Yield more than 8% |‘AA’ rated by CRISIL & BWR | Minimum investment amount is 10 K

IIFL Home Loans is a Housing Finance Company that has been awarded as ‘Best Affordable Housing Finance Company of the Year’ by Economics Times in February 2020. IIFL Home Loans is issuing NCDs. The base issue size is 100 Crores, and it can be stretched up to 1000 Crores. The NCDs will be issued in eight series. The coupon rate ranges between 8.20% p.a and 8.75% p.a. They come with different tenures such as 36 months, 60 months, and 84 months. The IPO opens on December 8 and closes on December 28. These NCDs are senior and secured. These are AA rated by CRISIL and BWR. Catalyst Trusteeship Limited is the Debenture Trustee and Link In Time India Private Limited is the Registrar of the issue. The IPO may close before December 28 if oversubscribed.

Apply Now

| Issuer | IIFL Home Finance Limited |

| Type of instrument | Secured, redeemable, non-convertible debentures |

| Seniority | Senior |

| Listing | The NCDs will be listed on BSE and NSE within 6 working days from the issue closing date |

| Issue Size | Base size- Rs. 100 Crores (aggregating up to Rs. 1000 Crores) |

| Issue Price | Rs. 1000 per NCD |

| Minimum Investment | Rs. 10,000 |

| Issue Opening Date | December 08, 2021 |

| Issue Closing Date | December 28, 2021 (*with an option of early closure) |

| Mode of Application | ASBA only |

| Mode of Issuance | Dematerialized only |

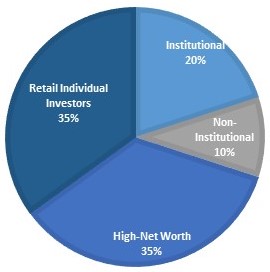

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the allocation ratio for IIFL NCD-IPO.

What are the coupon rates for retail, HNIs, institutional & non-institutional investors?

| Series | Frequency | Tenure | Coupon Rate | Yield |

| I | Annual | 36 Months | 8.25% | 8.24% |

| II | Cumulative | 36 Months | NA | 8.25% |

| III | Monthly | 60 Months | 8.20% | 8.51% |

| IV | Annual | 60 Months | 8.50% | 8.50% |

| V | Cumulative | 60 Months | NA | 8.50% |

| VI | Monthly | 84 Months | 8.43% | 8.76% |

| VII | Annual | 84 Months | 8.75% | 8.74% |

| VIII | Cumulative | 84 Months | NA | 8.75% |

Issue Analysis

Pros

- The coupon rate ranges between 8.2% and 8.75% P.A., which is more than the FD rate.

- These NCDs are secured and senior

- These AA-rated by CRISIL and BWR

Cons

- BWR’s rating indicated a negative outlook. According to BWR the ratings of these NCDs may come down in near future.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About the Issuer

IIFL Home Loans Limited is a Housing Finance Company registered with National Housing Bank. The company is offering financial products like mortgage loans to retail and corporate customers. It provides Housing Loans and Loans Against property. IIFL Home Loans Limited was incorporated in 2009. It is a wholly-owned subsidiary of IIFL Finance Limited. The company is headquartered in Gurgaon. It has established 125 branches and 2377 touchpoints in the country. IIFL Home Loans Limited has employed more than 2000 people. Mr.Monu Ratra is the Chief Executive Officer at IIFL Home Loans Limited.

Strengths

Unique Business Model

The company is operating via several branches and touchpoints; hence, its affordable financial solutions have efficiently reached Tier II and Tier III cities.

Superior Asset Quality

The company’s advanced credit appraisal tools and analysis techniques help to reduce non-performing-assets and maintain asset quality.

Capitalizing on Technology

![]()

The company can render a good customer experience and reduce operation cost turn-around time by adopting the latest technology.

Effective Risk Management

IIFL has a systematic risk management policy and system to identify and mitigate risk.

IIFL has a systematic risk management policy and system to identify and mitigate risk.

Sound Corporate Governance Policies

![]()

The company has been maintaining high business standards, and it is adhering to Corporate Governance Policies.

Extensive Distribution Footprint

![]() The distribution network has enabled the company to reach the vast population in India.

The distribution network has enabled the company to reach the vast population in India.

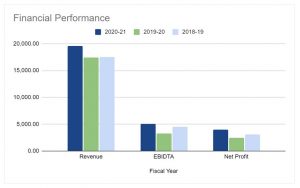

The year 2020-21

Financial Performance

*Rs In Millions

Weaknesses

- Because of lockdown, the income from retail loans also has reduced considerably. Pandemics may continue to impact the company’s revenue.

- The company has grown substantially in the past few years; hence it is challenging to maintain the same growth rate.

- Home loans and MSME loans have long tenure and have limited seasoning so far.

Awards and Recognitions

Invest in Bond IPO online in just 5 minutes

You can invest in IPOs via GoldenPi in 3 easy steps.

IPOs are facilitated by entities called Lead Managers. Generally, these lead managers are brokerage firms. Investors need to apply for IPO through lead managers, and once the allotment is made, investors will receive the bond units in their Demat account.

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than 10 lakhs

If the investment amount is less than 10 lakhs, retail investors can apply for an IPO online in three simple steps.

- Select the product- Visit GoldenPi.Com and go to the collection page. Visit the IPO section and choose the issuing company. The product page provides information such as a coupon, yield, maturity, and payment frequency. The product page also displays credit rating and issuer details that help investors to make an appropriate decision.

- Decide Investment Amount – Decide the amount you want to invest. You need to select the series and the number of units you want to purchase. The calculator displays the total investment amount.

- Pay via UPI– Now provide UPI handle. You will receive a mandate in the UPI app. Go to the respective UPI app and make payment by approving the mandate.

If the investment amount is more than 10 Lakhs –

A.Fill up the form with the required information.

B.Take a photo of your form and share it with your Relationship Manager for bidding on exchange.

C.Courier the filled up IPO form to our office address as early as possible. The issue closes on the 28 th of December 2021. The earlier you send it, the better it is.

Our Address: IndiQube Orion, Ground Floor,

24th Main Road, Garden Layout, Sector 2,

HSR Layout, Bangalore, Pincode: 560102

IPO allotment

IPO will be allotted to you on a first-come, first-serve basis and credited to your Demat account.

Dos and Don’ts of IIFL Home Loan NCD IPO

- Every individual can submit only one IPO application.

- The Demat account must be active.

- After applying for an IPO, you can not change your contact details such as email id and cell number until allotment.

- If you are paying via UPI, then the UPI mandate must be accepted within 48 hours.

Apply Now

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| IIFL FINANCE LTD. NCD IPO – JUNE 2023 | 9% | 300 cr | CRISIL AA Stable, ICRA AA Stable | June 9, 2023 | June 22, 2023 | More Details |

| IIFL NCD IPO January 2023 | 9% | 1000 cr | ICRA, CRISIL AA (Stable) | January 6, 2023 | January 18,2023 | More Details |

| IIFL NCD IPO December 2021 | 8.75% | 100 cr | BWR, CRISIL AA | December 8, 2021 | December 28, 2021 | More Details |

| IIFL NCD IPO September 2021 | 8.75% | 1000 cr | CRISIL AA (Stable) | September 27, 2021 | October 18, 2021 | More Details |

| IIFL NCD IPO July 2021 | 10.03% | 100 cr | CRISIL AA | July 06, 2021 | July 28, 2021 | More Details |