India, one of the world’s fastest-growing economies – not just in terms of development but also as the second largest populated nation, has been lobbying hard with the large global bond indices to include Indian government bonds, particularly Government Securities (GSecs) in Global indices. According to a report published by Morgan Stanley, India’s government bonds are likely to gain inclusion in 2 global indices in 2022. JMP GBI-EM Global Diversified Index and Bloomberg Global Aggregate Index are the ones that will include Indian government bonds.

In this report, we are going to discuss the various impacts and implications of this inclusion on different sets of bodies, as well as will be talking about a few suggestions that can be implemented to make the situation more favorable.

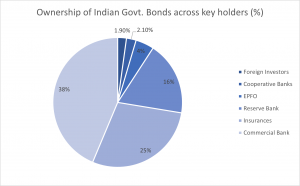

When compared with global Equity indices, India has a significant contribution thereby accounting for $655 billion in Foreign Portfolio Investment account. However, the number of Indian Government bond ownership by Foreign Portfolio Investors is just about $19 billion. In percentage terms, foreign ownership of Indian sovereign debt is 1.9% which is extremely low for an economy with a GDP of $2.75 trillion and market capitalization of $3.40 trillion.

Source- RBI

If you are new to bonds what can mystify you is not bonds but the language of bonds. To demystify bond terminologies, visit Bond Glossary.

WHAT DOES IT MEAN FOR THE INDIAN BOND MARKET?

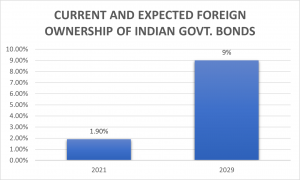

With India being included in the global indices, the foreign investments would increase into the Indian GSec Bond market. This supply will cause the yields to drop. But then, given that other developed economies like the United States and Japan, etc. offer around 1% yield on their sovereign bonds, the Indian GSec yields would still be higher. Over the next decade, foreign ownership of Indian government bonds will move up to 9%. India will also be the last major emerging market country to join the global bond indices. The forecast is that around 40 Billion US Dollars will enter India by the end of FY 2022. That’s just around the corner!

WHY INDIA NOW?

Despite economic progress being made by India on many fronts, there are regular challenges at both the worldwide and native levels—all of which have delayed the strengthening of the rupee against global currencies, especially the US dollar. But there has been a big change during this since 2013 once we were short on the exchange reserves front. Today, the nation’s fiscal deficit, also because of the accounting deficit, has inched lower. The political status of the country also seems to be perceived as stable by external investors. That makes our economy stronger in reality and also in the eyes of foreign investors. Also, the higher domestic yields (10-year GSec yields are 6.3ish % in November 2021) when compared with other countries earn an extra brownie point with these investment funds abroad.

Note :

Fiscal Deficit for a nation = Expense by nation – Earnings by the nation

Current Account Deficit = Expense on imports – Earnings from exports

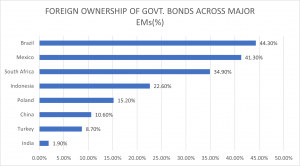

Source- IIFL

To know how NRIs can invest in Corporate Bonds, read our blog.

WHAT ARE THE IMPLICATIONS OF THIS GLOBAL-BOND-INDEX INCLUSION FOR INDIA?IMPACT ON DOMESTIC

A. YIELDS OF G-SECs AND GILT FUNDS

There could be a downward trend in the yields of these bonds because of increased inflows. With the inclusion of Indian bonds on the global indices, foreign investors who make their investments decisions as per the global benchmark will now move towards Indian bond markets for their investments. More demand for GSecs will lead to an increase in their market price. Simultaneously, yields will go down.

Note: Yield and bond price have an inverse relationship. If the yield goes up, the latter one goes down and vice-versa.

IMPACT ON RETAIL INVESTORS

Foreign capital infusion into the Indian GSec market will lead to an increase in the secondary liquidity in the debt market. For retail investors, the yields that they are enjoying now (GSec – 6.5% approx, AAA – 7% to 8.5% approx., AA – 8.5% to 10% approx, A – Above 10% approx.) will not sustain. Retail investors will be looking at yields that would be lower than these levels. However, the liquidity scenario for lower-rated papers (the lowest possible rating for a security to be considered investment grade like BBB- will improve. For institutional investors, they would be sitting on capital gains as the current price of their holdings would have gone up.

BOOST FOR GOVERNMENT BONDS

With the inclusion of Indian bonds in the global indices, Morgan Stanley estimates an inflow of $40 billion in the Indian govt. bonds in 2022/2023. Currently what India holds is even less than 2%. This would increase to approximately 9% in the next decade with its inclusion on global bond Indices. This event would increase the reachability of the Indian bonds to all foreign investors who would follow the indices for their investments. Also, as the markets influence the prices as and when the index adds new constituents, portfolios pegged to those benchmarks must adjust their allocations accordingly. It is estimated that with this local market inclusion, the yield curve could flatten by 50 basis points.

Source- RBI

BENEFITS TO CORPORATES

One of the major benefits to the corporates with Indian bonds inclusion will be towards their capital needs. Being Asia’s second-largest economy, India is performing below its set benchmarks in the Bond market. When compared with its GDP, it is as low as economies like Thailand. With its inclusion in the global bond indices, it would provide foreign investors with a larger pool of Indian Corporate issuers. Some of these Indian corporate issuers are still not properly rated in terms of credit. This would provide investors the opportunity to spot mispriced bonds. Also, more corporate institutions will access the bond market to raise funds thus leading to an increase in the number of issuers, fairness in pricing, and enhanced liquidity.

IMPACT ON THE RUPEE AND OUR NATION’S DEFICITS

As per an article by Bloomberg, India’s consolidated deficit is expected to shrink to 5% in 2029, by the inclusion of Indian bonds on the Global Bond indices. The current deficit is 14.4% in the fiscal year 2021. “The opening up indicates policy-makers desire to raise growth rates high through investment. It will push India’s balance of payments into a structural surplus zone, therefore creating an environment for a lower cost of capital and eventually be positive for growth” – says a senior executive of Morgan Stanley.

Inflows from foreign investors into the Indian bond market will help attain stability and strengthen the Indian Rupee. In exchange rate terms the Indian Rupee value can be stronger by 2% every year against other currencies. This is great news for us Indians. Why? Because we import most of our commodities by paying US dollars, such as Oil. With a stronger Indian rupee, we need to pay less in terms of US dollars. This will make oil imports cheaper for the nation. Consequently, the price of commodities in the market (all of which rise and fall with oil price) should get cheaper, all other factors remaining constant. Now, that’s a push down on inflation!

To take the advantage of increased inflows, it’s important that few structural changes take place sooner than later, some of them are listed below-

- The Government debt market should work similar to the Indian equity market. Foreign investment should not be restricted in the bond market, if needed there should be a certain percentage limit on foreign ownership. This will increase foreign participation as the bond market increases.

- There should be no distinction between asset classes be it in Government bonds or treasury bills. The limit for foreign investors to invest in the former one is $25 billion, whereas in the latter one is $5.5 billion. This should be eased out so that people will have the option to switch from long-term to short-term debt and vice-versa.

- Foreign investors face a major problem of complicated KYC. Hence, the current practice of submitting various documents should be simplified, so that more foreign investors can participate actively.

- Properly Justified tax clarification should be made for foreign asset managers who have set up their offices in India.

- For domestic financial development, participation by foreign investors in the bond-currency-derivative index is necessary. This will help achieve a deep and much-needed liquid bond market in India.

In a nutshell, the inclusion of Indian government bonds in the Global indices could leave a great effect on the Indian economy. This could help in building goodwill from the greater participation of foreign investors. This will also be helpful when India plans to raise billions of dollars for its infrastructure needs.