|

Getting your Trinity Audio player ready...

|

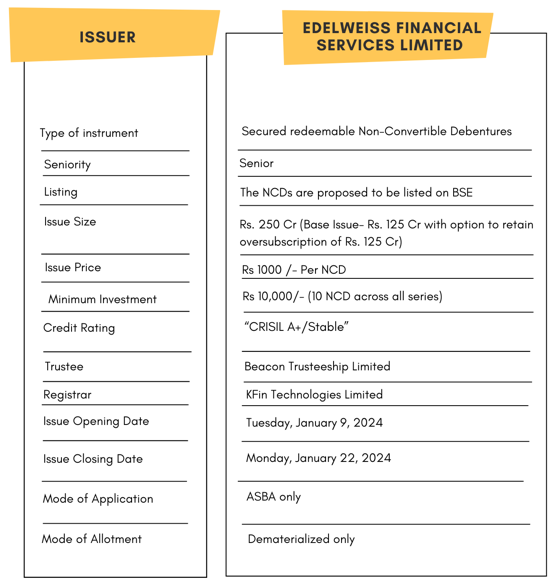

High Yield | A+/Stable Rated | Minimum Investment: 10k Only

EFSL NCD is giving the Non-Convertible Debentures.

Should you invest in edelweiss financial services NCD 2024?

Edelweiss ncd 2024 is offering secured NCDs with discount rates ranging from 8.95% to 10.45% yearly. The minimal investment should be ten thousand.

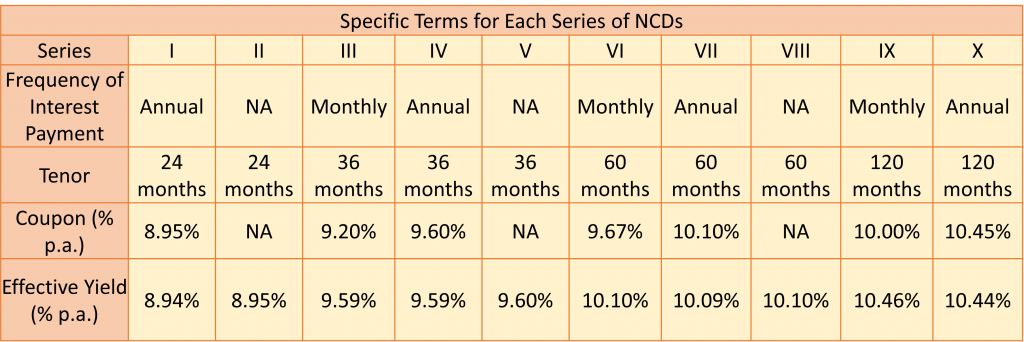

Edelweiss Financial Services Limited is issuing the Non-Convertible Debentures. These NCDs are A+/Stable rated by CRISIL. The NCDs are being issued in ten series: coupon ranges from 8.95% to 10.45% p.a. and different tenures of 24 months, 36 months, 60 months and 120 months . The NCDs are secured and redeemable in nature.

Edelweiss Financial Services Limited NCD IPO: Coupon rates and effective yield for each of the series

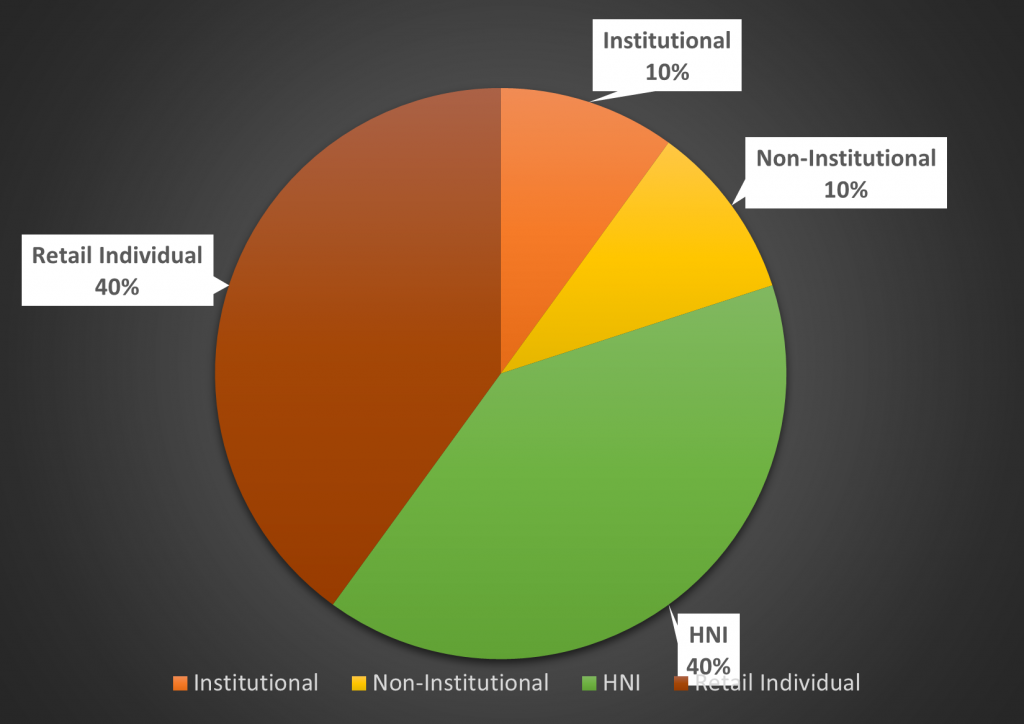

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Edelweiss Financial Services Limited NCD-IPO.

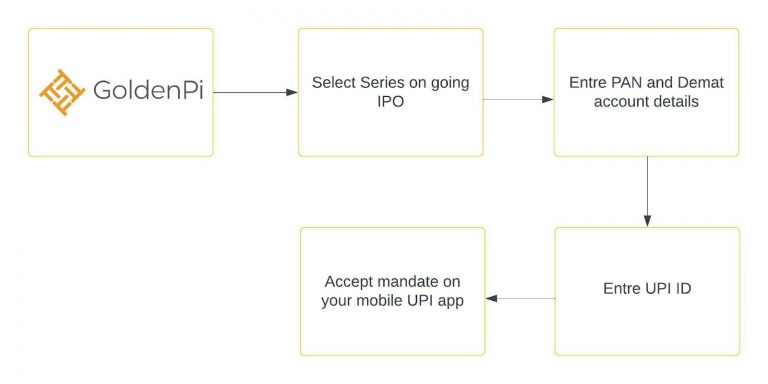

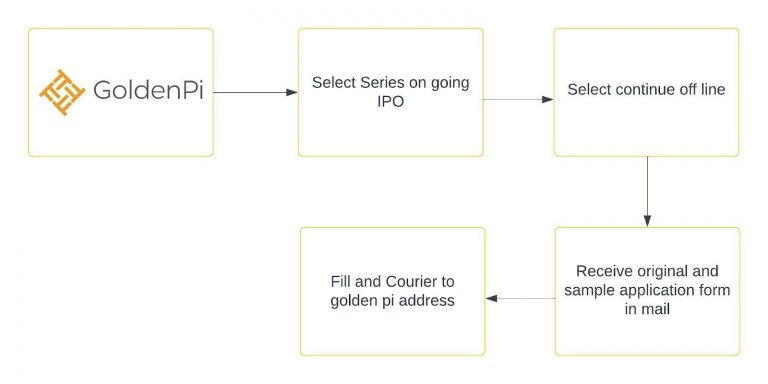

Investment Process for Edelweiss Financial Services Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

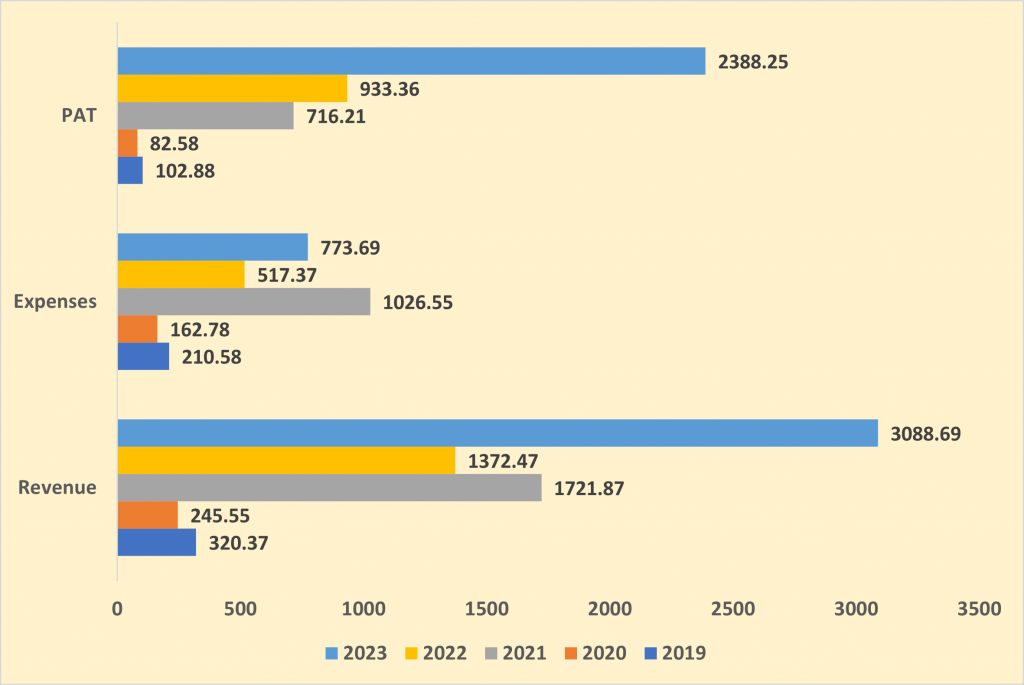

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

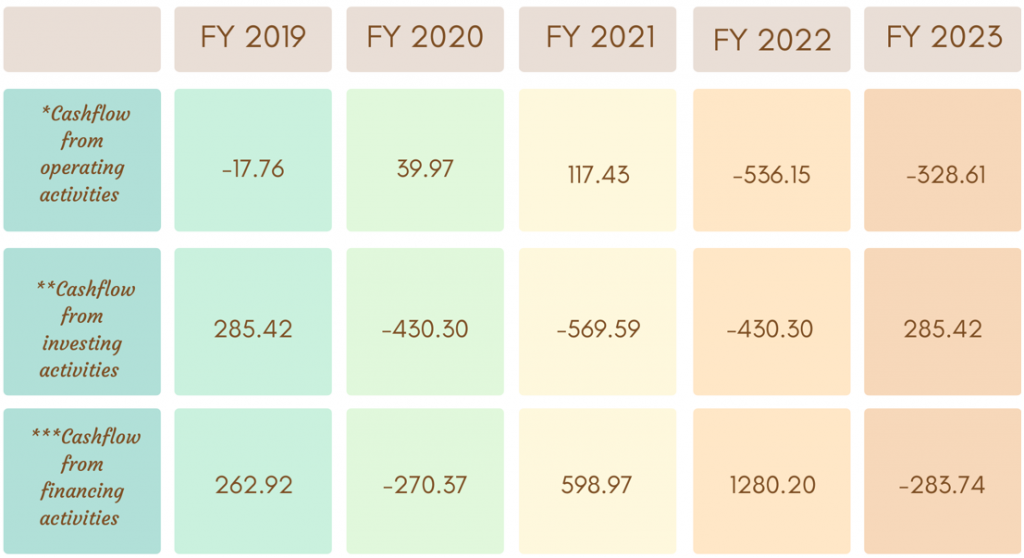

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

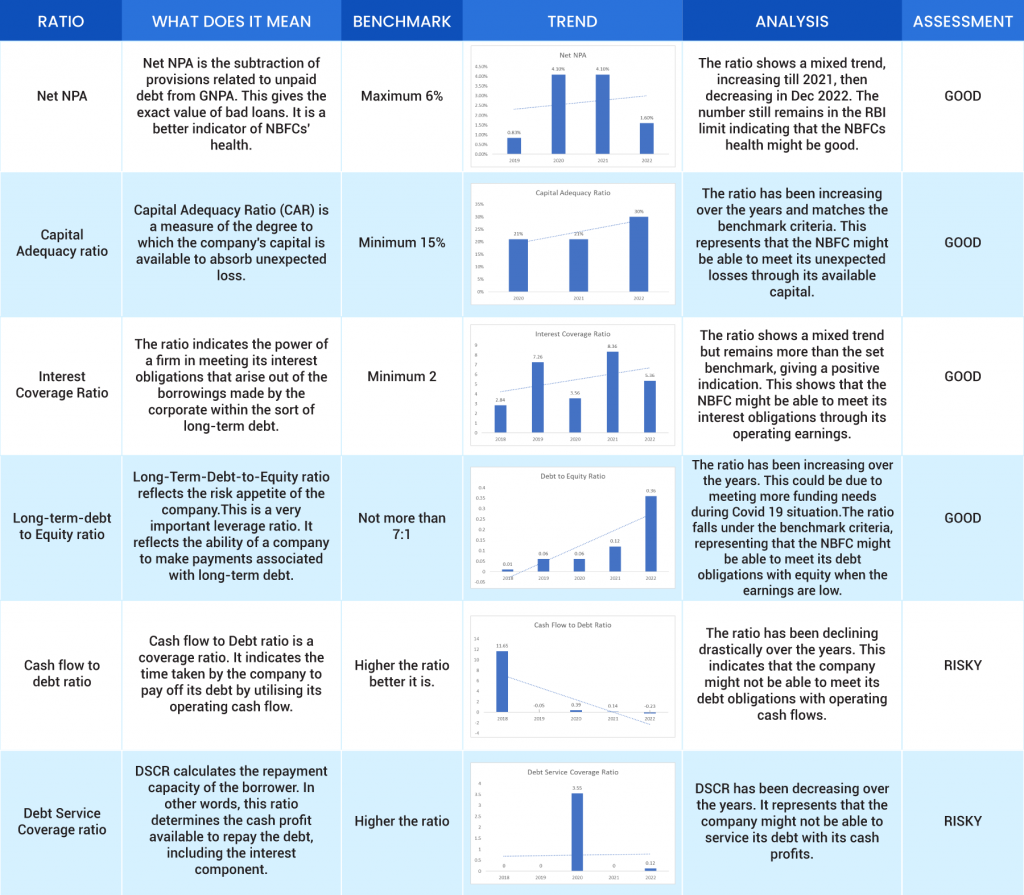

Ratio Analysis

Issue analysis

Pros

- These are secured securities.

- The issuer is offering high coupon rates, when compared with FD rates.

Cons

- Macroeconomic conditions such as COVID have negatively impacted the company. However, these conditions are gradually improving.

- The company is expected to face pressure as asset quality and profitability deteriorate.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Edelweiss Financial Services Limited

First-generation business owners founded Edelweiss Financial Services Limited (EFSL), the parent company of the Edelweiss Group of enterprises, in 1995 to provide investment banking services, especially to technology companies. The business is headquartered in Mumbai, India. Rashesh Shah and Venkat Ramaswamy jointly founded it.

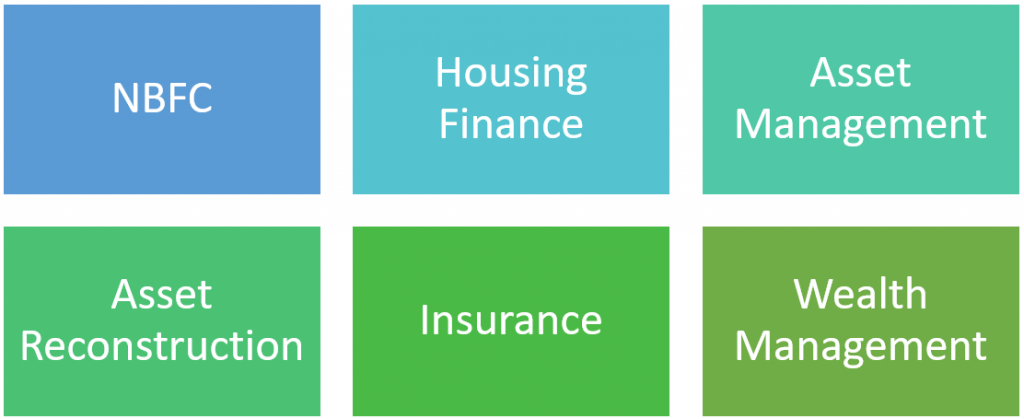

Business Verticals:

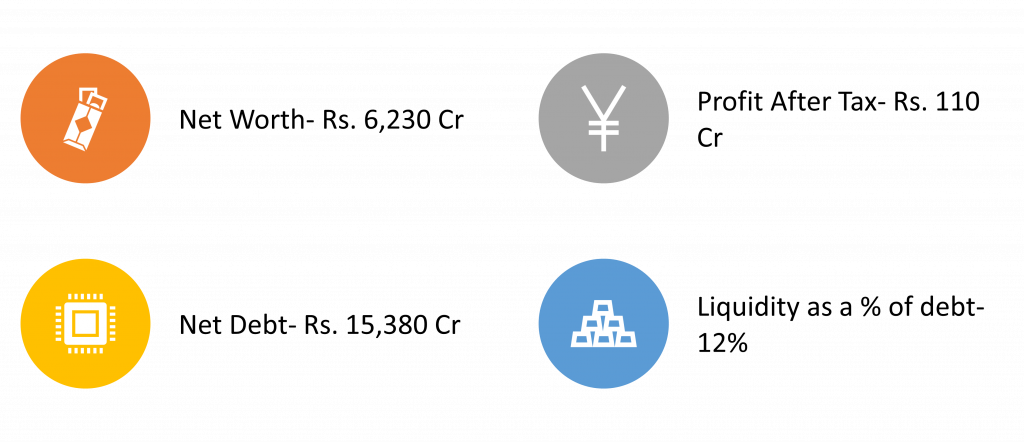

Quick walk through on Financials details for 2023

Strengths

- Balanced Capitalisation-Capital raised from global investors, and businesses.

- A diversified player with a variety of financial services and a track record of developing strong competitive positions across industries

Weakness

- Low Profitability.

- Negative Cash flow

Invest in Bond IPO online in just 5 minutes

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Edelweiss Financial Services Limited NCD IPO – January 2024 | 10.45% | 250 cr | CRISIL A+ Stable | January 9, 2024 | January 22, 2024 | More Details |

| Edelweiss Financial Services Limited NCD IPO – October 2023 | 10.45% | 100 cr | CRISIL AA- Negative | October 6, 2023 | October 19, 2023 | More Details |

| Edelweiss NCD IPO July 2023 | 10.46%% | 300 cr | CRISIL & ACUiTE AA- (Negative) | July 4, 2023 | July 17, 2023 | More Details |

| Edelweiss NCD IPO April 2023 | 10.46%% | 200 cr | CRISIL & ACUiTE AA- (Negative) | April 6, 2023 | April 21, 2023 | More Details |

| Edelweiss NCD IPO January 2023 | 10.46%% | 400 cr | CRISIL & ACUiTE AA- (Negative) | January 3, 2023 | January 25, 2023 | More Details |

| Edelweiss NCD IPO October 2022 | 10.10% | 400 cr | CRISIL & ACUiTE AA- (Negative) | October 3, 2022 | October 17, 2022 | More Details |

| Edelweiss NCD IPO July 2022 | 9.95% | 300 cr | CRISIL AA- & ACUiTE AA (Negative) | July 5, 2022 | July 26, 2022 | More Details |

| Edelweiss NCD IPO April 2022 | 9.70% | 300 cr | CRISIL AA- & ACUiTE AA (Negative) | April 6, 2022 | April 26, 2022 | More Details |

| Edelweiss NCD IPO December 2021 | 9.70% | 200 cr | CRISIL AA- & ACUiTE AA (Negative) | December 6, 2021 | December 22, 2021 | More Details |

| Edelweiss NCD IPO August 2021 | 9.70% | 400 cr | CRISIL AA- & ACUiTE AA (Negative) | August 17, 2021 | September 6, 2021 | More Details |

| Edelweiss NCD IPO April 2021 | 9.70% | 2000 cr | ACUiTE AA | April 1, 2021 | April 23, 2021 | More Details |

Key Takeaways

- Discount rates range from 8.95% to 10.45% p.a.

- Rated A+/Stable by CRISIL, it shows minimal credit risk.

- Available for 24, 36, 60, and 120 months.

- These EFSL NCD are safe and redeemable.

- Easy steps through an online application from GoldenPi.

- Impacted by COVID-19

- Impact on assets profitability.

FAQs About Edelweiss Financial Services Limited

1. How is the allocation ratio determined for the efsl ncd IPO?

The allocated ratio depends on SEBI rules, which were legalized before the IPO’s completion, ensuring an equal distribution between applicants.

2. How can retail investors apply for the Edelweiss Financial Services Limited NCD IPO online?

Retail investors can apply online using trusted platforms such as GoldenPi. Follow three simple steps to invest up to ₹10 lakhs as per SEBI rules.

3. What are the key details investors should be aware of before making an investment decision in january loan services limited?

Investors should check the AAA/Stable rating, a discount rate of 10.44%, a minimum investment of ₹10,000, and major risks aligned with NCDs.

4. What are the strengths and weaknesses of edelweiss ncd 2024 as highlighted in its financial overview?

Strengths include an AAA/Stable rating, a discount rate of 10.44%, and good credit.

Weaknesses include major risks, the probability of market interest rate changes, and low liquidity as compared to other investments.

5. Who are the founders of edelweiss financial services ncd 2024 and when was the company established?

Rashesh Shah and Venkat Ramaswamy founded Edelweiss Financial Services Limited. The corporation was founded on November 21, 1995.