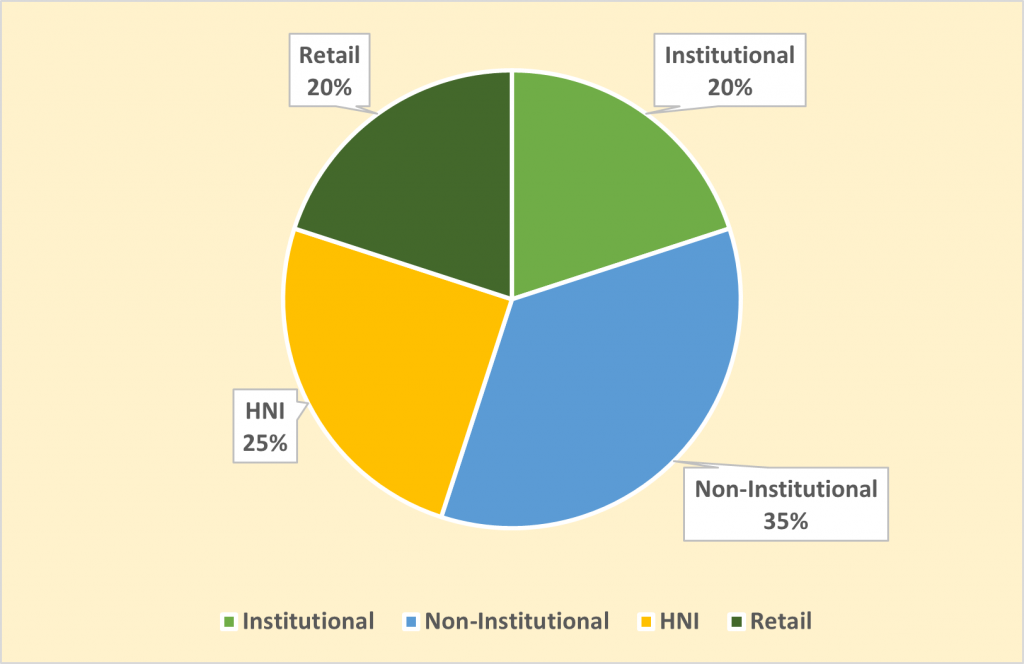

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Cholamandalam Investment and Finance Company Limited NCD-IPO.

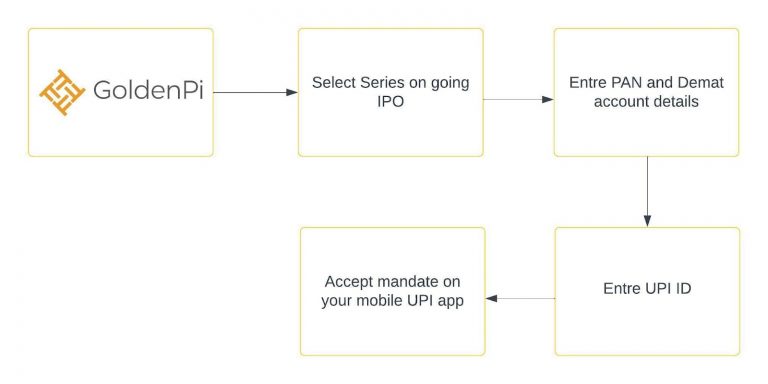

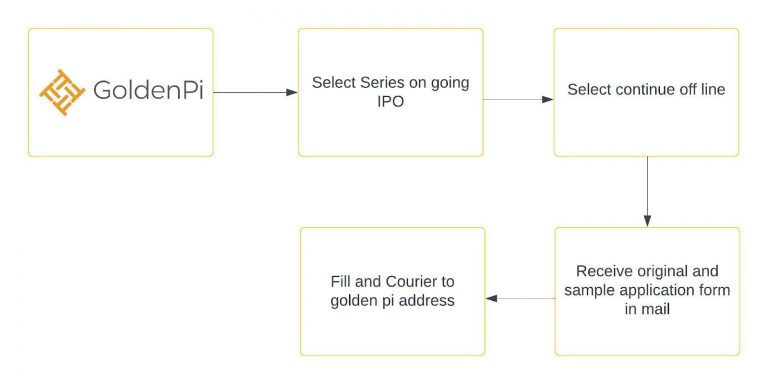

Investment Process for Cholamandalam Investment and Finance Company Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Financial Overview

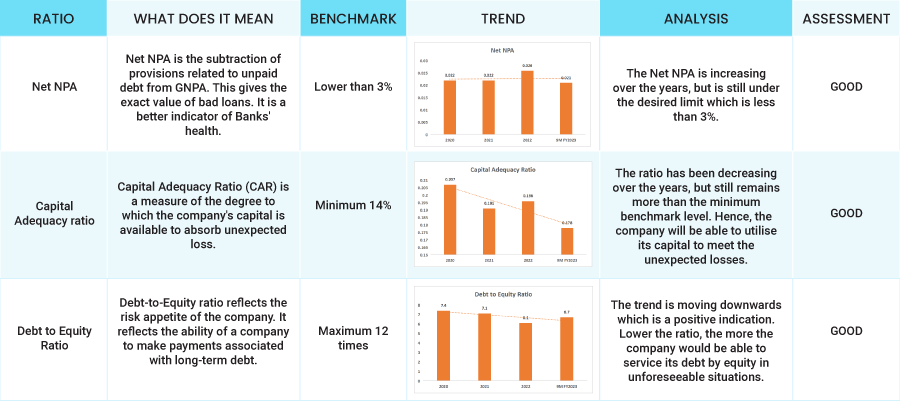

Ratio Analysis

Issue analysis

Pros

- The NCD is AA+ rated security with a stable outlook.

- The coupon rate is between 8.39% to 8.60% which is much higher than FDs.

Cons

- Net NPA has been very close to the limit set by the authorities

Liquidity

With cash and liquid investments of Rs. 7408 crores as of December 2022 and Rs. 2708 crores in unused bank lines, CIFCL maintains a healthy level of on-balance sheet liquidity;

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Cholamandalam Investment and Finance Company Limited;

CIFCL, founded in 1978, is the financial services arm of the Murugappa group, headquartered in Chennai. Vehicle finance (64%) and HE loans (21%) are the company’s two main business segments. Small and medium enterprise (SME) loans and housing loans make up the majority of the portfolio’s remaining loans. CIFCL has entered three new business sectors—CSEL, SBPL, and SME—within the consumer and SME ecosystem. It will be interesting to see how these areas perform and how they fit into the overall portfolio. As of 3QFY23, the Cholamandalam Finance Holdings Limited and Ambadi Investments Ltd group businesses held 45.4% and 4.1% of the Murugappa group’s 51.5% holding in CIFCL, respectively.

Strengths

- Well-diversified vehicle finance portfolio (3QFY23: 64.3% of assets under management (AUM), FY22: 68.8%; FY21: 72%)

- A significant player in the loan against property (LAP) segment (3QFY23: 20.9% of AUM) and has increased its focus on small ticket LAP loans

- Linkages with the Murugappa group, which, through its group entities, holds a 51.49% stake in CIFCL

Weakness

- Given that CIFCL is a service-oriented company, its direct exposure to environmental hazards and severe physical climate concerns is minimal. Through their asset portfolio, lending institutions may be indirectly exposed to environmental concerns; 64% of CIFCL’s portfolio is allocated to financing vehicles.

Invest in Bond IPO online in just 5 minutes

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Cholamandalam NCD IPO November 2023 | 8.60% | 500 cr | IND AA+ Stable, ICRA AA+ Stable | November 28, 2023 | December 11, 2023 | More Details |

| Cholamandalam NCD IPO July 2023 | 8.25% | 500 cr | IND AA+ Stable, ICRA AA+ Stable | July 28, 2023 | August 10, 2023 | More Details |

| Cholamandalam NCD IPO April 2023 | 8.40% | 500 cr | IND AA+ (Stable) / ICRA AA+ (Stable) | April 25, 2023 | May 9, 2023 | More Details |