High Yield | AA/Stable | Minimum Investment: 10k Only

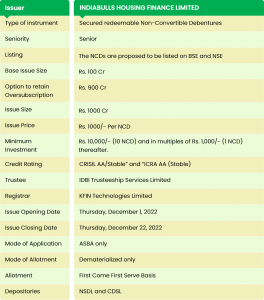

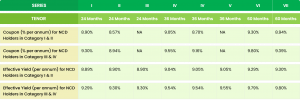

India’s third-largest Housing Finance Company, Indiabulls Housing Finance Limited is issuing AA/Stable rated NCDs from 1st December 2022. They are being issued in eight different series. The coupon ranges between 8.57% and 9.55% which is much higher than FD rates. They come with different tenures such as 2 years, 3 years, and 5 years. The present bondholders or equity shareholders of Indiabulls are considered Primary Holders. In this IPO, Primary holders will be incentivized by a maximum of 0.25% p.a. This incentive applies only to Retail and HNI categories. The issue will close on 22 December 2022.

IBHFL NCD IPO: Coupon Rates and Effective Yield for each of the Series

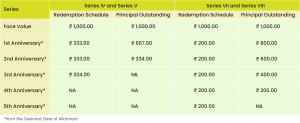

Principal Redemption Schedule and Redemption Amounts

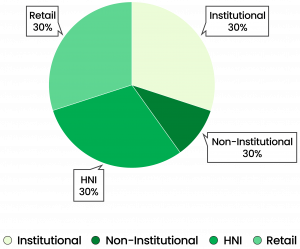

Allocation Ratio

The allocation ratio of IBHFL NCD IPO is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for IBHFL NCD-IPO.

Financial Overview

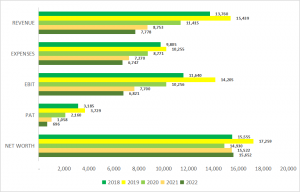

Snapshot stating the Revenue, Expenses, EBIT and PAT (tabular format)

(All Values are in Rs. Cr.)

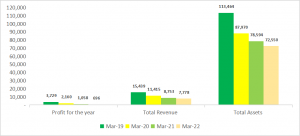

Cash flow last 5 years

(All Values are in Rs. Cr.)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

*Cash flow from operating activities reflects the amount a company generates through its product of services.

**Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

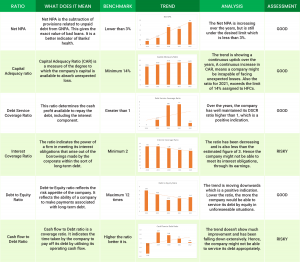

Ratio Analysis

Issue Analysis

Pros

- The NCDs are AA/Stable rated securities. AA/Stable-rated securities fall into the category of investment grade hence underlying credit risk is assumed to be quite low.

- The coupon rate is between 8.57% to 9.55% which is much higher than (3 to 4%) higher than FD rates.

- Few of the series are secured by the company’s assets.

- In this IPO, Primary holders will be incentivized by a maximum of 0.25% p.a.

- Indiabulls has made a strong presence in India with 130 branches and 8000+ channel partners that can efficiently manage to execute new growth strategies.

- The company is agile in adopting technology to reduce costs and reach the untapped market.

Cons

- All of the series are not secured.

- The company’s revenue has been decreasing for the past 3 years.

- Loan books are less seasoned because of pandemics.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Indiabulls Housing Finance Limited

Indiabulls Housing Finance Limited (IBHFL) was founded in 2005. It is headquartered in New Delhi, India. It is the third-largest housing finance company regulated by National Housing Bank. IBHFL is part of the Indiabulls group: IBHFL leads 80% of the group turnover. IBHFL is operating via 125 branches in 92 cities in India. IBHFL has made its presence in the United Kingdom and the United Arab Emirates. Mr. Gagan Banga is leading the IBHFL team as Managing Director of the company.

CRAR for 9M FY22 – 31.2%

Loan disbursed- Rs. 2.84 lakh Cr

Customer base – 10 Lakh +

Number of branches- 130

Number of channel partners- 8000

9M FY 2022

Net NPA- 1.80%

Balance Sheet- Rs. 82,285 Cr

Net Worth- Rs. 16,405 Cr

Asset Under Management- Rs. 73,914 Cr

Loan Book- Rs. 60,979 Cr

Borrowings- Rs. 55,361 Cr

PAT – Rs. 303 Cr

Financial Performance

Pandemic has hit the company’s performance hence annual revenue has reduced. The company is agile in adopting technology. It has an end-to-end digitized home loan. With the help of digital assets, the company is trying to make a presence in tier-3 and tier-4 locations.

Strengths

- Strong Capital Adequacy

- Low Gearing

- Healthy Liquidity & Matched ALM

- Stable Asset Quality

Key Points

- Since September 2018, the debt of almost 88,000 crores has been serviced on a gross basis.

- Net gearing has decreased from levels of 7x to under 3x.

- On target to cut the wholesale book in half by December 22 and by 33% by March 22 [on numbers from March 21]

- No new, distinct structured arrangements are necessary for the creation of liquidity. 45% of the investment for structured capital from deals that were finalised a year ago. Proof of the reliability and availability of wholesale loan assets.

- As additional books begin to be added, net gearing will stabilise between 2 and 2.5 times. will stay steady at these levels as an additional business is conducted using an approach that prioritises light assets.

Invest in Bond IPO online in just 5 minutes

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Indiabulls NCD IPO March 2024 | 10.75% | 200 cr | CRISIL AA Stable, ICRA AA Stable | March 5, 2024 | March 19, 2024 | More Details |

| Indiabulls NCD IPO September 2023 | 10.75% | 100 cr | CRISIL, ICRA AA (Stable) | September 6, 2023 | September 20, 2023 | More Details |

| Indiabulls NCD IPO October 2023 | 10.75% | 100 cr | CRISIL AA Stable, ICRA AA Stable | October 20, 2023 | November 3, 2023 | More Details |

| Indiabulls NCD IPO July 2023 | 10.14% | 200 cr | CRISIL, ICRA AA (Stable) | July 10, 2023 | July 21, 2023 | More Details |

| Indiabulls NCD IPO April 2023 | 10.50% | 100 cr | CRISIL, ICRA AA (Stable) | April 5, 2023 | April 19, 2023 | More Details |

| Indiabulls NCD IPO March 2023 | 10.30% | 200 cr | CRISIL AA Stable, ICRA AA Stable | January 5, 2023 | January 7, 2023 | More Details |

| Indiabulls NCD IPO January 2023 | 10.30% | 200 cr | CRISIL, ICRA AA (Stable) | January 5, 2023 | January 27, 2023 | More Details |

| Indiabulls NCD IPO December 2022 | 9.55% | 1000 cr | CRISIL, ICRA AA (Stable) | December 1, 2022 | December 22, 2022 | More Details |

| Indiabulls NCD IPO September 2022 | 9.54% | 1000 cr | CRISIL, ICRA AA (Stable) | September 5, 2022 | September 22, 2022 | More Details |

| Indiabulls NCD IPO March 2022 | 9.26% | 200 cr | CRISIL, ICRA AA (Stable) | March 30, 2022 | April 22, 2022 | More Details |

| Indiabulls NCD IPO September 2021 | 9.75% | 1000 cr | CRISIL AA | September 6, 2021 | September 20, 2021 | More Details |