High Yield | AA-Rated | Minimum Investment: 10,000 only

High coupon rates, varying tenures, secure investment, and low investment are all necessary.

Why Edelweiss Financial Services Limited is issuing the Non-Convertible Debentures?

Edelweiss Financial Services issues NCDs to allow funds for corporate growth, debt control, and working capital requirements at good interest rates, which is good for both the company and the investors.

Edelweiss Financial Services Limited is issuing the Non-Convertable Debentures. These Edelweiss NCD are AA-rated by CRISIL and ACUITE. The Edelweiss NCDs are being issued in ten series: coupon ranges from 8.75% to 9.70% p.a. and different tenures of 2 years, 3 years, 5 years, and 10 years. The NCDs are secured and redeemable in nature.

Apply Now

| Issuer | Edelweiss Financial Services Limited |

| Type of instrument | Secured redeemable non-convertible debentures |

| Listing | The NCDs shall be listed on the BSE Limited (Stock Exchange)

Within 6 working days of issue closure. |

| Issue Size | The base issue size is Rs. 200 cr can aggravate up to 500 cr |

| Issue Price (in Rs.) | Rs. 1000 per NCD |

| Minimum Investment (in Rs.) | 10,000 |

| Issue Opening Date | December 6, 2021 |

| Issue Closing Date | December 22, 2021 |

| Mode of Issuance | Public Issue |

| Mode of trading | Dematerialized only |

| Debenture Trustee | Beacon Trusteeship Limited |

| Registrar of the issue | KFin Technologies Private Limited |

Coupon rates and effective yield for each of the series

| Series | Frequency | Tenure | Coupon Rate | Yield |

| I | Annual | 24 Months | 8.75% | 8.75% |

| II | Cumulative | 24 Months | NA | 8.75% |

| III | Monthly | 36 Months | 8.75% | 9.10% |

| IV | Annual | 36 Months | 9.10% | 9.09% |

| V | Cumulative | 36 Months | NA | 9.10% |

| VI | Monthly | 60 Months | 9.15% | 9.54% |

| VII | Annual | 60 Months | 9.55% | 9.54% |

| VIII | Cumulative | 60 Months | NA | 9.55% |

| IX | Monthly | 120 Months | 9.30% | 9.70% |

| X | Annual | 120 Months | 9.70% | 9.69% |

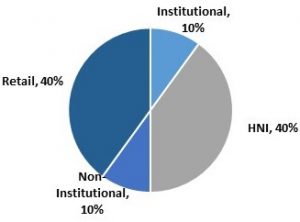

Allocation Ratio for Edelweiss NCD

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for EFSL NCD-IPO.

Edelweiss NCD: Issue analysis

Pros

- These NCDs are and secured by the assets of the company providing an additional layer of protection to your investment.

- These are senior securities

- The issuer is offering high coupon rates.

- These NCDs are AA-rated. AA-rated NCDs are considered investment-grade securities.

Cons

- Macroeconomic conditions such as COVID have negatively impacted the company. However, these conditions are gradually improving.

- After the IL&FS crisis, the investors’ sentiment towards NBFCs has been dampened. The point to be noted here is that the bigger NBFCs like Edelweiss have earned brand equity; hence investors may show interest in Edelweiss.

- Though these NCDs are AA-rated outlook is negative hence market demand for these NCDs may reduce making them slightly illiquid.

- These NCDs are subordinates: during insolvency subordinate, NCDs are paid after senior NCDs.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About EFSL

Edelweiss Financial Services Limited(EFSL), also known as Edelweiss Group, is an investment and financial services company with a net worth of Rs. 85.41 Billion and serving 1.2 million clients.

Business Verticals:

- Credit (Retail, Corporate)

- Investment & Advisory (Wealth Management, Asset Management)

- Insurance (Life, General)

Strengths

Weakness

Promoters’ shareholding has been decreasing.

Invest in Bond IPO online in just 5 minutes

Investment Process

IPOs are facilitated by entities called Lead Managers. Generally, these lead managers are brokerage firms. Investors need to apply for IPO through lead managers, and once the allotment is made, investors will receive the bond units in their Demat account.

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is more than 10 Lakhs –

A.Fill up the form with the required information.

B.Take a photo of your form and share it with your Relationship Manager for bidding on exchange.

C.Courier the filled up IPO form to our office address as early as possible. The issue closes on the 22nd of December 2021. The earlier you send it, the better it is.

Our Address: IndiQube Orion, Ground Floor,

24th Main Road, Garden Layout, Sector 2,

HSR Layout, Bangalore, Pincode: 560102

If the investment amount is less than 10 lakhs

If the investment amount is less than 10 lakhs, retail investors can apply for an IPO online in three simple steps.

- Select the product- Visit GoldenPi.Com and go to the collection page. Visit the IPO section and choose the issuing company. The product page provides information such as a coupon, yield, maturity, and payment frequency. The product page also displays credit rating and issuer details that help investors to make an appropriate decision.

- Decide Investment Amount – Decide the amount you want to invest. You need to select the series and the number of units you want to purchase. The calculator displays the total investment amount.

- Pay via UPI– Now provide UPI handle. You will receive a mandate in the UPI app. Go to the respective UPI app and make payment by approving the mandate.

IPO allotment

IPO will be allotted to you on a first-come, first-serve basis and credited to your Demat account.

Dos and Don’ts of Edelweiss NCD IPO

- Every individual can submit 5 IPO applications.

- The Demat account must be active.

- After applying for an IPO, you can not change your contact details such as email id and cell number until allotment.

- If you are paying via UPI, then the UPI mandate must be accepted within 48 hours.

Apply Now

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Edelweiss Financial Services Limited NCD IPO – January 2024 | 10.45% | 250 cr | CRISIL A+ Stable | January 9, 2024 | January 22, 2024 | More Details |

| Edelweiss Financial Services Limited NCD IPO – October 2023 | 10.45% | 100 cr | CRISIL AA- Negative | October 6, 2023 | October 19, 2023 | More Details |

| Edelweiss NCD IPO July 2023 | 10.46%% | 300 cr | CRISIL & ACUiTE AA- (Negative) | July 4, 2023 | July 17, 2023 | More Details |

| Edelweiss NCD IPO April 2023 | 10.46%% | 200 cr | CRISIL & ACUiTE AA- (Negative) | April 6, 2023 | April 21, 2023 | More Details |

| Edelweiss NCD IPO January 2023 | 10.46%% | 400 cr | CRISIL & ACUiTE AA- (Negative) | January 3, 2023 | January 25, 2023 | More Details |

| Edelweiss NCD IPO October 2022 | 10.10% | 400 cr | CRISIL & ACUiTE AA- (Negative) | October 3, 2022 | October 17, 2022 | More Details |

| Edelweiss NCD IPO July 2022 | 9.95% | 300 cr | CRISIL AA- & ACUiTE AA (Negative) | July 5, 2022 | July 26, 2022 | More Details |

| Edelweiss NCD IPO April 2022 | 9.70% | 300 cr | CRISIL AA- & ACUiTE AA (Negative) | April 6, 2022 | April 26, 2022 | More Details |

| Edelweiss NCD IPO December 2021 | 9.70% | 200 cr | CRISIL AA- & ACUiTE AA (Negative) | December 6, 2021 | December 22, 2021 | More Details |

| Edelweiss NCD IPO August 2021 | 9.70% | 400 cr | CRISIL AA- & ACUiTE AA (Negative) | August 17, 2021 | September 6, 2021 | More Details |

| Edelweiss NCD IPO April 2021 | 9.70% | 2000 cr | ACUiTE AA | April 1, 2021 | April 23, 2021 | More Details |

Key Takeaways

- Discount rates range from 8.75% to 9.70% per year, depending on the series and tenure.

- CRISIL and ACUITE both grade it AA, showing that it is of high investment standard.

- Secured and redeemable debentures guaranteed by the company’s assets.

- Various tenures are provided (2 years to 10 years) to accommodate different investment goals.

- Edelweiss Financial Services is a well-known financial service that focuses on growth and working capital needs with these returns.

FAQs About Edelweiss NCD IPO

Q. What is the minimum investment required for the Edelweiss ncd ipo in dec 2021?

The minimum investment for the Edelweiss ncd ipo in dec 2021 is ₹10,000, with additional investments that multiply from one NCD.

Q. Are the Edelweiss NCDs secured or unsecured investments?

The Edelweiss Non-Convertible Debentures (NCDs) are secured investments, which means they are supported by the company’s assets, providing additional security for investors.

Q. How does Edelweiss Financial Services Limited plan to utilize the funds raised through the NCD issue?

Edelweiss Financial Services Limited seeks to use the funds raised from the NCD offering for lending, financing, repayment of interest and principal on existing borrowings, and general corporate purposes.

Q. What is the best ncd to invest 2021?

The best NCD to invest in 2021 is Muthoot Finance NCD Tranche II, which has the best interest rates and an AA+/Stable rating, which indicates minimal risk and higher returns.

Q. What are the do’s and don’ts that investors need to follow when applying for the Edelweiss NCD IPO?

Apply online, submit correct information, and follow SEBI guidelines. Do not give wrong information, beyond the investment limit, or ignore the offer materials and risk statements.