|

Getting your Trinity Audio player ready...

|

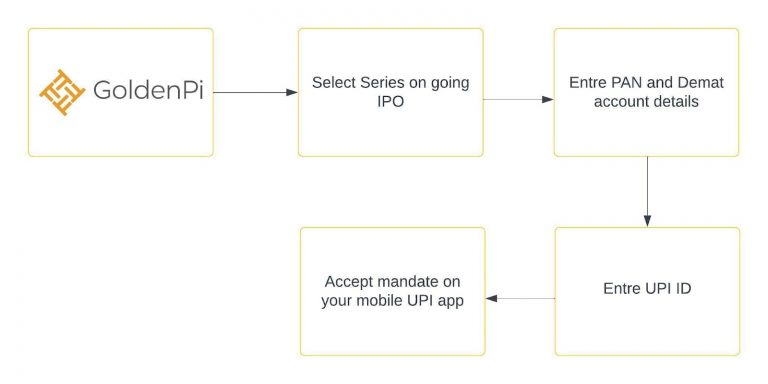

High Yield | A/Stable rated | Minimum Investment: 10k Only

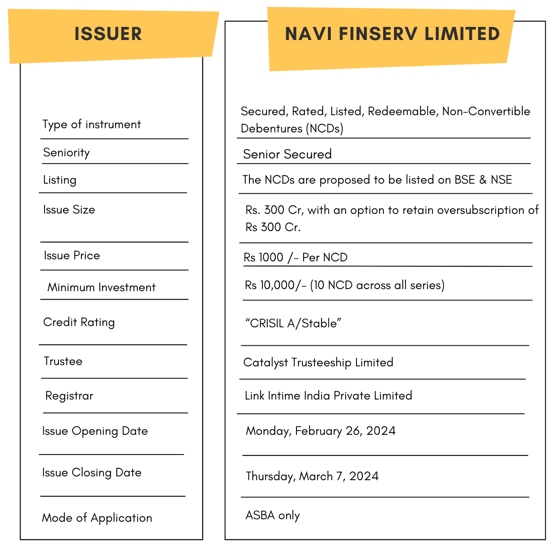

Navi Finserv Limited is issuing the Non-Convertible Debentures. These NCDs are A/Stable rated by CRISIL. The NCDs are being issued in five series: coupon ranges from 10% to 11.19% p.a. and different tenures of 18, 27 and 36 months. The NCDs are secured and redeemable in nature.

NAVI FINSERV PVT. LTD. NCD IPO: Coupon rates and effective yield for each of the series

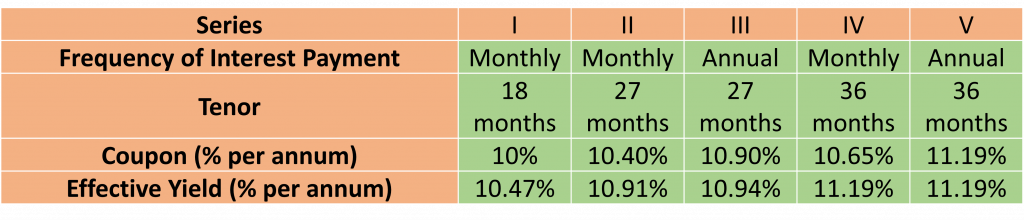

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for NAVI NCD-IPO.

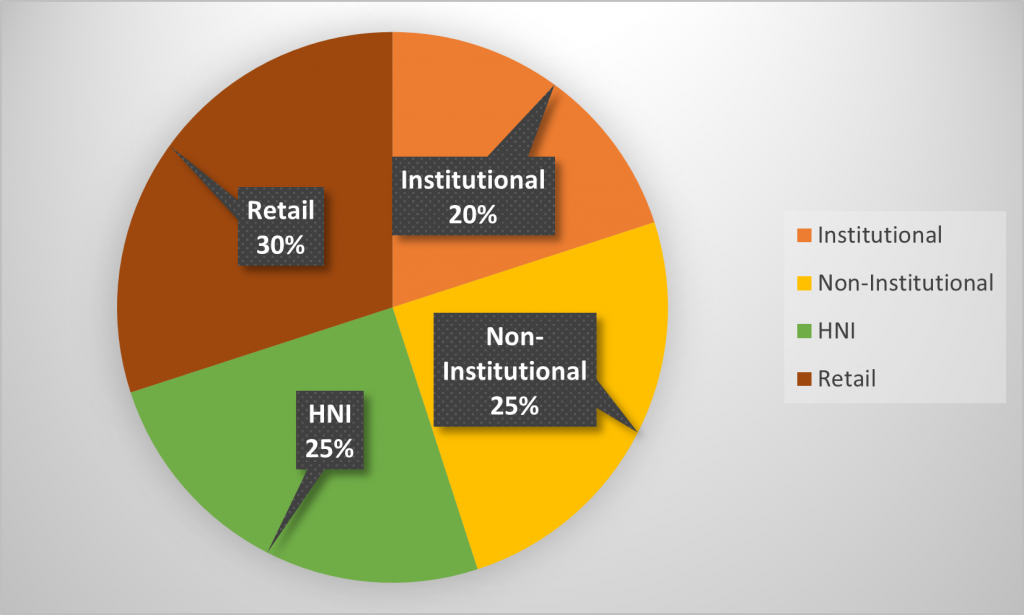

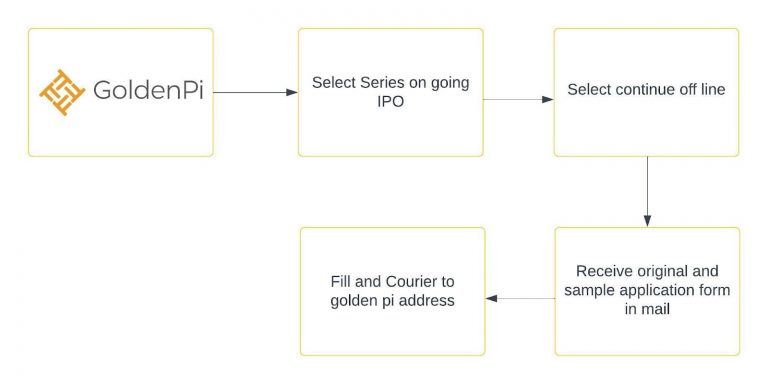

Investment Process for NAVI FINSERV PVT LTD NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

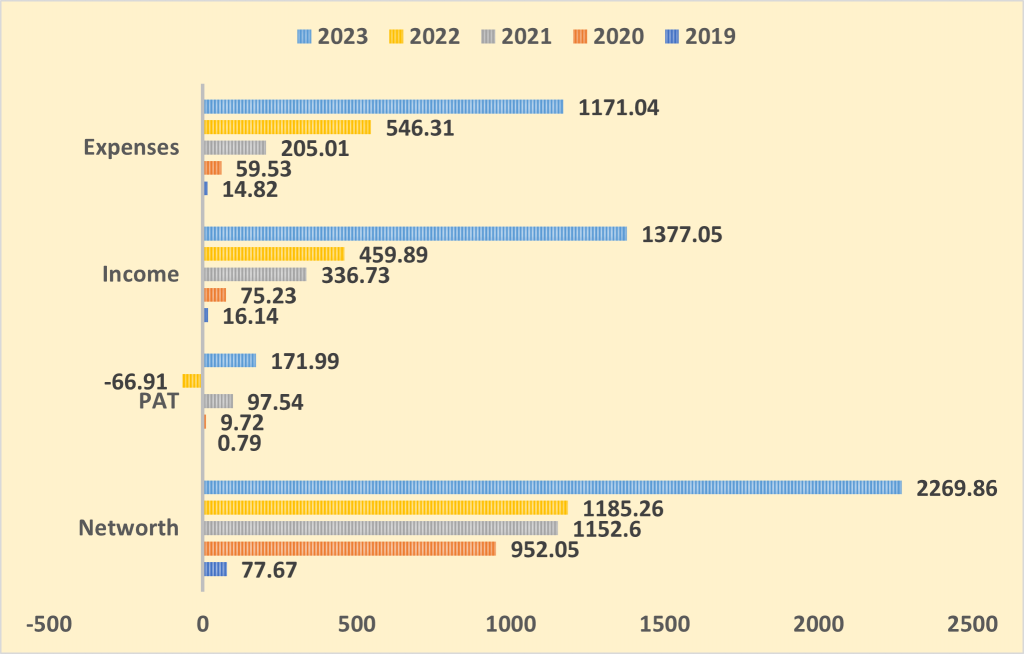

Financial Overview

Snapshot stating the Income, Expenses, Networth and PAT

(Amount in Rs. Crore)

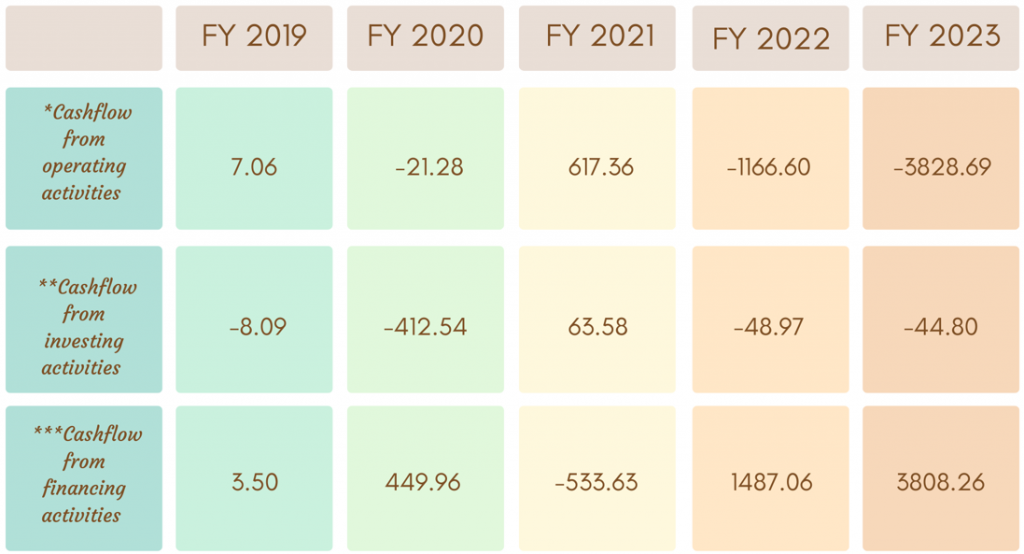

Cash flow for last 5 years

(Amount in Rs. Crore)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

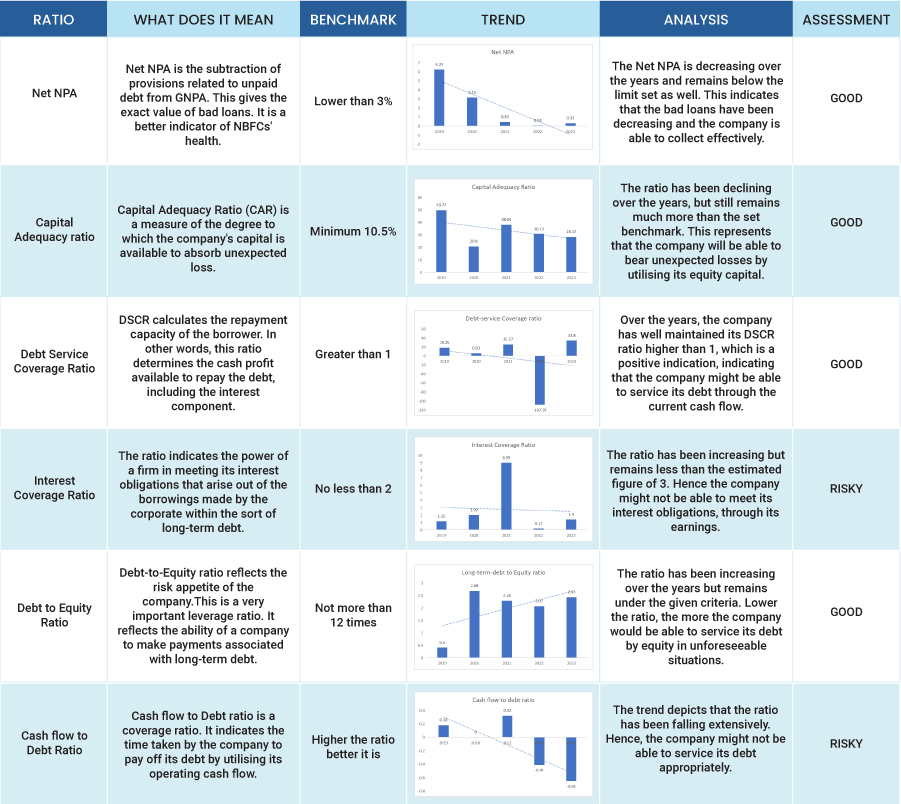

Ratio Analysis

Issue analysis

Pros

- These are secured securities.

- The issuer is offering high coupon rates, when compared with FD rates.

- These NCDs are A rated with a stable outlook. A rated NCDs are considered investment-grade securities.

Cons

- Constrained regional presence

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Navi Finserv Private Ltd.

Navi Finserv Private Ltd, is a non-banking financial institution. Incorporated in 2012, NFPL is a fully owned subsidiary of the Navi Group. The company was set up by the founder and ex-promoter of Flipkart, Sachin Bansal and his friend Ankit Agarwal.

Business Verticals:

- Digital Personal Loans

- Home Loans

- Mutual Funds

- Health Insurance

- Micro-Loans

Strengths

- Robust Capitalization: Thanks to a substantial capital infusion of Rs 1,950 crore by Mr. Sachin Bansal in fiscal 2020 through NTL, NFL’s capitalization has significantly improved.

- Enhanced Asset Quality: NFL has seen a positive trend in asset quality over the past 2-4 quarters, overcoming pandemic-related challenges. This improvement is attributed to evolving risk management systems, notably the effectiveness of the Navi app and digital underwriting and monitoring models.

- Strengthened Resource Profile: NFL’s resource profile has been on an upward trajectory in recent years. The company’s lender base has expanded, with more banks onboarded, and the cost of borrowing has remained competitive following equity infusion in October 2019.

Weakness

- Steadily Improving Profitability: NFL’s profitability, though initially hampered by the pandemic, is on the rise. Fiscal 2022 saw a moderation in earnings due to increased credit costs and a sharp uptick in marketing expenses.

- Portfolio Vulnerability to External Factors: NFL’s digital personal loan portfolio, serving the prime middle class, is exposed to regulatory and macroeconomic risks. Events like mass layoffs and income loss pose significant threats.

- Limited Portfolio History: The digital personal loan portfolio has experienced remarkable growth, surging by 409% in fiscal 2022 to reach Rs 2,504 crore by March 31, 2022, and further climbing to Rs 8,707 crore by September 30, 2023, driven by substantial monthly disbursements.

Invest in Bond IPO online in just 5 minutes

Source – Prospectus February 9, 2024

Disclaimer – The information is published as on date 22/02/2024 based on information available on Prospectus February 9, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Navi Finserv NCD IPO July, 2023 | 11.01% | 500 cr | CRISIL A Stable, IND A Stable | July 10, 2023 | July 21, 2023 | More Details |

| Navi Finserv NCD IPO May 2022 | 9.80% | 600 cr | IND A (Stable) | May 23, 2022 | June 10, 2022 | More Details |