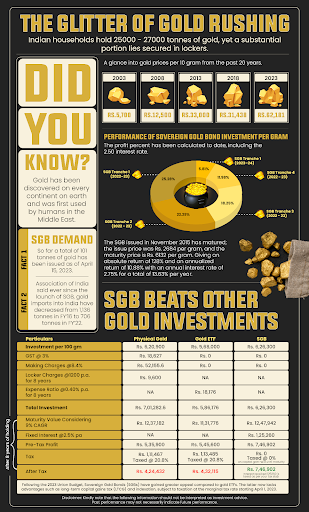

For anyone wondering how to invest in gold safely, both Sovereign Gold Bonds and gold ETFs remain good options. Both track the price of gold and help you invest in gold without having to purchase gold in physical form, or worry about its purity.

However, SGBs and gold ETFs differ in terms of returns, liquidity, taxation, and costs. This guide offers a clear SGB vs Gold ETF comparison to help you understand how each option works, their benefits, taxation, and which gold investment may be better for 2026.

What Are Sovereign Gold Bonds?

Sovereign Gold Bonds or SGBs are government securities issued by the RBI on behalf of the Indian Government. The bonds are issued in denominations of 1 gram of gold and multiples thereof. They act as a substitute for holding physical gold, offering exposure to gold without storage and purity issues.

You pay the issue price in cash and receive the market price of gold at redemption, along with 2.5% yearly interest which is paid every six months.

Key Features of SGBs

- Issued by RBI on behalf of the Government of India

- Denominated in grams of gold

- 8-year tenure with a 5-year lock-in; early exit allowed only on interest payment dates

- Sovereign Gold Bonds can be sold on the secondary market, but liquidity may be limited

- Offer 2.5% annual interest on the issue price which is paid every 6 months

- Redemption value linked to prevailing 24k gold prices

- Investment limits:

- Individuals/HUFs: Up to 4 kg per financial year

- Trusts/notified entities: Up to 20 kg

- SGBs can be held in Demat format.

What Are Gold ETFs?

Gold Exchange-Traded Funds (Gold ETFs) are digital investment units that represent physical gold. Each unit typically equals 1 gram of 24K gold, and the fund house backs these units by investing in physical gold bullion. Gold ETFs are listed on the NSE and BSE, allowing investors to buy and sell them easily—just like stocks—through a Demat and trading account.

Key Features of Gold ETFs:

- Backed by 99.5% pure physical gold

- Traded on NSE/BSE, similar to stocks

- Units represent 1 gram of gold

- You must have a Demat and trading account to invest in gold ETFs

- Gold ETF prices closely track domestic gold rates

- Highly liquid so you can buy or sell anytime during market hours

- No concerns about purity, storage, or security

SGB vs. Gold ETF Comparison: A Quick Overview

The following table represents the SGB vs. Gold ETF comparison clearly:

| Feature | Sovereign Gold Bond (SGB) | Gold ETF |

| Issuer | Government of India | Mutual fund companies |

| Regulated by | The Reserve Bank of India (RBI) | SEBI |

| Interest Payment | Fixed 2.5% p.a (paid semi-annually) | No interest payments |

| Liquidity | Lower; 5-year lock-in, full maturity at 8 years | High; can be traded anytime on exchanges |

| Costs | No expense ratio or management fees | Fund management fees + brokerage costs |

| Safety | Very high (government-backed) | High (regulated by SEBI) |

| Taxation | Zero tax on redemption at maturity or withdrawal after 5 years | LTCG and STCG applicable as per equity fund rules |

Pros and Cons of Investing in Sovereign Gold Bonds

Pros

- One of the key benefits of Sovereign Gold Bonds over gold ETFs is the fixed 2.5% interest p.a. on top of whatever gains you make from rising gold prices.

- There’s no hassle of storage, purity checks, or security because the bonds are fully digital and backed by the Government of India.

- If you hold SGBs till maturity, your capital gains become completely tax-free, making them one of the most tax-efficient gold investment options.

- You can hold them jointly, nominate someone, and even use them as collateral for loans.

Cons

- SGBs come with a 5-year lock-in and an 8-year maturity, so they may not be suitable if you want quick access to your money.

- The value of sovereign Gold Bonds depends on the current price of gold in the market. If gold prices fall, the value of your investment in the secondary market may also fall.

- Since you can’t convert these bonds into jewellery, they’re not suitable if your end goal is to buy physical gold.

- The 2.5% interest is taxable, so only the capital gains at maturity get tax benefits.

- There’s also a 4 kg annual investment limit for individuals and HUFs which is not present in gold ETFs.

Pros and Cons of Investing in Gold ETFs

Pros

- Gold ETFs trade on NSE and BSE, so you get high liquidity. This means, you can buy or sell them anytime, just like stocks.

- Gold ETF prices track live 24K gold rates, giving you transparent, market-linked pricing.

- You can invest small amounts or even set up SIPs if you want to accumulate gold ETF investments gradually.

- Since ETFs are stored in your Demat account, there’s no risk of theft, purity issues, or storage costs.

- They offer simple diversification and may act as a hedge against inflation and currency risk.

Cons

- Gold ETFs don’t offer any fixed interest, so your returns depend entirely on gold prices.

- Long-term capital gains are taxed at 12.5% (above the 1.25 Lakh per year threshold) and short-term gains are taxed at slab rates.

- Unlike Sovereign Gold Bonds which have zero ongoing costs, gold ETFs have brokerage fees and expense ratio charges.

- You must have both a Demat and trading account to invest in gold ETFs.

- Like SGBs, you can’t convert the ETF units into physical gold, so they’re not useful for jewellery purposes.

Sovereign Gold Bonds Vs. Gold ETF: Which is Better?

From the above SGB vs. gold ETF comparison its clear that both are smart, hassle-free ways to invest in gold in India without dealing with storage or purity concerns. But each may suit different investor needs.

If you want long-term growth, tax-free maturity gains, and fixed interest, SGBs suit you better. But if liquidity, easy trading, and flexibility matter more, Gold ETFs are the superior choice for short- to medium-term investors.

Note that the SGB maturity period spans 8 years, with the sovereign gold bond lock in period of 5 years before premature redemption options apply. Investors should track their SGB maturity date to plan accordingly in gold bond vs gold etf decisions.

For those looking to diversify beyond gold, GoldenPi offers a range of fixed-income products, including FDs, bonds, and debentures.

Also browse Bonds Under 10,000, NBFC Bonds, Highly Rated Bonds (AAA Rated), Bonds at Discounted Price, Tax Free Bonds, Bonds at Discounted Price, etc. on GoldenPi.

FAQs on Sovereign Gold Bonds Vs. Gold ETFs

1. What is the main difference between SGBs and gold ETFs?

The main difference is that Sovereign Gold Bonds and gold ETFs is that the former comes with a fixed annual interest of 2.5% in addition to capital appreciation based on gold price changes, while the latter does not offer any fixed interest.

2. Is gold ETF better than SGB?

Deciding which is better in the SGB vs. gold ETF comparison depends entirely on your goals, liquidity needs, and return expectation. Gold ETFs may be better for short-term investors seeking liquidity and easy exits. SGBs may be better for those who are comfortable with limited liquidity and are seeking tax-efficient long-term gold investment options.

3. How do gold ETFs and SGBs compare in returns?

While both gold ETFs and SGBs are linked to the price of physical gold, returns from two can vary. SGBs pay an additional fixed interest of 2.50% p.a. on your investment. However, there is no fixed interest income on gold ETF investments. This is one of the key benefits of Sovereign Gold Bonds over ETFs.

4. How do gold ETFs and SGBs compare in risks?

Sovereign Gold Bonds are backed by the Indian government and regulated by the RBI. This means the interest payment is guaranteed by the government, making possibility of default extremely low.

While gold ETFs do not have the backing of the Indian government, they are regulated by SEBI. SEBI has introduced various rules like storage of physical gold in custodian banks and physical gold verification by auditors every 6 months to protect investor interests.

5. Is buying gold ETF a good investment?

Gold ETFs may be a good investment option in 2026 if you’re looking for a liquidity, diversification, and ease of trading. However, returns are not guaranteed and depend on gold price movements.

6. How do gold ETFs and Sovereign Gold Bonds compare in liquidity?

SGBs come with a lock-in period of 5 years, post which redemptions are allowed. But since transaction volumes can be low, SGBs may have limited liquidity in the secondary market.

Gold ETFs are traded on stock exchanges and can be bought and sold easily using your existing trading account. This means you can easily exit the investment if you need immediate liquidity.

7. How do gold ETFs and SGBs compare in terms of taxation?

Interest from SGBs is taxable as per your tax slab. But tax advantages of gold investment through SGBs include zero capital gains taxation if the investment is held till maturity or redeemed after 5 years. However, if:

- SGBs are sold in the secondary market within 12 months, an LTCG of 12.5% is applicable.

- SGBs are sold after 12 months, STCG is applicable at slab rates.

If you’re investing in gold in India through ETFs, you should note that:

- Sales of gold ETF units before 12 months of golding attracts STCG at slab rates

- Sales of gold ETF units after 12 months of holding attracts LTCG at 12.5%.

8. Which is better in terms of cost: SGB vs. gold ETF?

One of the key benefits of Sovereign Gold Bonds over ETFs is that they do not have any recurring cost of ownership. This makes them a promising gold investment option in 2026 and beyond.

Gold ETFs, on the other hand, have various charges like brokerage costs and expense ratios. This may mean a higher cost of investment.

9. What is the SGB maturity period?

The SGB maturity period is 8 years from issuance, aligning with the overall SGB maturity timeline for redemption at gold’s market value plus accrued interest.

10. How do you buy bonds like SGBs in India?

You can buy Sovereign Gold Bonds by applying during the subscription window announced by the Reserve Bank of India. You can purchase them online through your bank’s net banking facility (if designated) or make in-person offline applications. Alternatively, you can also purchase them from the secondary market at the prevailing market prices.

11. Does GoldenPi have an app?

No, GoldenPi does not currently offer a mobile application. The platform operates through its website. You can view and invest in both bonds and FDs directly through the web platform.

12. Where can you buy bonds in India for 2026 investments?

You may consider buying bonds online on RBI-approved OBPPs like GoldenPi. All you have to do is complete your KYC (if not registered) and browse multiple bond options. Lastly, make the payment, and the bonds will be credited to your linked Demat account.

Disclaimer:

This information is for general information purposes only. GoldenPi makes no guarantee on the accuracy of the data provided here; the information displayed is subject to change and is provided on an as-is basis. Nothing contained herein is intended to or shall be deemed to be investment advice, implied or otherwise. Investments in the securities market are subject to market risks. Read all the offer-related documents carefully before investing.

Fixed Deposit schemes are regulated by the Reserve Bank of India. GoldenPi Securities Private Limited is a registered debt broker and acts as a distributor and not as a manufacturer of the product.

Latest Updated: 21-02-2026