|

Getting your Trinity Audio player ready...

|

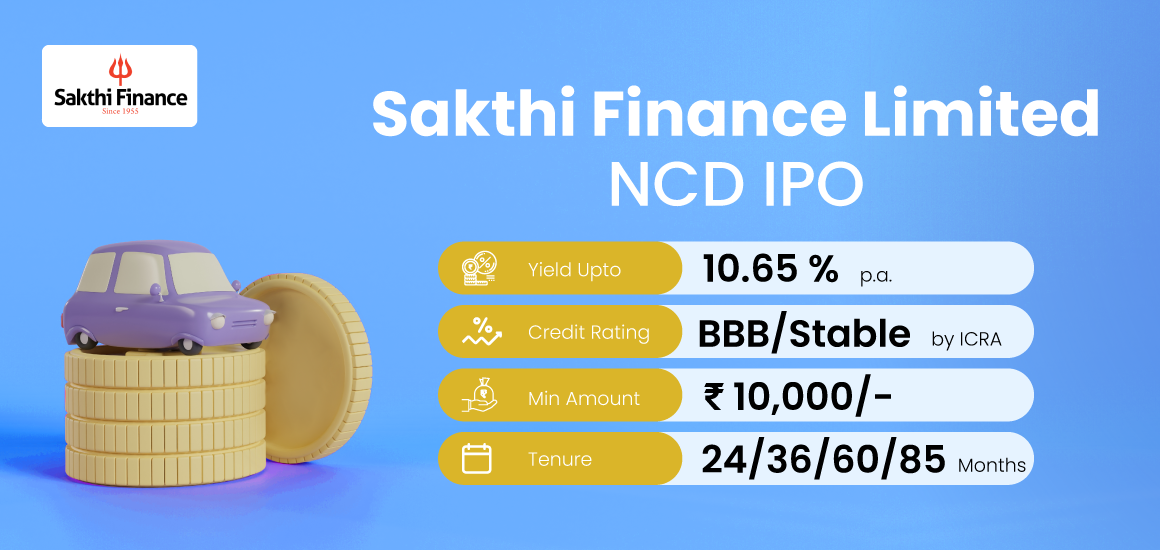

High Yield | BBB /Stable Rated | Minimum Investment: 10k Only

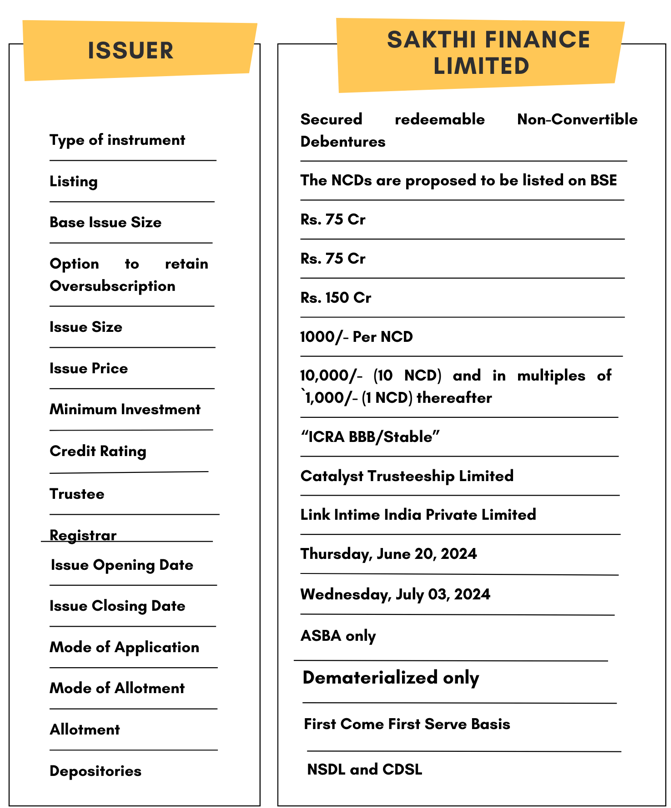

Bond overview

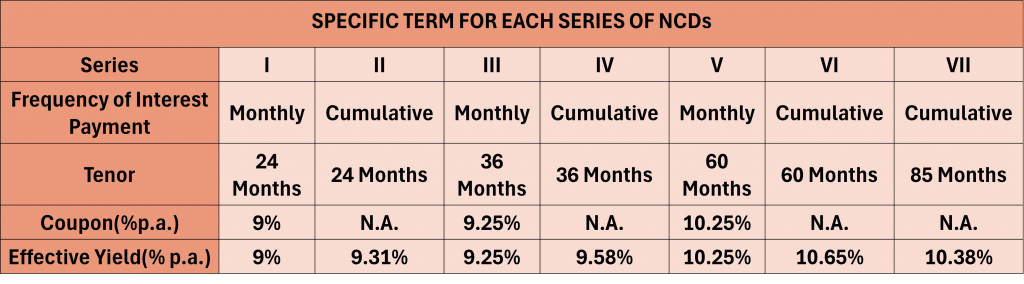

Sakthi Finance Limited is issuing the Non-Convertible Debentures. These NCDs are BBB/Stable rated by ICRA. The NCDs are being issued in seven series: coupon ranges from 9% to 10.25% p.a. and different tenures of 24 months, 36 months, 60 months and 85 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

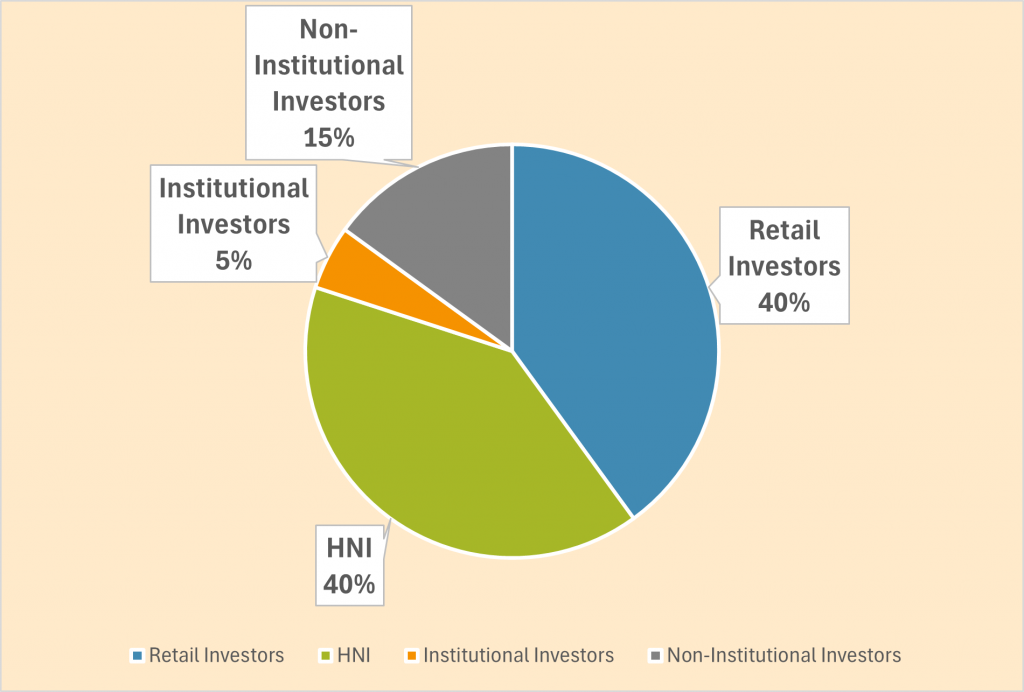

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Sakthi Finance Limited NCD-IPO.

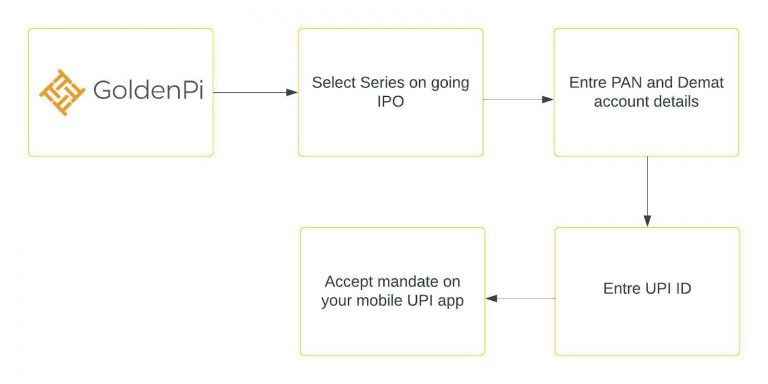

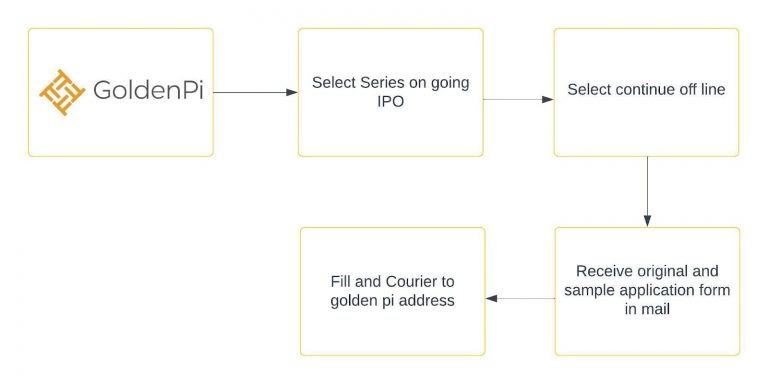

Investment Process for Sakthi Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

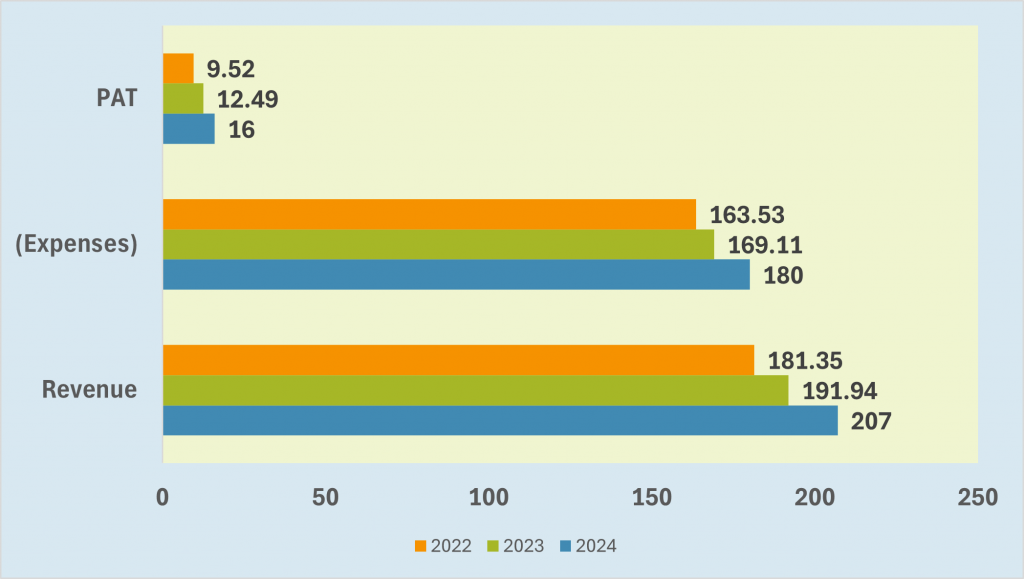

Financial Overview

Snapshot stating the Revenue, Expenses, PAT (In crores)

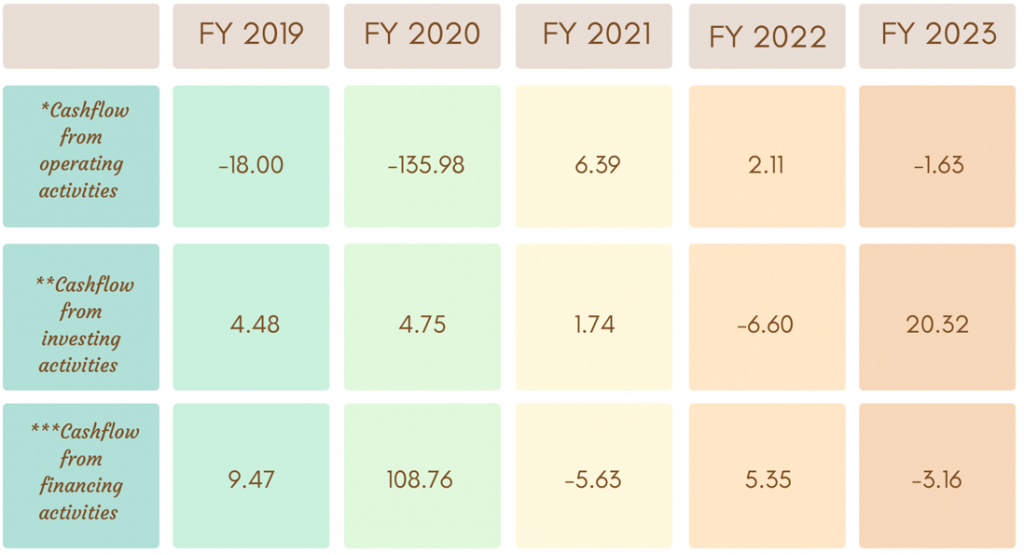

Cash flow for last 5 years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

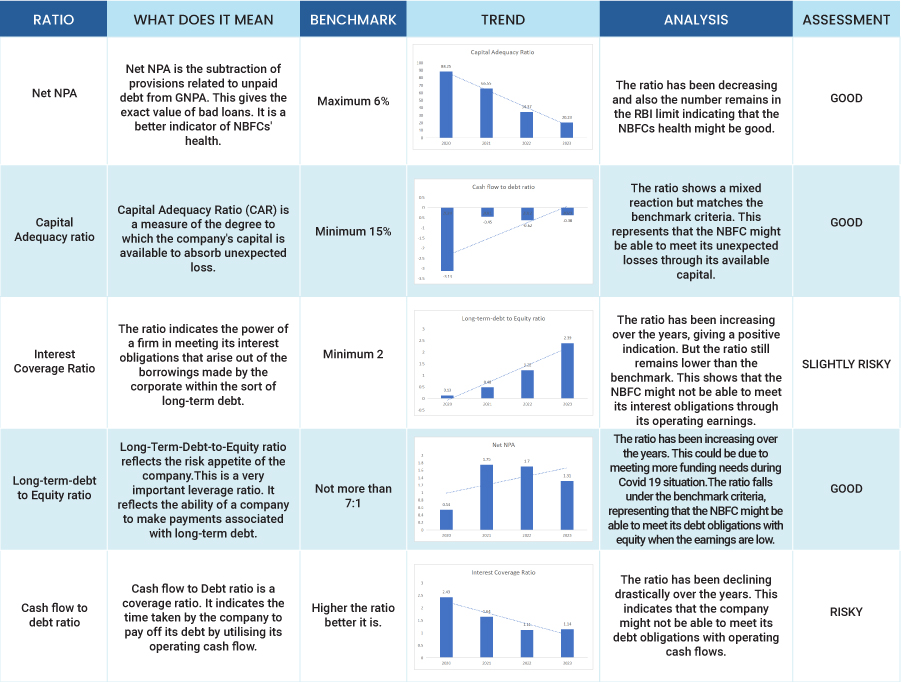

Ratio Analysis

Issue analysis

Pros

- The NCD is BBB rated security with a stable outlook, which falls under investment grade category.

- The yield offered is upto 10.65% which is much higher than many traditional fixed-income investments like FDs.

- The company maintains a good Capital Adequacy Ratio, indicating that it has a sufficient capital buffer to absorb unexpected losses.

- Sakthi Finance Limited maintains adequate capitalization with plans to reduce gearing below 6.0 times, ensuring controlled growth and improved financial stability.

Cons

- The NBFCs operations are primarily focused within a specific geographic region, with South India accounting for 95% of its activities.

- Despite recent improvements, Sakthi Finance Limited’s profitability remains subdued with increasing operating costs.

Liquidity

Sakthi Finance Limited has a strong liquidity profile with unencumbered cash and liquid investments of 66.8 Crores as of 31st March,2024.The upcoming public issuance of NCDs in June 2024 is expected to further enhance its liquidity profile.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Sakthi Finance Limited

Sakthi Finance Limited is an Asset Finance Company within the NBFC sector, established in 1955 in Pollachi, Tamil Nadu. Sakthi Finance was started with the intent of catering to the hire purchase requirements of the TELCO dealerships of the Sakthi Group. The company now offers financing for purchasing assets like commercial vehicles, construction equipment, and machinery. Apart from that, the company also accepts deposits from the public and offers bonds and debentures at attractive rates to investors.

The company has a strong presence in southern states like Kerala,Tamil Nadu and Andhra Pradesh accounting for more than 95% of the market share in these areas. More than 96% of the revenue comes from Interest Income and rest is covered through commission income and sale of power from windmills. Sakthi Finance and one of its group companies Sakthi Sugars both are listed on the Stock Exchange.

Strengths

- Strong regional experience: Over 60 years in vehicle finance across 4 South Indian states.

- Mobilized– Raised Rs. 200 crore debt with strong retail investor participation.

- Diversified Portfolio: The company offers financing for a variety of assets such as commercial vehicles, construction equipment, and machinery, catering to diverse customer needs.

- Real-Time Monitoring: Utilizing a workflow management system in most branches allows Sakthi Finance to monitor sourcing and collection activities in real-time, enhancing operational efficiency and risk management.

Weakness

- Regional concentration: 95% of portfolio in Tamil Nadu and Kerala, limiting geographic diversification.

- Economic Sensitivity: Sakthi Finance’s business performance may be sensitive to macroeconomic factors such as interest rates, inflation, and overall economic growth, potentially affecting loan demand and credit quality.

- Subdued profitability: Profit margins historically low, showing modest improvement recently.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus June 13 , 2024

Disclaimer- The information is published as on date 18/06/2024 based on information available on Prospectus June 13,, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors