|

Getting your Trinity Audio player ready...

|

High Yield | A/Stable rated | Minimum Investment: 10k Only

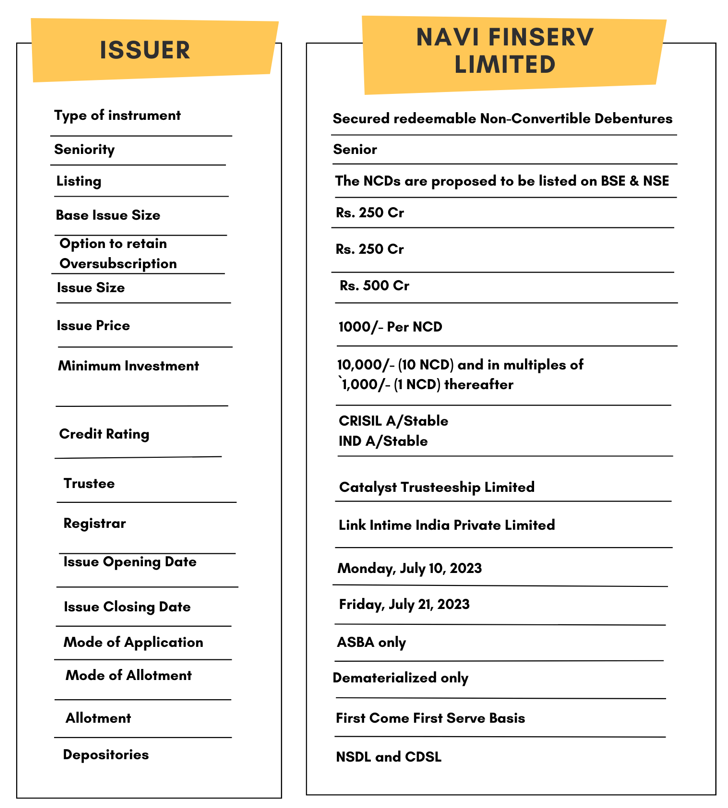

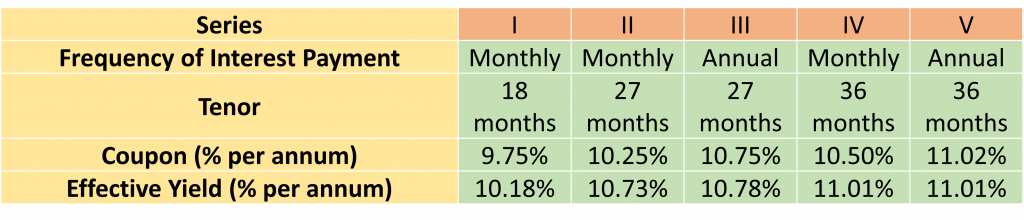

Navi Finserv Limited is issuing the Non-Convertible Debentures. These NCDs are A/Stable rated by India Ratings and CRISIL. The NCDs are being issued in five series: coupon ranges from 9.75% to 11.01% p.a. and different tenures of 18, 27 and 36 months. The NCDs are secured and redeemable in nature.

NAVI FINSERV PVT. LTD. NCD IPO: Coupon rates and effective yield for each of the series

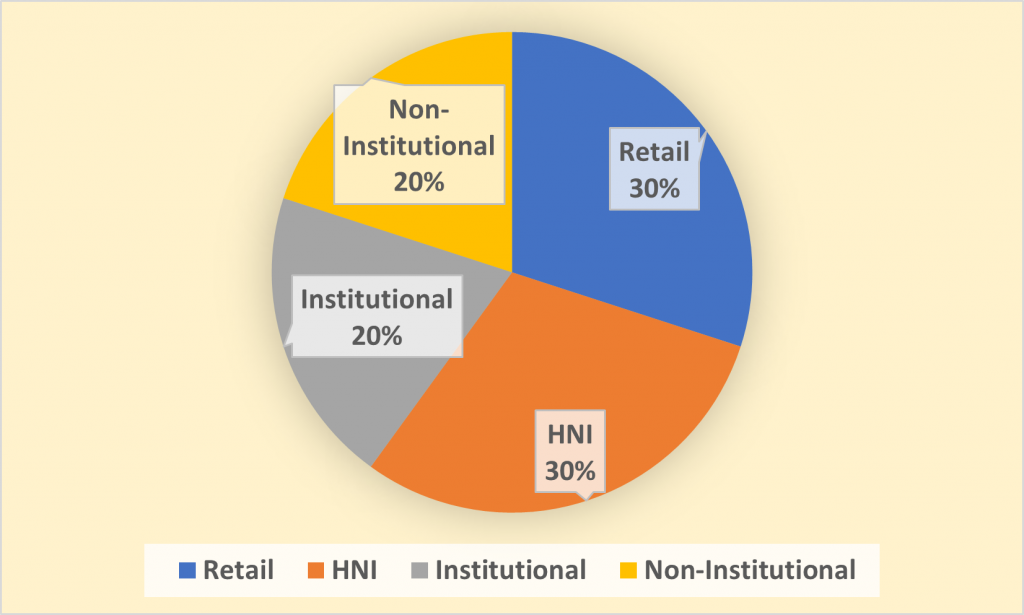

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for NAVI NCD-IPO.

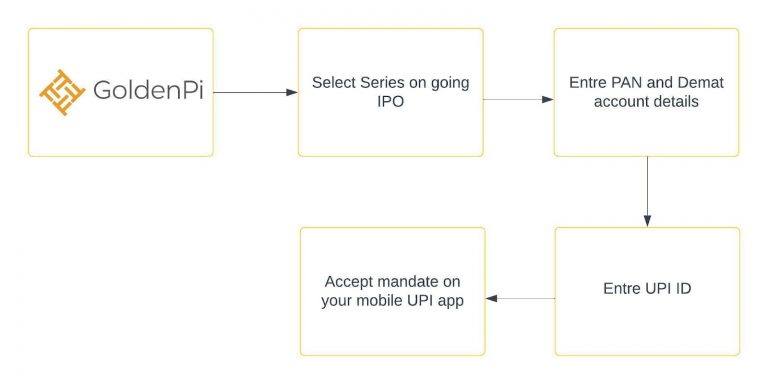

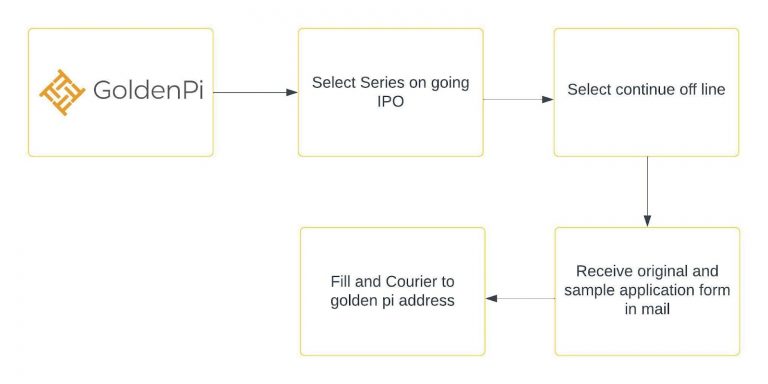

Investment Process for NAVI FINSERV PVT LTD NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

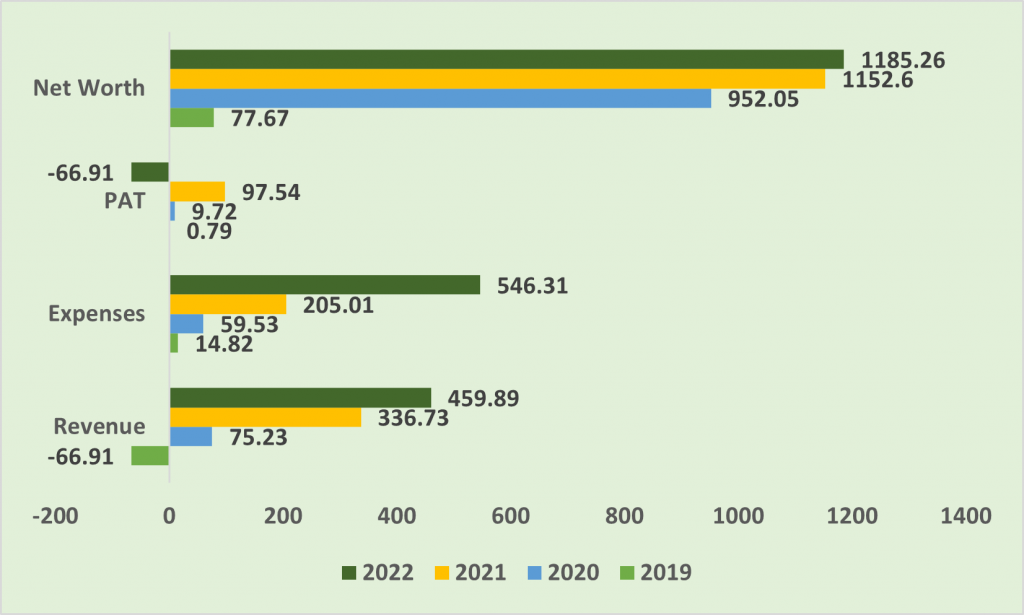

Financial Overview

Snapshot stating the Revenue, Expenses, EBIT, Net Worth and PAT

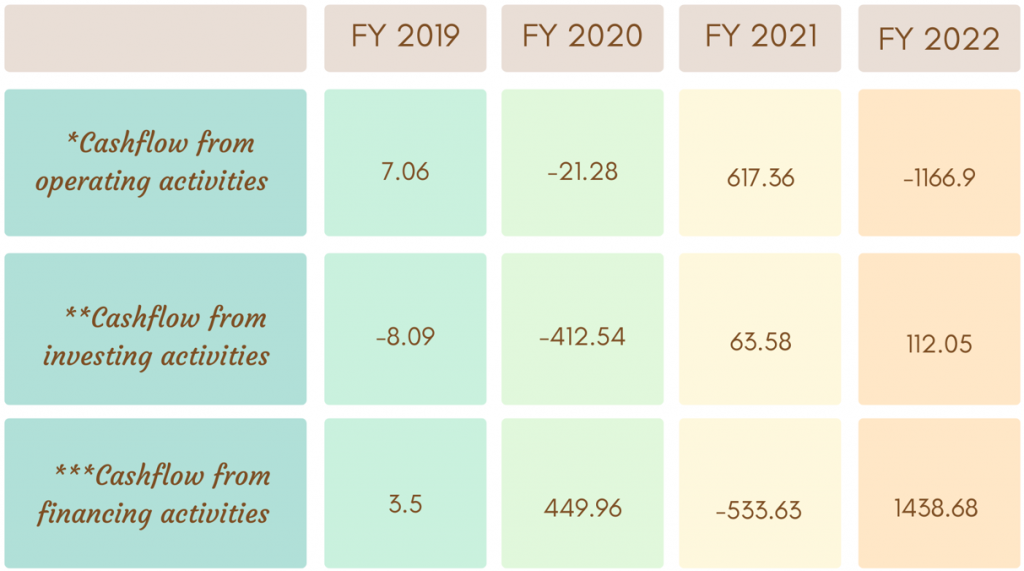

Cash flow for last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

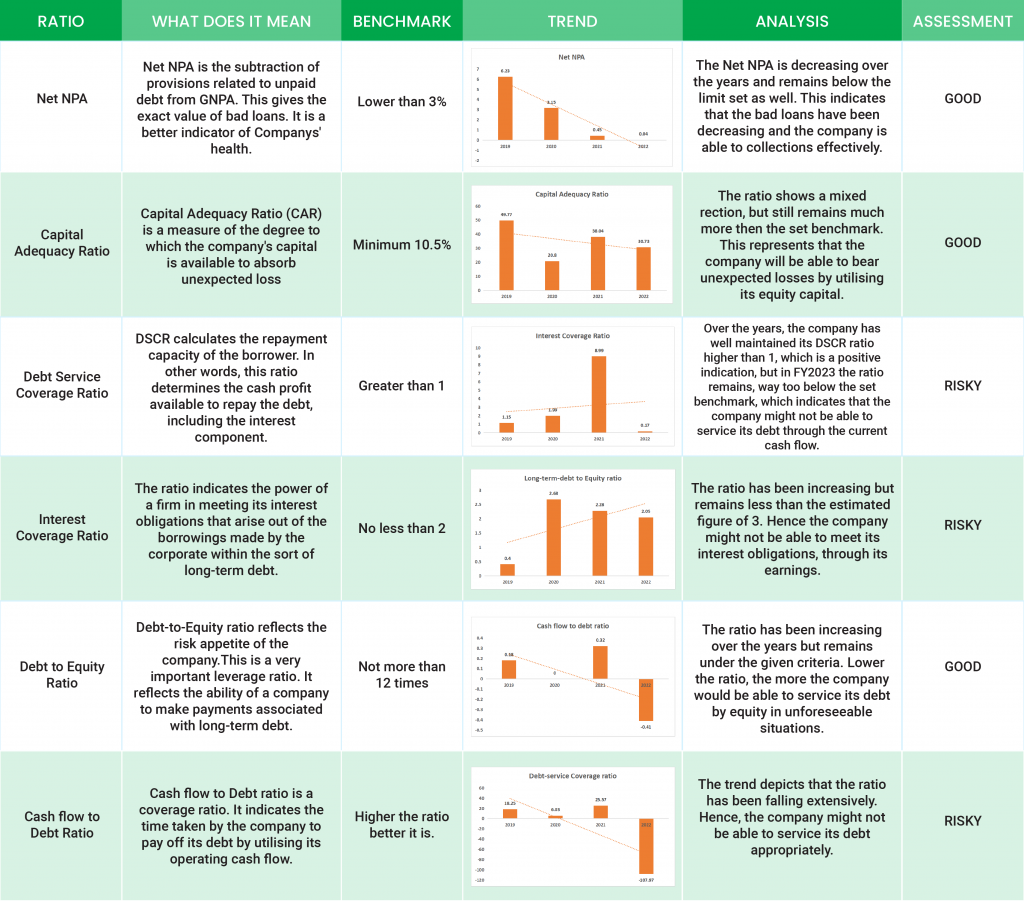

Ratio Analysis

Issue analysis

Pros

- These NCDs have a security cover of 110% which is equivalent to the total outstanding principal, all interest due and to be paid thereon.

- These are secured securities.

- The issuer is offering high coupon rates, when compared with FD rates.

- These NCDs are A rated with a stable outlook. A rated NCDs are considered investment-grade securities.

Cons

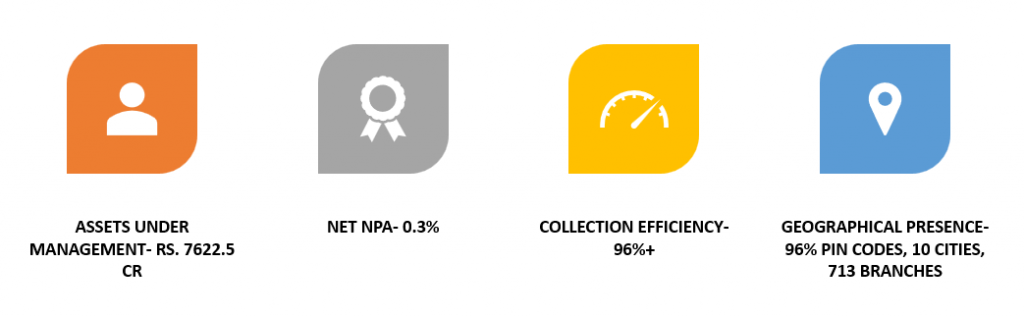

- Constrained regional presence

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Navi Finserv Limited

Navi Finserv Ltd, is a non-banking financial institution. Incorporated in 2012, NFPL is a fully owned subsidiary of the Navi Group. The company was set up by the founder and ex-promoter of Flipkart, Sachin Bansal and his friend Ankit Agarwal.

Business Verticals:

- Digital Personal Loans

- Home Loans

- Mutual Funds

- Health Insurance

- Micro-Loans

FY 2023

Strengths

- Strong leadership backed by experienced management team and high corporate governance standards

- Long term focus on utilising technology and data science capabilities

- Better customer engagement and experience through Navi App

- Leveraging Navi’s integrated ecosystem for synergies and cross-sell opportunities

Weakness

- Weak Operating Parameters

- Regional Constrains

Invest in Bond IPO online in just 5 minutes

SOURCE: All of the information in this blog post was compiled from the Navi Public Issue Presentation and the Prospectus, dated June 30, 2023.

DISCLAIMER: Investment in debt securities are subject to risks. Read all the offer related documents carefully. This blog should not be construed as financial advice or as an offer or recommendation to buy or sell any security or any products/services of GoldenPi or any product/services of its third party client(s).

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Navi Finserv NCD IPO July, 2023 | 11.01% | 500 cr | CRISIL A Stable, IND A Stable | July 10, 2023 | July 21, 2023 | More Details |

| Navi Finserv NCD IPO May 2022 | 9.80% | 600 cr | IND A (Stable) | May 23, 2022 | June 10, 2022 | More Details |